Xcel Energy 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Electric and Resource Adjustment Clauses

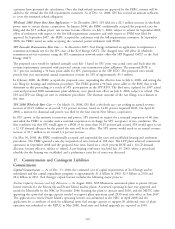

New Mexico Fuel Factor Continuation Filing — In August 2005, SPS filed with the NMPRC requesting continuation

of the use of SPS’ fuel and purchased power cost adjustment clause (FPPCAC) and current monthly factor cost

recovery methodology. This filing was required by NMPRC rule.

Testimony was filed in the case by staff and intervenors objecting to SPS’ assignment of system average fuel costs to

certain wholesale sales and the inclusion of certain purchased power capacity and energy payments in the FPPCAC.

The testimony also proposed limits on SPS’ future use of the FPPCAC. Related to these issues, some intervenors

requested disallowances for past periods, which in the aggregate total approximately $45 million. This claim was for the

period from Oct. 1, 2001 through May 31, 2005 and does not include the value of incremental cost assigned for

wholesale transactions from that date forward. Other issues in the case include the treatment of renewable energy

certificates and SO2 allowance credit proceeds in relation to SPS’ New Mexico retail fuel and purchased power recovery

clause.

In December 2007, SPS, the NMPRC, Occidental Permian Ltd. and the New Mexico Industrial Energy Consumers

filed an uncontested settlement of this matter with the NMPRC.

• The settlement resolves all issues in the fuel continuation proceeding for total consideration of $15 million,

which includes customer refunds of $11.7 million.

• At Dec. 31, 2007, a reserve had been previously established for this potential exposure, with no further expense

accrual required.

• The settlement would also provide for significantly greater certainty surrounding system average fuel cost

assignment on a going forward basis and reduce percentages of system average cost wholesale sales between now

and 2019 on a stepped down basis.

• Under the terms of the settlement, SPS anticipates additional fuel cost disallowances in 2008 and a portion of

2009 of approximately $2 million per year. It does not anticipate any future disallowances beyond this period.

• Finally, the settlement provides for SPS to continue its use of the FPPCAC subject to additional reporting

provisions.

On Aug. 26, 2008, the NMPRC issued a final order approving the unanimous stipulation.

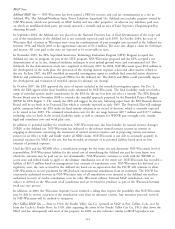

Investigation of SPS Participation in SPP — In October 2007, the NMPRC issued an order initiating an investigation

to consider the prudence and reasonableness of SPS’ participation in the SPP RTO. The investigation will consider the

costs and benefits of RTO participation to SPS customers in New Mexico. SPS filed its direct testimony on July 31,

2008.

Pending and Recently Concluded Regulatory Proceedings — FERC

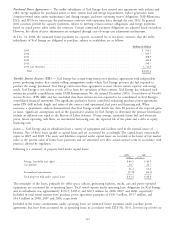

Wholesale Rate Complaints — In November 2004, Golden Spread Electric, Lyntegar Electric, Farmer’s Electric, Lea

County Electric, Central Valley Electric and Roosevelt County Electric, all wholesale cooperative customers of SPS, filed

a rate complaint with the FERC alleging that SPS’ rates for wholesale service were excessive and that SPS had

incorrectly calculated monthly fuel cost adjustment charges to such customers (the Complaint). Among other things,

the complainants asserted that SPS had inappropriately allocated average fuel and purchased power costs to other

wholesale customers, effectively raising the fuel cost charges to complainants. Cap Rock Energy Corporation (Cap

Rock), another full-requirements customer of SPS, Public Service Company of New Mexico (PNM) and Occidental

Permian Ltd. and Occidental Power Marketing, L.P. (Occidental), SPS’ largest retail customer, intervened in the

proceeding.

In May 2006, a FERC ALJ issued an initial decision in the proceeding. The ALJ found that SPS should recalculate its

FCAC billings for the period beginning Jan. 1, 1999, to reduce the fuel and purchased power costs recovered from the

complaining customers by deducting from such costs the incremental fuel costs attributed to SPS’ sales of system firm

capacity and associated energy to other wholesale customers served under market-based rates during this period based

on the view that such sales should be treated as opportunity sales made out of temporarily excess capacity. In addition,

the ALJ made recommendations on a number of base rate issues including a 9.64 percent ROE and the use of a

3-month coincident peak (3CP) demand allocator.

128