Xcel Energy 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

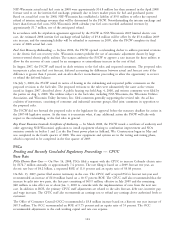

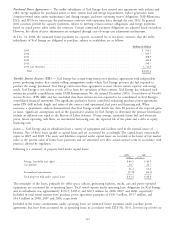

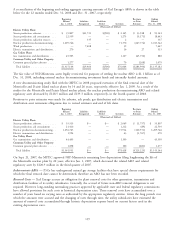

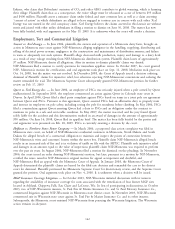

Arrangement Contains a Lease and SFAS No. 13, Accounting for Leases. Future commitments under operating and capital

leases for continuing operations are:

Purchase Power

Other Agreement Total

Operating Operating Operating

Leases Leases(a)(b) Leases Capital Leases

(Millions of Dollars)

2009 ........................................... $26.1 $ 160.3 $ 186.4 $ 6.0

2010 ........................................... 22.9 157.4 180.3 5.8

2011 ........................................... 20.3 147.6 167.9 5.7

2012 ........................................... 17.2 144.4 161.6 5.5

2013 ........................................... 16.7 148.1 164.8 5.3

Thereafter ....................................... 38.1 2,322.0 2,360.1 51.5

Total minimum obligation ............................ 79.8

Interest component of obligation ......................... (36.4)

Present value of minimum obligation ..................... $43.4

(a) Amounts not included in purchase power agreement estimated future payments above.

(b) Purchase power agreement operating leases contractually expire through 2033.

WYCO — Xcel Energy has invested approximately $128 million as of Dec. 31 2008 for construction of WYCO’s High

Plains gas pipeline and the related Totem gas storage facilities. The High Plains gas pipeline began operations in 2008

and the Totem gas storage facilities are expected to begin operations in 2009. The gas pipeline and storage facilities will

be leased under a FERC-approved agreement to Colorado Interstate Gas Company, a subsidiary of El Paso Corporation.

Technology Agreements — Xcel Energy has a contract that extends through 2015 with International Business Machines

Corp. (IBM) for information technology services. The contract is cancelable at Xcel Energy’s option, although there are

financial penalties for early termination. In 2008, Xcel Energy paid IBM $110.8 million under the contract and

$0.2 million for other project business. The contract also has a committed minimum payment each year from 2009

through September 2015. Payments under this obligation are $19.9 million, $19.6 million, $19.1 million,

$18.9 million, $18.7 million and $32.5 million for 2009 to 2013 and thereafter, respectively.

On Aug. 1, 2008, Xcel Energy entered into a contract with Accenture for information technology services, which begins

on Feb. 1, 2009 and extends through 2014. The contract is cancelable at Xcel Energy’s option, although there are

financial penalties for early termination. The contract also has a committed minimum payment each year from 2009

through 2014. Payments under this obligation are $11.4 million, $11.6 million, $11.6 million, $11.8 million,

$12.0 million and $12.3 million for 2009 to 2013 and thereafter, respectively.

Environmental Contingencies

Xcel Energy and its subsidiaries have been, or are currently involved with, the cleanup of contamination from certain

hazardous substances at several sites. In many situations, the subsidiary involved believes it will recover some portion of

these costs through insurance claims. Additionally, where applicable, the subsidiary involved is pursuing, or intends to

pursue, recovery from other potentially responsible parties (PRPs) and through the rate regulatory process. New and

changing federal and state environmental mandates can also create added financial liabilities for Xcel Energy and its

subsidiaries, which are normally recovered through the rate regulatory process. To the extent any costs are not recovered

through the options listed above, Xcel Energy would be required to recognize an expense.

Site Remediation — Xcel Energy must pay all or a portion of the cost to remediate sites where past activities of its

subsidiaries or other parties have caused environmental contamination. Environmental contingencies could arise from

various situations, including sites of former MGPs operated by Xcel Energy subsidiaries, predecessors, or other entities;

and third-party sites, such as landfills, to which Xcel Energy is alleged to be a PRP that sent hazardous materials and

wastes. At Dec. 31, 2008, the liability for the cost of remediating these sites was estimated to be $71.3 million, of

which $1.5 million was considered to be a current liability.

133