Xcel Energy 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

regulations did not require cash funding for 2006 through 2008 for Xcel Energy’s pension plans and are not expected

to require cash funding in 2009.

• Voluntary contributions were made to the PSCo Bargaining Pension Plan of $35 million in 2008, $35 million in

2007 and $30 million in 2006.

• Voluntary contributions were made to the NCE Non-Bargaining Pension Plan of $2 million in 2006. No

voluntary contributions were made to the plan during 2007 or 2008.

• Xcel Energy projects cash funding of $70 million to $130 million in 2009. Pension funding contributions for

2010, which will be dependent on several factors including, realized asset performance, future discount rate, IRS

and legislative initiatives as well as other actuarial assumptions, are estimated to range between $150 million to

$250 million.

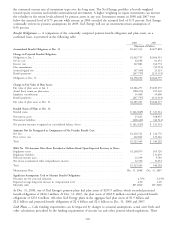

Plan Changes — The Pension Protection Act of 2006 (PPA) was effective Dec. 31, 2006. PPA requires a change in the

conversion basis for lump-sum payments and three-year vesting for plans with account balance or pension equity

benefits. These changes are reflected as a plan amendment for purposes of SFAS No. 87, Employers’ Accounting for

Pensions.

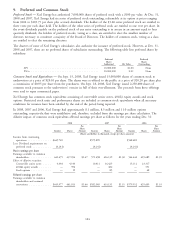

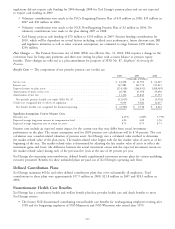

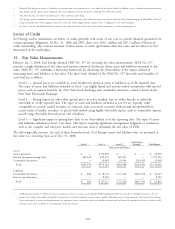

Benefit Costs — The components of net periodic pension cost (credit) are:

2008 2007 2006

(Thousands of Dollars)

Service cost ................................................. $ 62,698 $ 61,392 $ 61,627

Interest cost ................................................. 167,881 162,774 155,413

Expected return on plan assets ..................................... (274,338) (264,831) (268,065)

Amortization of prior service cost ................................... 20,584 25,056 29,696

Amortization of net loss ......................................... 11,156 15,845 17,353

Net periodic pension (credit) cost under SFAS No. 87 ..................... (12,019) 236 (3,976)

Credits not recognized due to effects of regulation ......................... 9,034 9,682 12,637

Net benefit (credit) cost recognized for financial reporting ................... $ (2,985) $ 9,918 $ 8,661

Significant Assumptions Used to Measure Costs:

Discount rate ................................................ 6.25% 6.00% 5.75%

Expected average long-term increase in compensation level .................... 4.00 4.00 3.50

Expected average long-term rate of return on assets ........................ 8.75 8.75 8.75

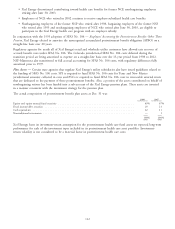

Pension costs include an expected return impact for the current year that may differ from actual investment

performance in the plan. The return assumption used for 2009 pension cost calculations will be 8.50 percent. The cost

calculation uses a market-related valuation of pension assets. Xcel Energy uses a calculated value method to determine

the market-related value of the plan assets. The market-related value begins with the fair market value of assets as of the

beginning of the year. The market-related value is determined by adjusting the fair market value of assets to reflect the

investment gains and losses (the difference between the actual investment return and the expected investment return on

the market-related value) during each of the previous five years at the rate of 20 percent per year.

Xcel Energy also maintains noncontributory, defined benefit supplemental retirement income plans for certain qualifying

executive personnel. Benefits for these unfunded plans are paid out of Xcel Energy’s operating cash flows.

Defined Contribution Plans

Xcel Energy maintains 401(k) and other defined contribution plans that cover substantially all employees. Total

contributions to these plans were approximately $17.9 million in 2008, $21.8 million in 2007 and $18.3 million in

2006.

Postretirement Health Care Benefits

Xcel Energy has a contributory health and welfare benefit plan that provides health care and death benefits to most

Xcel Energy retirees.

• The former NSP discontinued contributing toward health care benefits for nonbargaining employees retiring after

1998 and for bargaining employees of NSP-Minnesota and NSP-Wisconsin who retired after 1999.

111