Xcel Energy 2008 Annual Report Download - page 135

Download and view the complete annual report

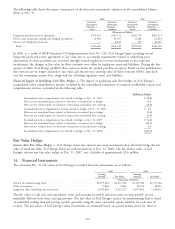

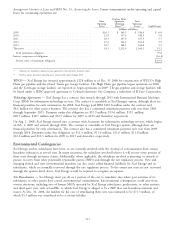

Please find page 135 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other parties filing testimony affecting the revenue requirements were the Colorado Energy Consumers which

supported use of a historic test year; Ratepayers United of Colorado, which recommended a 9.5 percent ROE; and

Leslie Glustrom, a citizen intervenor, who raised concerns about the Comanche 3 project as well as PSCo’s consulting

and personal communication costs.

A final decision is expected in the summer of 2009. The following procedural schedule has been established:

• PSCo rebuttal testimony on March 20, 2009;

• Staff and intervenor surrebuttal testimony on April 10, 2009; and

• The hearing on the merits are scheduled for April 20 — May 1, 2009.

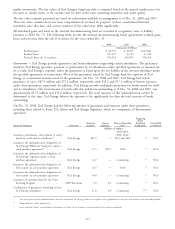

Natural Gas Rate Case — Phase II — In July 2007, the CPUC issued a final written order approving a natural gas

rate increase of approximately $32.3 million, based on a 10.25 percent ROE and a 60.17 percent equity ratio. Final

rates were implemented effective July 30, 2007, through a general rate schedule adjustment (GRSA) applied to all

customer classes. Under the provisions of the settlement between PSCo and the CPUC, PSCo filed its Phase II (cost

allocation and rate design) in April 2008 to spread the settled revenue requirement from its 2006 Phase I gas rate case

among PSCo’s customer classes.

In December 2008, the CPUC issued its final order in which the CPUC approved with certain exceptions PSCo’s

proposed reallocation of its revenue requirement, including the $32.3 million final written order referenced above,

among rate classes.

In this same order, the CPUC rejected PSCo’s proposal to raise its fixed monthly service and facilities charges. The

CPUC also approved the recovery of PSCo’s $15 million pilot low-income assistance program through customers’

service and facilities charges. The costs of this low-income program are in addition to the $32.3 million base-rate

increase approved in July 2007.

On Jan. 1, 2009, PSCo implemented the CPUC’s approved reallocation of the revenue requirement, eliminated the

GRSA and began recovering the costs of its low-income program.

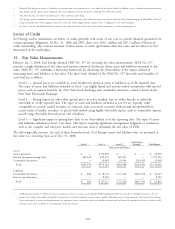

Electric, Purchased Gas and Resource Adjustment Clauses

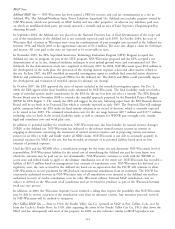

TCA Rider — In September 2007, PSCo filed with the CPUC a request to implement a TCA. In December 2007, the

CPUC approved PSCo’s application to implement the TCA rider. The CPUC limited the scope of the costs that could

be recovered through the rider during 2008 to only those costs associated with transmission investment made after the

new legislation authorizing the TCA rider became effective on March 26, 2007. The CPUC also required PSCo to base

its revenue requirement calculation on a thirteen-month average net transmission plant balance. As a result of the

CPUC’s decision, PSCo implemented a rider on Jan. 1, 2008, designed to recover approximately $4.5 million in 2008.

PSCo filed updates to the TCA rider on Nov. 3, 2008, and new rates went into effect on Jan. 1, 2009, to recover

approximately $18.0 million on an annual basis until the time rates in the pending rate case take effect.

Enhanced DSM Program — In July 2008, the CPUC issued an order approving PSCo’s proposal to expand the DSM

program and recover 100 percent of its forecasted expenses associated with the DSM program during the year in which

the rider is in effect, beginning in 2009. An incentive mechanism was also approved to reward PSCo for meeting and

exceeding program goals.

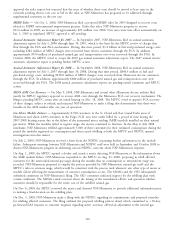

Pending and Recently Concluded Regulatory Proceedings — FERC

Pacific Northwest FERC Refund Proceeding — In July 2001, the FERC ordered a preliminary hearing to determine

whether there may have been unjust and unreasonable charges for spot market bilateral sales in the Pacific Northwest

for the period Dec. 25, 2000 through June 20, 2001. PSCo supplied energy to the Pacific Northwest markets during

this period and has been a participant in the hearings. In September 2001, the presiding ALJ concluded that prices in

the Pacific Northwest during the referenced period were the result of a number of factors, including the shortage of

supply, excess demand, drought and increased natural gas prices. Under these circumstances, the ALJ concluded that the

prices in the Pacific Northwest markets were not unreasonable or unjust and no refunds should be ordered. Subsequent

to the ruling, the FERC has allowed the parties to request additional evidence. Parties have claimed that the total

amount of transactions with PSCo subject to refund is $34 million. In June 2003, the FERC issued an order

terminating the proceeding without ordering further proceedings. Certain purchasers filed appeals of the FERC’s orders

in this proceeding with the U. S. Court of Appeals for the Ninth Circuit.

125