Xcel Energy 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

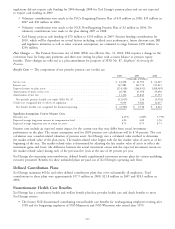

Cash Flows — The postretirement health care plans have no funding requirements under income tax and other

retirement-related regulations other than fulfilling benefit payment obligations, when claims are presented and approved

under the plans. Additional cash funding requirements are prescribed by certain state and federal rate regulatory

authorities, as discussed previously. Xcel Energy contributed $55.6 million during 2008 and expects to contribute

approximately $63.1 million during 2009.

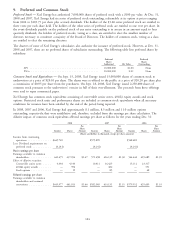

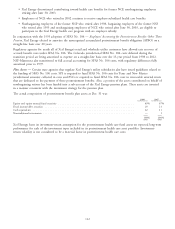

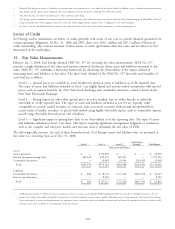

Benefit Costs — The components of net periodic postretirement benefit costs are:

2008 2007 2006

(Thousands of Dollars)

Service cost .................................... $ 5,350 $ 5,813 $ 6,633

Interest cost .................................... 51,047 50,475 52,939

Expected return on plan assets ......................... (31,851) (30,401) (26,757)

Amortization of transition obligation ..................... 14,577 14,577 14,444

Amortization of prior service credit ...................... (2,175) (2,178) (2,178)

Amortization of net loss gain .......................... 11,498 14,198 24,797

Net periodic postretirement benefit cost under SFAS No. 106 ..... 48,446 52,484 69,878

Additional cost recognized due to effects of regulation .......... 3,891 3,891 3,891

Net cost recognized for financial reporting ................. $52,337 $ 56,375 $ 73,769

Significant assumptions used to measure costs (income):

Discount rate ................................... 6.25% 6.00% 5.75%

Expected average long-term rate of return on assets (before tax) .... 7.50 7.50 7.50

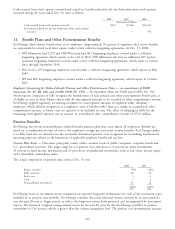

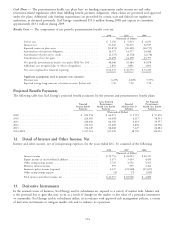

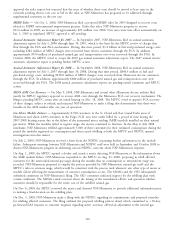

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

Gross Projected Net Projected

Projected Postretirement Expected Postretirement

Pension Benefit Health Care Benefit Medicare Part D Health Care Benefit

Payments Payments Subsidies Payments

(Thousands of Dollars)

2009 .............................. $ 224,558 $ 62,975 $ 5,725 $ 57,250

2010 .............................. 226,585 64,468 6,117 58,351

2011 .............................. 226,446 66,390 6,433 59,957

2012 .............................. 230,763 67,400 6,804 60,596

2013 .............................. 234,149 68,008 7,127 60,881

2014-2018 .......................... 1,237,114 351,249 38,796 312,453

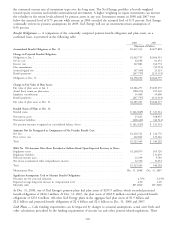

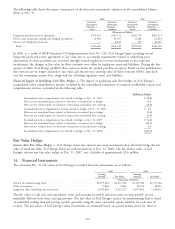

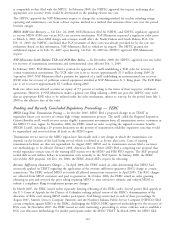

12. Detail of Interest and Other Income, Net

Interest and other income, net of nonoperating expenses, for the years ended Dec. 31 consisted of the following:

2008 2007 2006

(Thousands of Dollars)

Interest income .................................. $29,753 $ 24,093 $ 20,317

Equity income in unconsolidated affiliates .................. 3,571 3,459 4,450

Other nonoperating income .......................... 5,725 4,352 5,253

Minority interest income ............................ 595 599 2,361

Insurance policy income (expense) ...................... 4,337 (21,548) (27,637)

Other nonoperating expense .......................... (4) (7) (659)

Total interest and other income, net ..................... $43,977 $ 10,948 $ 4,085

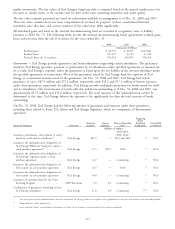

13. Derivative Instruments

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk

is the potential loss or gain that may occur as a result of changes in the market or fair value of a particular instrument

or commodity. Xcel Energy and its subsidiaries utilize, in accordance with approved risk management policies, a variety

of derivative instruments to mitigate market risk and to enhance its operations.

114