Xcel Energy 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

similar investments. The fair values of Xcel Energy’s long-term debt is estimated based on the quoted market prices for

the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2008 and 2007.

These fair value estimates have not been comprehensively revalued for purposes of these consolidated financial

statements since that date, and current estimates of fair values may differ significantly.

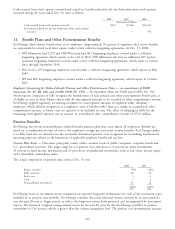

All unrealized gains and losses in the external decommissioning fund are recorded as a regulatory asset or liability

pursuant to SFAS No. 71. The following tables provide the external decommissioning fund’s approximate realized gains,

losses and proceeds from the sale of securities for the years ended Dec. 31:

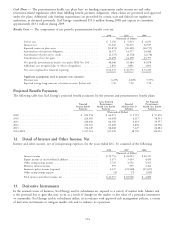

2008 2007 2006

(Thousands of Dollars)

Realized gains ................................... $65,779 $ 38,745 $310,066

Realized losses ................................... 107,272 35,794 32,412

Proceeds from sale of securities ........................ 914,514 669,070 958,294

Guarantees — Xcel Energy provides guarantees and bond indemnities supporting certain subsidiaries. The guarantees

issued by Xcel Energy guarantee payment or performance by its subsidiaries under specified agreements or transactions.

As a result, Xcel Energy’s exposure under the guarantees is based upon the net liability of the relevant subsidiary under

the specified agreements or transactions. Most of the guarantees issued by Xcel Energy limit the exposure of Xcel

Energy to a maximum amount stated in the guarantees. On Dec. 31, 2008 and 2007, Xcel Energy had issued

guarantees of up to $67.5 million and $75.2 million, respectively, with $18.2 and $17.5 million of known exposure

under these guarantees, respectively. In addition, Xcel Energy provides indemnity protection for bonds issued for itself

and its subsidiaries. The total amount of bonds with this indemnity outstanding as of Dec. 31, 2008 and 2007, was

approximately $27.9 million and $31.6 million, respectively. The total exposure of this indemnification cannot be

determined at this time. Xcel Energy believes the exposure to be significantly less than the total amount of bonds

outstanding.

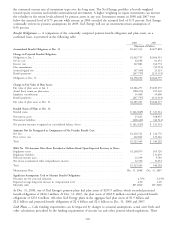

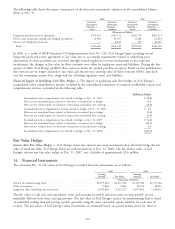

On Dec. 31, 2008, Xcel Energy had the following amount of guarantees and exposure under these guarantees,

including those related to Seren, UE, Quixx and Xcel Energy Argentina, which are components of discontinued

operations:

Triggering

Event

Guarantee Current Term or Expiration Requiring Assets Held

Nature of Guarantee Guarantor Amount Exposure Date Performance as Collateral

(Millions of Dollars)

2009-2010,

Guarantee performance and payment of surety 2012, 2014,

bonds for itself and its subsidiaries(f) ..... Xcel Energy $27.9 (a) 2015 and 2022 (d) N/A

Guarantee the indemnification obligations of

Xcel Energy Wholesale Group Inc. under a

stock purchase agreement(g) ........... Xcel Energy 17.5 $17.5 2010 (c) N/A

Guarantee the indemnification obligations of

Xcel Energy Argentina under a stock

purchase agreement ................ Xcel Energy 14.7 — Continuing (c) N/A

Guarantee the indemnification obligations of

Seren under an asset purchase agreement . . Xcel Energy 12.5 — 2010 (c) N/A

Guarantee the indemnification obligations of

Seren under an asset purchase agreement . . Xcel Energy 10.0 — Continuing (c) N/A

Guarantee of customer loans for the Farm

Rewiring Program ................ NSP-Wisconsin 1.0 0.3 Continuing (e) N/A

Combination of guarantees benefiting various

Xcel Energy subsidiaries ............. Xcel Energy 11.8 0.4 Continuing (b)(c) N/A

(a) The total exposure of this indemnification cannot be determined. Xcel Energy believes the exposure to be significantly less than the total amount of the outstanding bonds.

(b) Nonperformance and/or nonpayment.

(c) Losses caused by default in performance of covenants or breach of any warranty or representation in the purchase agreement.

117