Xcel Energy 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

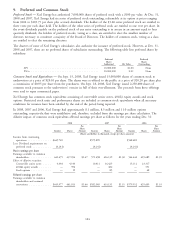

9. Preferred and Common Stock

Preferred Stock — Xcel Energy has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31,

2008 and 2007, Xcel Energy had six series of preferred stock outstanding, redeemable at its option at prices ranging

from $102 to $103.75 per share plus accrued dividends. The holders of the $3.60 series preferred stock are entitled to

three votes per each share held. The holders of the other series of preferred stock are entitled to one vote per share. In

the event dividends payable on the preferred stock of any series outstanding is in arrears in an amount equal to four

quarterly dividends, the holders of preferred stocks, voting as a class, are entitled to elect the smallest number of

directors necessary to constitute a majority of the Board of Directors. The holders of common stock, voting as a class,

are entitled to elect the remaining directors.

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31,

2008 and 2007, there are no preferred shares of subsidiaries outstanding. The following table lists preferred shares by

subsidiary:

Preferred Preferred

Shares Shares

Authorized Par Value Outstanding

SPS ......................................... 10,000,000 $1.00 None

PSCo ........................................ 10,000,000 0.01 None

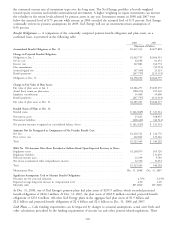

Common Stock and Equivalents — On Sept. 15, 2008, Xcel Energy issued 15,000,000 shares of common stock to

underwriters at a price of $20.10 per share. The shares were re-offered to the public at a price of $20.20 per share plus

a commission of $0.05 per share from the purchasers. On Sept. 18, 2008, Xcel Energy issued 2,250,000 shares of

common stock pursuant to the underwriters’ exercise in full of their over-allotment. The proceeds from these offerings

were used to repay commercial paper.

Xcel Energy has common stock equivalents consisting of convertible senior notes, 401(k) equity awards and stock

options. Restricted stock units and performance shares are included as common stock equivalents when all necessary

conditions for issuance have been satisfied by the end of the period being reported.

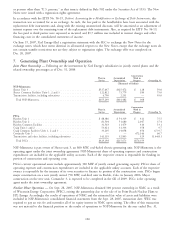

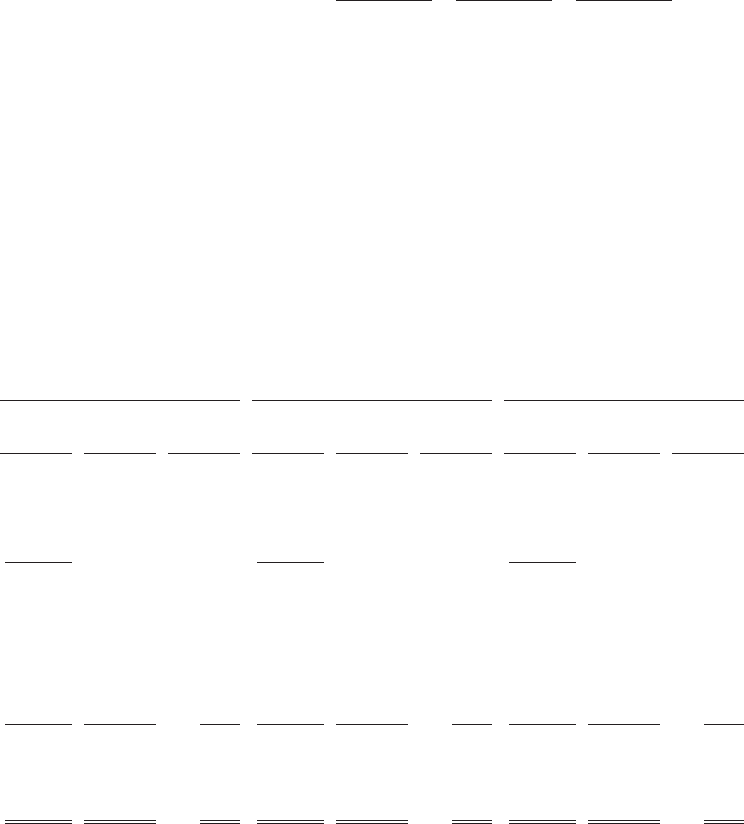

In 2008, 2007 and 2006, Xcel Energy had approximately 8.1 million, 8.5 million and 11.0 million options

outstanding, respectively, that were antidilutive and, therefore, excluded from the earnings per share calculation. The

dilutive impact of common stock equivalents affected earnings per share as follows for the years ending Dec. 31:

2008 2007 2006

Per Per Per

Share Share Share

Income Shares Amount Income Shares Amount Income Shares Amount

(Shares and dollars in thousands, except per share amounts)

Income from continuing

operations .............. $645,720 $575,899 $568,681

Less: Dividend requirements on

preferred stock ........... (4,241) (4,241) (4,241)

Basic earnings per share

Earnings available to common

shareholders ............. 641,479 437,054 $1.47 571,658 416,139 $1.38 564,440 405,689 $1.39

Effect of dilutive securities:

Convertible senior notes ..... 4,498 4,144 10,411 16,425 15,112 23,317

401(k) equity awards ....... — 596 — 482 — 551

Stock options ............ — 19 — 85 — 48

Diluted earnings per share

Earnings available to common

shareholders and assumed

conversions ............. $645,977 441,813 $1.46 $582,069 433,131 $1.35 $579,552 429,605 $1.35

104