Xcel Energy 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

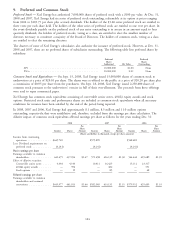

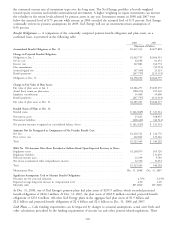

Total income tax expense from continuing operations differs from the amount computed by applying the statutory

federal income tax rate to income before income tax expense. The following is a table reconciling such differences for

the years ending Dec. 31:

2008 2007 2006

Federal statutory rate ............................... 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit ......... 4.4 4.5 3.0

Life insurance policies ............................ (0.2) (3.7) (4.6)

Tax credits recognized, net of federal income tax expense ....... (1.8) (2.5) (3.2)

Capital loss carry forward utilization ................... — — (2.6)

Resolution of income tax audits and other ................ — (0.7) (1.5)

Regulatory differences — utility plant items ............... (2.1) (1.1) (0.5)

FIN 48 expense — unrecognized tax benefits .............. (0.1) 3.1 —

Other, net .................................... (0.8) (0.8) (1.4)

Effective income tax rate from continuing operations ........... 34.4% 33.8% 24.2%

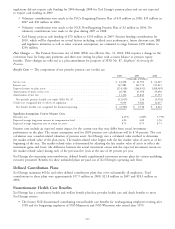

The components of Xcel Energy’s income tax expense from continuing operations for the years ending Dec. 31 were:

2008 2007 2006

(Thousands of Dollars)

Current federal tax expense ........................... $56,044 $ 10,649 $209,941

Current state tax expense ............................ 26,904 6,726 41,119

Current FIN 48 tax expense .......................... 3,891 20,512 —

Deferred federal tax expense (benefit) .................... 236,307 225,971 (35,795)

Deferred state tax expense (benefit) ...................... 38,758 47,555 (8,503)

Deferred FIN 48 tax (benefit) expense .................... (4,535) 6,926 —

Deferred tax credits ............................... (11,485) (15,175) (15,545)

Deferred investment tax credits ........................ (7,198) (8,680) (9,806)

Total income tax expense from continuing operations ......... $338,686 $294,484 $181,411

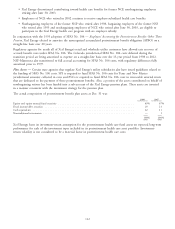

The components of Xcel Energy’s net deferred tax liability from continuing operations (current and noncurrent

portions) at Dec. 31 were:

2008 2007

(Thousands of Dollars)

Deferred tax liabilities:

Differences between book and tax bases of property .................... $2,770,768 $2,535,181

Regulatory assets .......................................... 188,603 168,080

Employee benefits ......................................... 40,708 16,707

Deferred costs ............................................ 49,195 101,287

Other ................................................. 57,126 30,507

Total deferred tax liabilities ..................................... $3,106,400 $2,851,762

Deferred tax assets:

Net operating loss carry forward ................................ $ 46,297 $ 77,350

Tax credit carry forward ...................................... 112,952 103,585

Unbilled revenues ......................................... 83,128 73,852

Other comprehensive income .................................. 37,032 19,794

Deferred investment tax credits ................................. 41,460 44,220

Rate refund ............................................. 40,347 23,767

Regulatory liabilities ........................................ 32,444 32,608

Environmental remediation .................................... 28,443 18,438

Bad debts .............................................. 25,136 19,299

Accrued liabilities and other ................................... 18,177 8,574

Total deferred tax assets ....................................... $ 465,416 $ 421,487

Net deferred tax liability ..................................... $2,640,984 $2,430,275

103