Entergy 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

125

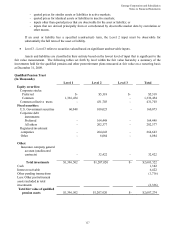

- quoted prices for similar assets or liabilities in active markets;

- quoted prices for identical assets or liabilities in inactive markets;

- inputs other than quoted prices that are observable for the asset or liability; or

- inputs that are derived principally from or corroborated by observable market data by correlation or

other means.

If an asset or liability has a specified (contractual) term, the Level 2 input must be observable for

substantially the full term of the asset or liability.

Level 3 - Level 3 refers to securities valued based on significant unobservable inputs.

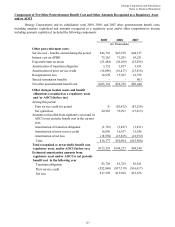

Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the

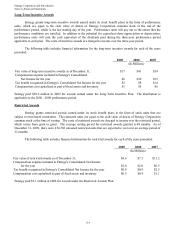

fair value measurement. The following tables set forth by level within the fair value hierarchy a summary of the

investments held for the qualified pension and other postretirement plans measured at fair value on a recurring basis

at December 31, 2009.

Qualified Pension Trust

(In Thousands)

Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $- $5,318 $- $5,318

Common 1,336,454 - 1,336,454

Common collective trusts - 431,703 - 431,703

Fixed securities:

U.S. Government securities 60,048 100,025 - 160,073

Corporate debt

instruments:

Preferred - 164,448 - 164,448

All others - 202,377 - 202,377

Registered investment

companies - 264,643 - 264,643

Other - 6,084 - 6,084

Other:

Insurance company general

account (unallocated

contracts) - 32,422 - 32,422

Total investments $1,396,502 $1,207,020 $- $2,603,522

Cash 1,382

Interest receivable 6,422

Other pending transactions (1,716)

Less: Other postretirement

assets included in total

investments (2,336)

Total fair value of qualified

pension assets $1,396,502 $1,207,020 $- $2,607,274

127