Xcel Energy 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

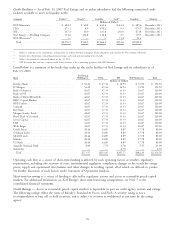

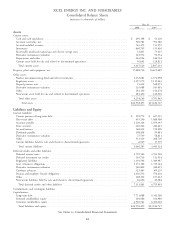

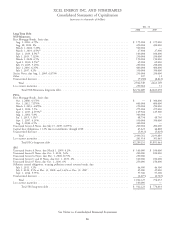

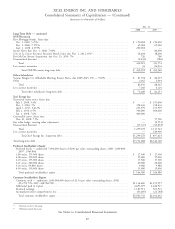

XCEL ENERGY INC. AND SUBSIDIARIES

Consolidated Statements of Capitalization

(amounts in thousands of dollars)

Dec. 31

2008 2007

Long-Term Debt

NSP-Minnesota

First Mortgage Bonds, Series due:

Aug. 1, 2010, 4.75% ..................................................... $ 175,000 $ 175,000

Aug. 28, 2012, 8% ...................................................... 450,000 450,000

March 1, 2018, 5.25% .................................................... 500,000 —

March 1, 2019, 8.5%(b) ................................................... 27,900 27,900

Sept. 1, 2019, 8.5%(b) .................................................... 100,000 100,000

July 1, 2025, 7.125% ..................................................... 250,000 250,000

March 1, 2028, 6.5% .................................................... 150,000 150,000

April 1, 2030, 8.5%(b) .................................................... 69,000 69,000

July 15, 2035, 5.25% ..................................................... 250,000 250,000

June 1, 2036, 6.25% ..................................................... 400,000 400,000

July 1, 2037, 6.2% ...................................................... 350,000 350,000

Senior Notes, due Aug. 1, 2009, 6.875% .......................................... 250,000 250,000

Other ................................................................ 107 31

Unamortized discount ...................................................... (9,258) (8,822)

Total ............................................................. 2,962,749 2,463,109

Less current maturities ...................................................... 250,060 31

Total NSP-Minnesota long-term debt ........................................ $2,712,689 $2,463,078

PSCo

First Mortgage Bonds, Series due:

Oct. 1, 2008, 4.375% .................................................... $ — $ 300,000

Oct. 1, 2012, 7.875% .................................................... 600,000 600,000

March 1, 2013, 4.875% ................................................... 250,000 250,000

April 1, 2014, 5.5% ..................................................... 275,000 275,000

Sept. 1, 2017, 4.375%(b) ................................................... 129,500 129,500

Aug. 1, 2018, 5.8% ...................................................... 300,000 —

Jan. 1, 2019, 5.1%(b) ..................................................... 48,750 48,750

Sept. 1, 2037, 6.25% ..................................................... 350,000 350,000

Aug. 1, 2038, 6.5% ...................................................... 300,000 —

Unsecured Senior A Notes, due July 15, 2009, 6.875% ................................. 200,000 200,000

Capital lease obligations, 11.2% due in installments through 2028 .......................... 43,423 44,868

Unamortized discount ...................................................... (5,912) (5,029)

Total ............................................................. 2,490,761 2,193,089

Less current maturities ...................................................... 201,510 301,445

Total PSCo long-term debt .............................................. $2,289,251 $1,891,644

SPS

Unsecured Senior A Notes, due March 1, 2009, 6.2% .................................. $ 100,000 $ 100,000

Unsecured Senior E Notes, due Oct. 1, 2016, 5.6% ................................... 200,000 200,000

Unsecured Senior G Notes, due Dec. 1, 2018, 8.75% .................................. 250,000 —

Unsecured Senior C and D Notes, due Oct. 1, 2033, 6% ................................ 100,000 100,000

Unsecured Senior F Notes, due Oct. 1, 2036, 6% .................................... 250,000 250,000

Pollution control obligations, securing pollution control revenue bonds, due:

July 1, 2011, 5.2% ...................................................... 44,500 44,500

July 1, 2016, 8.5% at Dec. 31, 2008, and 3.43% at Dec. 31, 2007 ........................ 25,000 25,000

Sept. 1, 2016, 5.75% ..................................................... 57,300 57,300

Unamortized discount ...................................................... (4,677) (2,767)

Total ............................................................. 1,022,123 774,033

Less current maturities ...................................................... 100,000 —

Total SPS long-term debt ............................................... $ 922,123 $ 774,033

See Notes to Consolidated Financial Statements

86