Xcel Energy 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Purchased Power Agreements — The utility subsidiaries of Xcel Energy have entered into agreements with utilities and

other energy suppliers for purchased power to meet system load and energy requirements, replace generation from

company-owned units under maintenance and during outages, and meet operating reserve obligations. NSP-Minnesota,

PSCo and SPS have various pay-for-performance contracts with expiration dates through the year 2032. In general,

these contracts provide for capacity payments, subject to meeting certain contract obligations, and energy payments

based on actual power taken under the contracts. Certain contractual payment obligations are adjusted based on indices.

However, the effects of price adjustments are mitigated through cost-of-energy rate adjustment mechanisms.

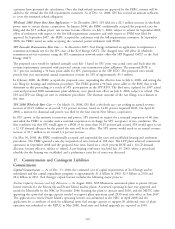

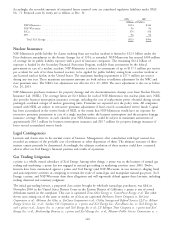

At Dec. 31, 2008, the estimated future payments for capacity, accounted for as executory contracts, that the utility

subsidiaries of Xcel Energy are obligated to purchase, subject to availability, are as follows:

(Millions of Dollars)

2009 ........................................................... $ 514.1

2010 ........................................................... 509.7

2011 ........................................................... 498.9

2012 ........................................................... 422.8

2013 ........................................................... 358.7

2014 and thereafter .................................................. 1,716.9

Total ......................................................... $4,021.1

Variable Interest Entities (VIE) — Xcel Energy has certain long-term power purchase agreements with independent

power producing entities that contain tolling arrangements under which Xcel Energy procures the fuel required to

produce the energy purchased. Xcel Energy enters into these agreements to meet electric system capacity and energy

needs. Xcel Energy is not subject to risk of loss from the operations of these entities. Xcel Energy has evaluated such

entities for possible consolidation under FASB Interpretation No. 46 (revised December 2003), Consolidation of Variable

Interest Entities, (FIN 46R) and has concluded that these entities are not required to be consolidated in Xcel Energy’s

consolidated financial statements. The significant qualitative factors considered evaluating purchase power agreements

under FIN 46R include length and terms of the contract and operational, fuel price and financing risk. When

necessary, a quantitative analysis demonstrated that Xcel Energy would absorb less than 50 percent of the expected gains

or losses. Significant assumptions used in the quantitative analysis by Xcel Energy, to determine the primary beneficiary,

include an inflation rate equal to the Bureau of Labor Statistics 10 year average, estimated future fuel and electricity

prices, future operating cash flows, an incremental borrowing rate, the expected life of the plant and a debt to equity

financing ratio.

Leases — Xcel Energy and its subsidiaries lease a variety of equipment and facilities used in the normal course of

business. Two of these leases qualify as capital leases and are accounted for accordingly. The capital leases contractually

expire in 2025 and 2028. The assets and liabilities acquired under capital leases are recorded at the lower of fair market

value or the present value of future lease payments and are amortized over their actual contract term in accordance with

practices allowed by regulators.

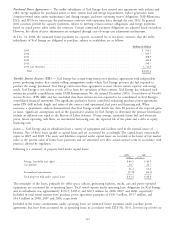

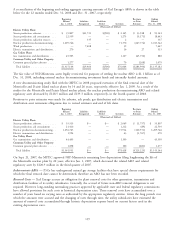

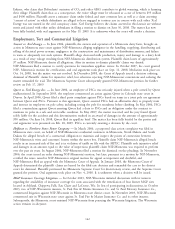

Following is a summary of property held under capital leases:

2008 2007

(Millions of Dollars)

Storage, leaseholds and rights .................................... $40.5 $ 40.5

Gas pipeline .............................................. 20.7 20.7

61.2 61.2

Accumulated amortization ...................................... (17.8) (16.3)

Total property held under capital leases .............................. $43.4 $ 44.9

The remainder of the leases, primarily for office space, railcars, generating facilities, trucks, cars and power-operated

equipment, are accounted for as operating leases. Total rental expense under operating lease obligations for Xcel Energy

and its subsidiaries was approximately $176.9, $105.2, and $60.3 million for 2008, 2007, and 2006, respectively.

Included in total rental expense were purchase power agreement payments of $130.3 million, $55.7 million, and

$14.5 million in 2008, 2007 and 2006, respectively.

Included in the future commitments under operating leases are estimated future payments under purchase power

agreements that have been accounted for as operating leases in accordance with EITF No. 01-8, Determining whether an

132