Xcel Energy 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007. NSP-Minnesota has reintegrated its nuclear operations into its generation operations. The NRC transferred the

nuclear operating licenses from NMC to NSP-Minnesota effective Sept. 22, 2008.

8. Income Taxes

COLI — As previously disclosed, Xcel Energy and the U.S. government settled an ongoing dispute regarding PSCo’s

right to deduct interest expense on policy loans related to its COLI program that insured lives of certain PSCo

employees. These COLI policies were owned and managed by PSRI, a wholly owned subsidiary of PSCo. The total

exposure for the tax years in dispute through 2007 was approximately $583 million, which includes income tax, interest

and potential penalties. In September 2007, Xcel Energy and the United States finalized a settlement, which terminated

the tax litigation pending between the parties. As a result of the settlement, the lawsuit filed by Xcel Energy in the

United States District Court has been dismissed and the Tax Court proceedings are in the process of being dismissed.

Terms of the Final Settlement

1. Xcel Energy paid the government a total of $64.4 million in full settlement of the government’s claims for tax,

penalty, and interest for tax years 1993-2007. Xcel Energy paid the settlement as follows:

• $32.2 million was satisfied by tax and interest amounts that Xcel Energy had previously paid or deemed under

the terms of the settlement to have been paid.

• $32.2 million was paid by Xcel Energy on Oct. 31, 2007.

2. The recognition of this settlement resulted in total expense of $59.5 million, including federal and state tax,

interest on the federal and state tax liabilities, penalties, and tax benefits on the interest expense for the nine

months ended Sept. 30, 2007. The expense of $59.5 million includes $43.4 million of interest and penalties and

income tax of $16.1 million (net of tax benefit on the interest expense of $14.3 million).

3. Xcel Energy surrendered the policies to its insurer on Oct. 31, 2007, without recognizing a taxable gain.

Accounting for Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109 (FIN 48) — Xcel Energy

files a consolidated federal income tax return and state tax returns based on income in its major operating jurisdictions

of Colorado, Minnesota, Texas, and Wisconsin, and various other state income-based tax returns.

In the first quarter of 2008, the IRS completed an examination of Xcel Energy’s federal income tax returns for 2004

and 2005 (and research credits for 2003). The IRS did not propose any material adjustments for those tax years. Tax

year 2004 is the earliest open year and the statute of limitations applicable to Xcel Energy’s 2004 federal income tax

return remains open until Dec. 31, 2009. In the third quarter of 2008, the IRS commenced an examination of tax

years 2006 and 2007. As of Dec. 31, 2008, the IRS had not proposed any material adjustments to tax years 2006 and

2007.

In the first quarter of 2008, the state of Minnesota concluded an income tax audit through tax year 2001 and the state

of Texas concluded an income tax audit through tax year 2005. No material adjustments were proposed for these state

audits. As of Dec. 31, 2008, Xcel Energy’s earliest open tax years in which an audit can be initiated by state taxing

authorities in its major operating jurisdictions are as follows: Colorado-2004, Minnesota-2004, Texas-2004,

Wisconsin-2004. There currently are no state income tax audits in progress.

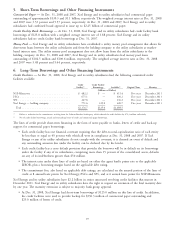

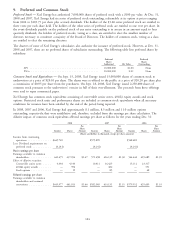

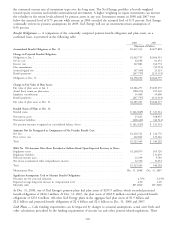

The amount of unrecognized tax benefits reported in continuing operations was $26.3 million on Dec. 31, 2007 and

$35.5 million on Dec. 31, 2008. The amount of unrecognized tax benefits reported in discontinued operations was

$4.3 million on Dec. 31, 2007 and $6.6 million on Dec. 31, 2008. A reconciliation of the beginning and ending

amount of unrecognized tax benefit in continuing operations is as follows:

2008 2007

(Millions of Dollars)

Balance at Jan. 1 ............................................ $26.3 $ 42.6

Additions based on tax positions related to the current year ................. 9.7 10.4

Reductions based on tax positions related to the current year ................ (1.0) (0.4)

Additions for tax positions of prior years ............................. 7.6 42.3

Reductions for tax positions of prior years ............................ (0.3) (5.0)

Settlements with taxing authorities ................................. (4.0) (63.6)

Lapse of applicable statute of limitations ............................. (2.8) —

Balance at Dec. 31 .......................................... $35.5 $ 26.3

101