Entergy 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

137

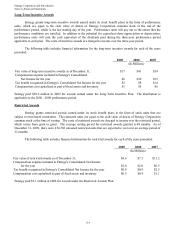

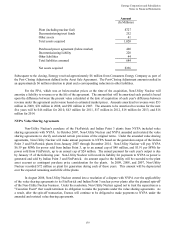

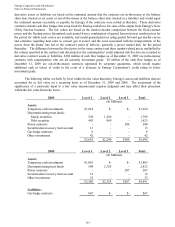

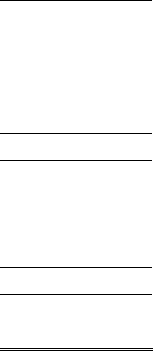

Amount

(In Millions)

Plant (including nuclear fuel) $727

Decommissioning trust funds 252

Other assets 41

Total assets acquired 1,020

Purchased power agreement (below market) 420

Decommissioning liability 220

Other liabilities 44

Total liabilities assumed 684

Net assets acquired $336

Subsequent to the closing, Entergy received approximately $6 million from Consumers Energy Company as part of

the Post-Closing Adjustment defined in the Asset Sale Agreement. The Post-Closing Adjustment amount resulted in

an approximately $6 million reduction in plant and a corresponding reduction in other liabilities.

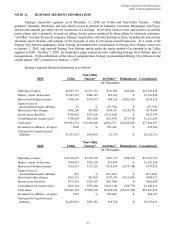

For the PPA, which was at below-market prices at the time of the acquisition, Non-Utility Nuclear will

amortize a liability to revenue over the life of the agreement. The amount that will be amortized each period is based

upon the difference between the present value calculated at the date of acquisition of each year's difference between

revenue under the agreement and revenue based on estimated market prices. Amounts amortized to revenue were $53

million in 2009, $76 million in 2008, and $50 million in 2007. The amounts to be amortized to revenue for the next

five years will be $46 million for 2010, $43 million for 2011, $17 million in 2012, $18 million for 2013, and $16

million for 2014.

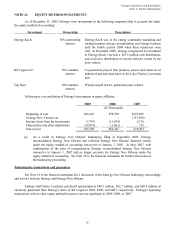

NYPA Value Sharing Agreements

Non-Utility Nuclear's purchase of the FitzPatrick and Indian Point 3 plants from NYPA included value

sharing agreements with NYPA. In October 2007, Non-Utility Nuclear and NYPA amended and restated the value

sharing agreements to clarify and amend certain provisions of the original terms. Under the amended value sharing

agreements, Non-Utility Nuclear will make annual payments to NYPA based on the generation output of the Indian

Point 3 and FitzPatrick plants from January 2007 through December 2014. Non-Utility Nuclear will pay NYPA

$6.59 per MWh for power sold from Indian Point 3, up to an annual cap of $48 million, and $3.91 per MWh for

power sold from FitzPatrick, up to an annual cap of $24 million. The annual payment for each year's output is due

by January 15 of the following year. Non-Utility Nuclear will record its liability for payments to NYPA as power is

generated and sold by Indian Point 3 and FitzPatrick. An amount equal to the liability will be recorded to the plant

asset account as contingent purchase price consideration for the plants. In 2009, 2008, and 2007, Non-Utility

Nuclear recorded $72 million as plant for generation during each of those years. This amount will be depreciated

over the expected remaining useful life of the plants.

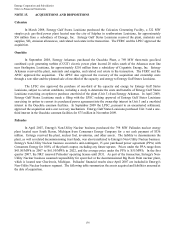

In August 2008, Non-Utility Nuclear entered into a resolution of a dispute with NYPA over the applicability

of the value sharing agreements to its FitzPatrick and Indian Point 3 nuclear power plants after the planned spin-off

of the Non-Utility Nuclear business. Under the resolution, Non-Utility Nuclear agreed not to treat the separation as a

"Cessation Event" that would terminate its obligation to make the payments under the value sharing agreements. As

a result, after the spin-off transaction, Enexus will continue to be obligated to make payments to NYPA under the

amended and restated value sharing agreements.

139