Entergy 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Management's Financial Discussion and Analysis

27

Dividends and Stock Repurchases

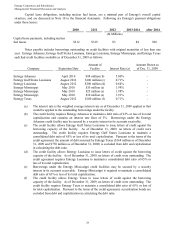

Declarations of dividends on Entergy's common stock are made at the discretion of the Board. Among other

things, the Board evaluates the level of Entergy's common stock dividends based upon Entergy's earnings, financial

strength, and future investment opportunities. At its January 2010 meeting, the Board declared a dividend of $0.75

per share, which is the same quarterly dividend per share that Entergy has paid since third quarter 2007. Entergy

paid $577 million in 2009, $573 million in 2008, and $507 million in 2007 in cash dividends on its common stock.

In accordance with Entergy's stock-based compensation plan, Entergy periodically grants stock options to its

key employees, which may be exercised to obtain shares of Entergy's common stock. According to the plan, these

shares can be newly issued shares, treasury stock, or shares purchased on the open market. Entergy's management

has been authorized by the Board to repurchase on the open market shares up to an amount sufficient to fund the

exercise of grants under the plan.

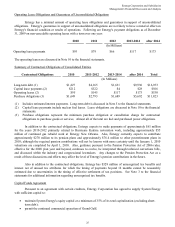

In addition to the authority to fund grant exercises, in January 2007 the Board approved a program under

which Entergy is authorized to repurchase up to $1.5 billion of its common stock. In January 2008, the Board

authorized an incremental $500 million share repurchase program to enable Entergy to consider opportunistic

purchases in response to equity market conditions. Entergy completed both the $1.5 billion and $500 million

programs in the third quarter 2009. In October 2009 the Board granted authority for an additional $750 million

share repurchase program.

The amount of repurchases may vary as a result of material changes in business results or capital spending

or new investment opportunities, or if limitations in the credit markets continue for a prolonged period.

Sources of Capital

Entergy's sources to meet its capital requirements and to fund potential investments include:

internally generated funds;

cash on hand ($1.71 billion as of December 31, 2009);

securities issuances;

bank financing under new or existing facilities; and

sales of assets.

Circumstances such as weather patterns, fuel and purchased power price fluctuations, and unanticipated

expenses, including unscheduled plant outages and storms, could affect the timing and level of internally generated

funds in the future.

Provisions within the Articles of Incorporation or pertinent indentures and various other agreements relating

to the long-term debt and preferred stock of certain of Entergy Corporation's subsidiaries restrict the payment of cash

dividends or other distributions on their common and preferred stock. As of December 31, 2009, Entergy Arkansas

and Entergy Mississippi had restricted retained earnings unavailable for distribution to Entergy Corporation of

$461.6 million and $236 million, respectively. All debt and common and preferred equity issuances by the Registrant

Subsidiaries require prior regulatory approval and their preferred equity and debt issuances are also subject to

issuance tests set forth in corporate charters, bond indentures, and other agreements. Entergy believes that the

Registrant Subsidiaries have sufficient capacity under these tests to meet foreseeable capital needs.

The FERC has jurisdiction over securities issuances by the Utility operating companies and System Energy

(except securities with maturities longer than one year issued by Entergy Arkansas and Entergy New Orleans, which

are subject to the jurisdiction of the APSC and the City Council, respectively). No approvals are necessary for

Entergy Corporation to issue securities. The current FERC-authorized short-term borrowing limits are effective

through October 2011, as established by a FERC order issued October 14, 2009. Entergy Gulf States Louisiana,

Entergy Louisiana, Entergy Mississippi, Entergy Texas, and System Energy have obtained long-term financing

29