Entergy 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

93

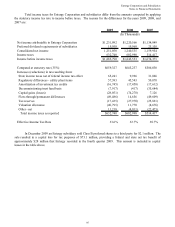

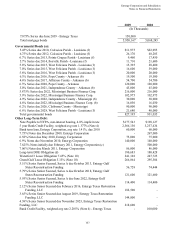

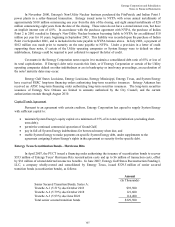

Total income taxes for Entergy Corporation and subsidiaries differ from the amounts computed by applying

the statutory income tax rate to income before taxes. The reasons for the differences for the years 2009, 2008, and

2007 are:

2009 2008 2007

Net income attributable to Entergy Corporation $1,231,092 $1,220,566 $1,134,849

Preferred dividend requirements of subsidiaries 19,958 19,969 25,105

Consolidated net income 1,251,050 1,240,535 1,159,954

Income taxes 632,740 602,998 514,417

Income before income taxes $1,883,790 $1,843,533 $1,674,371

Computed at statutory rate (35%) $659,327 $645,237 $586,030

Increases (reductions) in tax resulting from:

State income taxes net of federal income tax effect 65,241 9,926 31,066

Regulatory differences - utility plant items 57,383 45,543 50,070

Amortization of investment tax credits (16,745) (17,458) (17,612)

Decommissioning trust fund basis (7,917) (417) (35,684)

Capital gains (losses) (28,051) (74,278) 7,126

Flow-through/permanent differences (49,486) 14,656 (49,609)

Tax reserves (17,435) (27,970) (25,821)

Valuation allowance (40,795) 11,770 (8,676)

Other - net 11,218 (4,011) (22,473)

Total income taxes as reported $632,740 $602,998 $514,417

Effective Income Tax Rate 33.6% 32.7% 30.7%

(In Thousands)

In December 2009 an Entergy subsidiary sold Class B preferred shares to a third party for $2.1 million. The

sale resulted in a capital loss for tax purposes of $73.1 million, providing a federal and state net tax benefit of

approximately $28 million that Entergy recorded in the fourth quarter 2009. This amount is included in capital

losses in the table above.

95