Xcel Energy 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Legal Costs — Litigation accruals are recorded when it is probable Xcel Energy is liable for the costs and the liability

can be reasonably estimated. External legal fees related to settlements are expensed as incurred.

Income Taxes — Xcel Energy accounts for income taxes using the asset and liability method under SFAS No. 109,

which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events

that have been included in the financial statements. Xcel Energy defers income taxes for all temporary differences

between pretax financial and taxable income, and between the book and tax bases of assets and liabilities. Xcel Energy

uses the tax rates that are scheduled to be in effect when the temporary differences are expected to turn around, or

reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period

that includes the enactment date.

Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more likely

than not that some portion or all of the deferred tax asset will not be realized. In making such a determination, all

available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable

income, tax planning strategies and recent financial operations, is considered.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, the reversal of

some temporary differences are accounted for as current income tax expense. Investment tax credits are deferred and

their benefits amortized over the book depreciable lives of the related property. Utility rate regulation also has created

certain regulatory assets and liabilities related to income taxes, which are summarized in Note 19 to the consolidated

financial statements. For more information on income taxes, see Note 8 to the consolidated financial statements.

In July 2006, the FASB issued FIN 48, which prescribes how a company should recognize, measure, present and

disclose uncertain tax positions that such company has taken or expects to take in its income tax returns. FIN 48

requires that only income tax benefits that meet the ‘‘more likely than not’’ recognition threshold be recognized or

continue to be recognized on its effective date. As required, Xcel Energy adopted FIN 48 as of Jan. 1, 2007, and the

initial derecognition amounts were reported as a cumulative effect of a change in accounting principle. The cumulative

effect of the change, which was reported as an adjustment to the beginning balance of retained earnings, was not

material. Following implementation, the ongoing recognition of changes in measurement of uncertain tax positions will

be reflected as a component of income tax expense.

Xcel Energy reports interest and penalties related to income taxes within the interest charges section in the consolidated

statements of income.

Xcel Energy and its subsidiaries file consolidated federal income tax returns and combined and separate state income tax

returns.

Federal income taxes paid by Xcel Energy, as parent of the Xcel Energy consolidated group, are allocated to the Xcel

Energy subsidiaries based on separate company computations of tax. A similar allocation is made for state income taxes

paid by Xcel Energy in connection with combined state filings. The holding company also allocates its own net income

tax benefits to its direct subsidiaries based on the positive tax liability of each company.

Use of Estimates — In recording transactions and balances resulting from business operations, Xcel Energy uses

estimates based on the best information available. Estimates are used for such items as plant depreciable lives, AROs,

decommissioning, tax provisions, uncollectible amounts, environmental costs, unbilled revenues, jurisdictional fuel and

energy cost allocations and actuarially determined benefit costs. The recorded estimates are revised when better

information becomes available or when actual amounts can be determined. Those revisions can affect operating results.

The depreciable lives of certain plant assets are reviewed annually and revised, if appropriate.

Cash and Cash Equivalents — Xcel Energy considers investments in certain instruments, including commercial paper

and money market funds, with a remaining maturity of three months or less at the time of purchase, to be cash

equivalents.

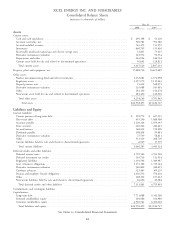

Restricted Cash — At Dec. 31, 2008 and 2007, Xcel Energy had restricted cash of $1 million and $33 million,

respectively. The restricted cash balances primarily represent deposits held in conjunction with short-term wholesale and

commodity trading activities. These balances are presented as a component of other assets on the consolidated balance

sheets.

Inventory — All inventory is recorded at average cost.

92