Xcel Energy 2008 Annual Report Download - page 84

Download and view the complete annual report

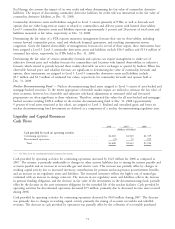

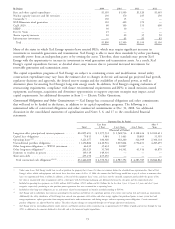

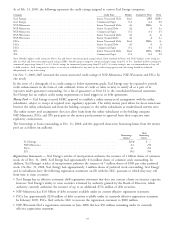

Please find page 84 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(f) Xcel Energy expects to have pension funding requirements of $70 million to $130 million in 2009. Pension funding contributions for 2010, which will be dependent on

several factors including, realized asset performance, future discount rate, IRS and legislative initiatives as well as other actuarial assumptions, are estimated to range between

$150 million to $250 million.

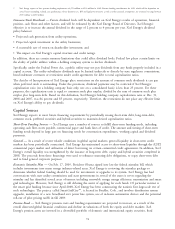

Common Stock Dividends — Future dividend levels will be dependent on Xcel Energy’s results of operations, financial

position, cash flows and other factors, and will be evaluated by the Xcel Energy Board of Directors. Xcel Energy’s

objective is to increase the annual dividend in the range of 2 percent to 4 percent per year. Xcel Energy’s dividend

policy balances:

• Projected cash generation from utility operations;

• Projected capital investment in the utility businesses;

• A reasonable rate of return on shareholder investment; and

• The impact on Xcel Energy’s capital structure and credit ratings.

In addition, there are certain statutory limitations that could affect dividend levels. Federal law places certain limits on

the ability of public utilities within a holding company system to declare dividends.

Specifically, under the Federal Power Act, a public utility may not pay dividends from any funds properly included in a

capital account. The utility subsidiaries dividends may be limited indirectly or directly by state regulatory commissions,

bond indenture covenants or restrictions under credit agreements for debt to total capitalization ratios.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay

when preferred stock is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’s

capitalization ratio (on a holding company basis only, not on a consolidated basis) is less than 25 percent. For these

purposes, the capitalization ratio is equal to common stock plus surplus, divided by the sum of common stock plus

surplus plus long-term debt. Based on this definition, Xcel Energy’s holding company capitalization ratio at Dec. 31,

2008 and 2007, was 84 percent and 85 percent, respectively. Therefore, the restrictions do not place any effective limit

on Xcel Energy’s ability to pay dividends.

Capital Sources

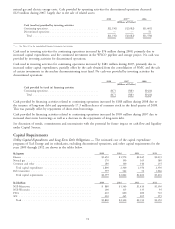

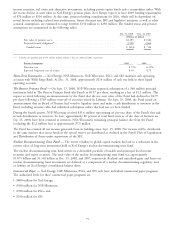

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt,

common stock, preferred securities and hybrid securities to maintain desired capitalization ratios.

Short-Term Funding Sources — Xcel Energy uses a number of sources to fulfill short-term funding needs, including

operating cash flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term

funding needs depend in large part on financing needs for construction expenditures, working capital and dividend

payments.

General — As a result of recent volatile conditions in global capital markets, general liquidity in short-term credit

markets has been periodically constrained. Xcel Energy has maintained access to short-term liquidity through the A2/P2

commercial paper market and utilization of direct borrowing on certain committed credit agreements. In addition, Xcel

Energy’s overall liquidity was strengthened by the issuance of long-term debt, equity and hybrid securities completed in

2008. The proceeds from these financings were used to refinance maturing debt obligations, to repay short-term debt

and to fund general corporate purposes.

Economic Stimulus Plan — On Feb. 17, 2009, President Obama signed into law the federal stimulus bill, which

includes investments into many energy industry-related areas. Xcel Energy is reviewing the stimulus package to

determine whether federal funding should be used for investments or upgrades to its system. Xcel Energy has had

conversations with state utility commissions and state governments in several of the states it serves regarding the

stimulus and has identified several areas of interest including renewable energy, energy efficiency, transmission and smart

grid technologies. However, Xcel Energy is still debating the merit of applying for such funds. Of particular interest is

the smart grid funding because since April 2008, Xcel Energy has been constructing the nation’s first large-scale test of

such technologies. The project, called SmartGridCity, is located in Boulder, Colo., and involves distribution system

upgrades, installation of a new broadband over power line system, use of in-home automation devices and the potential

roll-out of pilot pricing tariffs in fall 2009.

Pension Fund — Xcel Energy’s pension costs and funding requirements are projected to increase, as a result of the

overall distressed global financial conditions and decline in valuations of both the equity and debt markets. Xcel

Energy’s pension assets are invested in a diversified portfolio of domestic and international equity securities, fixed

74