Xcel Energy 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

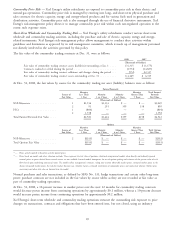

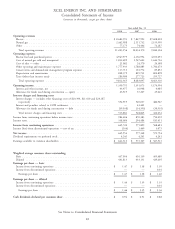

income securities, real estate and alternative investments, including private equity funds and a commodities index. With

the recent decline in asset value in Xcel Energy’s pension plans, Xcel Energy expects to have 2009 funding requirements

of $70 million to $130 million. At this time, pension funding contributions for 2010, which will be dependent on

several factors including realized asset performance, future discount rate, IRS and legislative initiatives as well as other

actuarial assumptions, are estimated to range between $150 million to $250 million. The funded status and pension

assumptions are summarized in the following tables:

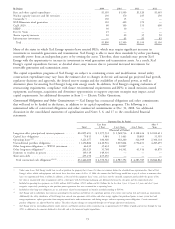

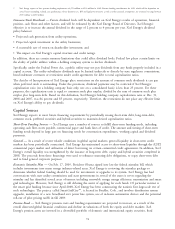

Dec. 31, 2008 Dec. 31, 2007

(Millions of dollars)

Fair value of pension assets ..................................... $2,185 $3,186

Projected benefit obligation(a) .................................... 2,598 2,662

Funded status ............................................ $(413) $ 524

(a) — Excludes non-qualified plan of $46 million and $42 million at Dec. 31, 2008 and 2007, respectively.

Pension Assumptions 2009 2008

Discount rate .............................................. 6.75% 6.25%

Expected long-term rate of return ................................. 8.50 8.75

Short-Term Investments — Xcel Energy, NSP-Minnesota, NSP-Wisconsin, PSCo and SPS maintain cash operating

accounts with Wells Fargo Bank. At Dec. 31, 2008, approximately $214 million of cash was held in these liquid

operating accounts.

The Reserve Primary Fund — On Sept. 17, 2008, NSP-Wisconsin requested redemption of a $40 million principal

investment held in The Reserve Primary Fund (the Fund) at $0.97 per share, resulting in a loss of $1.2 million. This

request occurred following an announcement by the Fund that the net asset value of the Fund had declined to $0.97

per share following a $785 million write-off of securities issued by Lehman. On Sept. 29, 2008, the Fund issued an

announcement that its Board of Trustees had voted to liquidate assets and make a cash distribution to investors in the

Fund, including investors who had submitted redemption orders that had not yet been funded.

During the fourth quarter, NSP-Wisconsin received $31.6 million representing its pro-rata share of the Fund’s first and

second distributions to investors. To date, approximately 80 percent of total fund assets as of the close of business on

Sep. 15, 2008, have been returned to investors. NSP-Wisconsin’s remaining principal balance due from the Fund

(excluding the $1.2 million loss) is approximately $7.3 million.

The Fund has retained all net income generated from its holdings since Sept. 15, 2008. Net income will be distributed

in the same manner that excess funds in the special reserve are distributed as outlined in the Fund’s Plan of Liquidation

and Distribution of Assets under supervision of the SEC.

Nuclear Decommissioning Trust Fund — The recent volatility in global capital markets has lead to a reduction in the

current value of long-term investments held in Xcel Energy’s nuclear decommissioning trust fund.

The nuclear decommissioning trust fund invests in a diversified portfolio of taxable and municipal fixed income

securities and equity securities. The total value of the nuclear decommissioning trust fund was approximately

$1.075 billion and $1.318 billion at Dec. 31, 2008, and 2007, respectively. Realized and unrealized gains and losses on

nuclear decommissioning fund investments are deferred as a component of a nuclear decommissioning regulatory asset

or liability on Xcel Energy’s consolidated balance sheet.

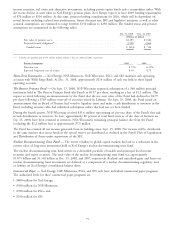

Commercial Paper — Xcel Energy, NSP-Minnesota, PSCo and SPS each have individual commercial paper programs.

The authorized levels for these commercial paper programs are:

• $800 million for Xcel Energy,

• $500 million for NSP-Minnesota,

• $700 million for PSCo and

• $250 million for SPS.

75