Entergy 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

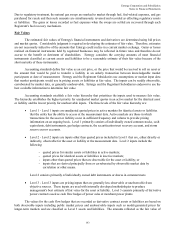

Entergy Corporation and Subsidiaries

Notes to Financial Statements

133

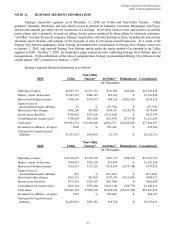

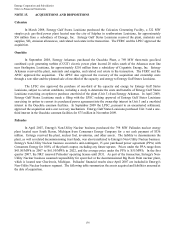

NOTE 13. BUSINESS SEGMENT INFORMATION

Entergy's reportable segments as of December 31, 2009 are Utility and Non-Utility Nuclear. Utility

generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas,

and provides natural gas utility service in portions of Louisiana. Non-Utility Nuclear owns and operates six nuclear

power plants and is primarily focused on selling electric power produced by those plants to wholesale customers.

"All Other" includes the parent company, Entergy Corporation, and other business activity, including the non-nuclear

wholesale assets business and earnings on the proceeds of sales of previously-owned businesses. As a result of the

Entergy New Orleans bankruptcy filing, Entergy discontinued the consolidation of Entergy New Orleans retroactive

to January 1, 2005, and reported Entergy New Orleans results under the equity method of accounting in the Utility

segment in 2006. On May 7, 2007, the bankruptcy judge entered an order confirming Entergy New Orleans' plan of

reorganization. With confirmation of the plan of reorganization, Entergy reconsolidated Entergy New Orleans in the

second quarter 2007, retroactive to January 1, 2007.

Entergy's segment financial information is as follows:

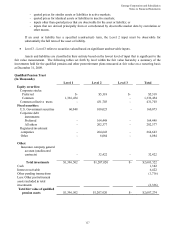

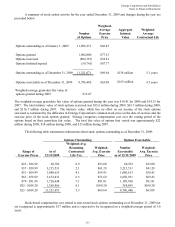

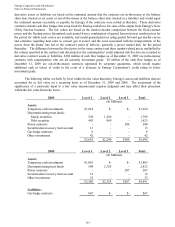

2009 Utility

Non-Utility

Nuclear* All Other* Eliminations Consolidated

(In Thousands)

Operating revenues $8,055,353 $2,555,254 $161,506 ($26,463) $10,745,650

Deprec., amort. & decomm. $1,025,922 $240,747 $15,169 $- $1,281,838

Interest and dividend income $180,505 $170,033 $88,106 ($202,016) $236,628

Equity in loss of

unconsolidated equity affiliates $1 $- ($7,794) $- ($7,793)

Interest and other charges $462,206 $55,884 $180,931 ($128,577) $570,444

Income taxes (benefits) $388,682 $379,266 ($135,208) $- $632,740

Consolidated net income (loss) $708,905 $631,020 ($15,437) ($73,438) $1,251,050

Total assets $29,694,732 $10,590,809 ($294,277) ($2,626,667) $37,364,597

Investment in affiliates - at equity $200 $- $39,380 $- $39,580

Cash paid for long-lived asset

additions $1,872,997 $654,003 $1,719 $- $2,528,719

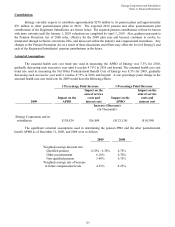

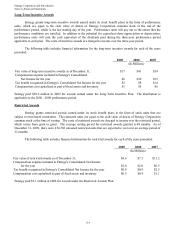

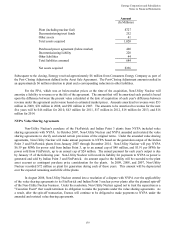

2008 Utility

Non-Utility

Nuclear* All Other* Eliminations Consolidated

(In Thousands)

Operating revenues $10,318,630 $2,558,378 $241,715 ($24,967) $13,093,756

Deprec., amort. & decomm. $984,651 $220,128 $15,490 $- $1,220,269

Interest and dividend income $122,657 $112,129 $116,830 ($153,744) $197,872

Equity in loss of

unconsolidated equity affiliates ($3) $- ($11,681) $- ($11,684)

Interest and other charges $425,216 $53,926 $243,745 ($113,966) $608,921

Income taxes (benefits) $371,281 $319,107 ($87,390) $- $602,998

Consolidated net income (loss) $605,144 $797,280 ($122,110) ($39,779) $1,240,535

Total assets $28,810,147 $7,848,195 $2,586,456 ($2,627,980) $36,616,818

Investment in affiliates - at equity $199 $- $66,048 $- $66,247

Cash paid for long-lived asset

additions $2,478,014 $478,285 $18,730 $- $2,975,029

135