Entergy 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

115

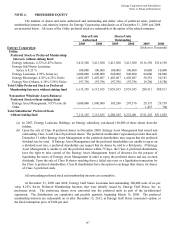

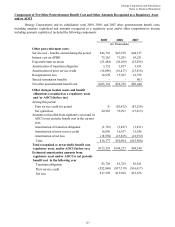

Lease payments are based on nuclear fuel use. The table below represents the total nuclear fuel lease

payments (principal and interest), as well as the separate interest component charged to operations, in 2009, 2008,

and 2007 for the four Registrant Subsidiaries that own nuclear power plants:

2009 2008 2007

Lease

Payments Interest

Lease

Payments Interest

Lease

Payments Interest

(In Millions)

Entergy Arkansas $79.5 $8.1 $63.5 $4.7 $61.7 $5.8

Entergy Gulf States Louisiana 33.9 1.9 29.3 2.5 31.5 2.8

Entergy Louisiana 50.0 3.3 44.6 3.0 44.2 4.0

System Energy 50.3 5.4 33.0 2.9 30.4 4.0

Total $213.7 $18.7 $170.4 $13.1 $167.8 $16.6

Sale and Leaseback Transactions

Waterford 3 Lease Obligations

In 1989, in three separate but substantially identical transactions, Entergy Louisiana sold and leased back

undivided interests in Waterford 3 for the aggregate sum of $353.6 million. The interests represent approximately

9.3% of Waterford 3. The leases expire in 2017. Under certain circumstances, Entergy Louisiana may repurchase

the leased interests prior to the end of the term of the leases. At the end of the lease terms, Entergy Louisiana has the

option to repurchase the leased interests in Waterford 3 at fair market value or to renew the leases for either fair

market value or, under certain conditions, a fixed rate.

Entergy Louisiana issued $208.2 million of non-interest bearing first mortgage bonds as collateral for the

equity portion of certain amounts payable under the leases.

Upon the occurrence of certain events, Entergy Louisiana may be obligated to assume the outstanding bonds

used to finance the purchase of the interests in the unit and to pay an amount sufficient to withdraw from the lease

transaction. Such events include lease events of default, events of loss, deemed loss events, or certain adverse

"Financial Events." "Financial Events" include, among other things, failure by Entergy Louisiana, following the

expiration of any applicable grace or cure period, to maintain (i) total equity capital (including preferred membership

interests) at least equal to 30% of adjusted capitalization, or (ii) a fixed charge coverage ratio of at least 1.50

computed on a rolling 12 month basis. As of December 31, 2009, Entergy Louisiana was in compliance with these

provisions.

117