Xcel Energy 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

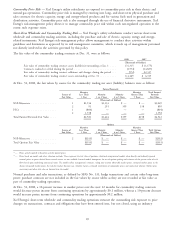

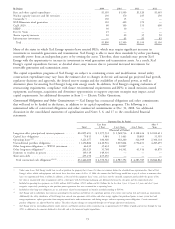

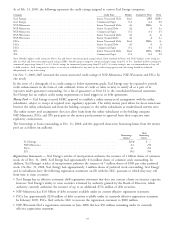

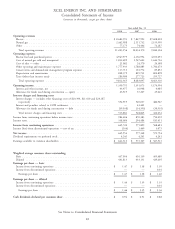

By Project 2009 2010 2011 2012

Base and other capital expenditures........................ $1,305 $1,500 $1,520 $1,665

Nuclear capacity increases and life extension .................. 130 170 185 150

Comanche 3 ...................................... 130 15 — —

NSP-Minnesota wind generation ......................... 110 420 370 —

CapX 2020 ....................................... 60 100 155 400

MERP .......................................... 30 10 — —

Fort St. Vrain ..................................... 25———

Sherco capacity increases .............................. 10 20 35 50

Infrastructure investment .............................. — 65 85 85

Total ......................................... $1,800 $2,300 $2,350 $2,350

Many of the states in which Xcel Energy operates have enacted RESs, which may require significant increases in

investment in renewable generation and transmission. Xcel Energy is able to meet these standards by either purchasing

renewable power from an independent party or by owning the assets. Therefore, these standards may present Xcel

Energy with the opportunity to increase its investment in wind generation and transmission assets. As a result, Xcel

Energy’s capital expenditure forecast, as detailed above, may increase due to potential increased investments for

renewable generation and transmission assets.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility

construction expenditures may vary from the estimates due to changes in electric and natural gas projected load growth,

regulatory decisions and approvals, the desired reserve margin and the availability of purchased power, as well as

alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of

restructuring requirements, compliance with future environmental requirements and RPSs to install emission-control

equipment, and merger, acquisition and divestiture opportunities to support corporate strategies may impact actual

capital requirements. See additional discussion in Item 1 — Electric Utility Operations.

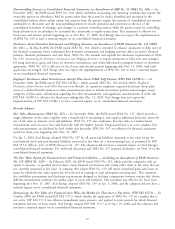

Contractual Obligations and Other Commitments — Xcel Energy has contractual obligations and other commitments

that will need to be funded in the future, in addition to its capital expenditure programs. The following is a

summarized table of contractual obligations and other commercial commitments at Dec. 31, 2008. See additional

discussion in the consolidated statements of capitalization and Notes 5, 6, and 17 to the consolidated financial

statements.

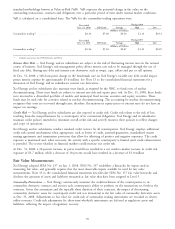

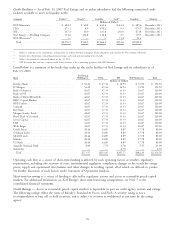

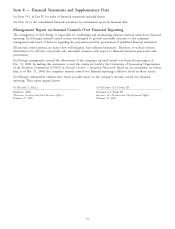

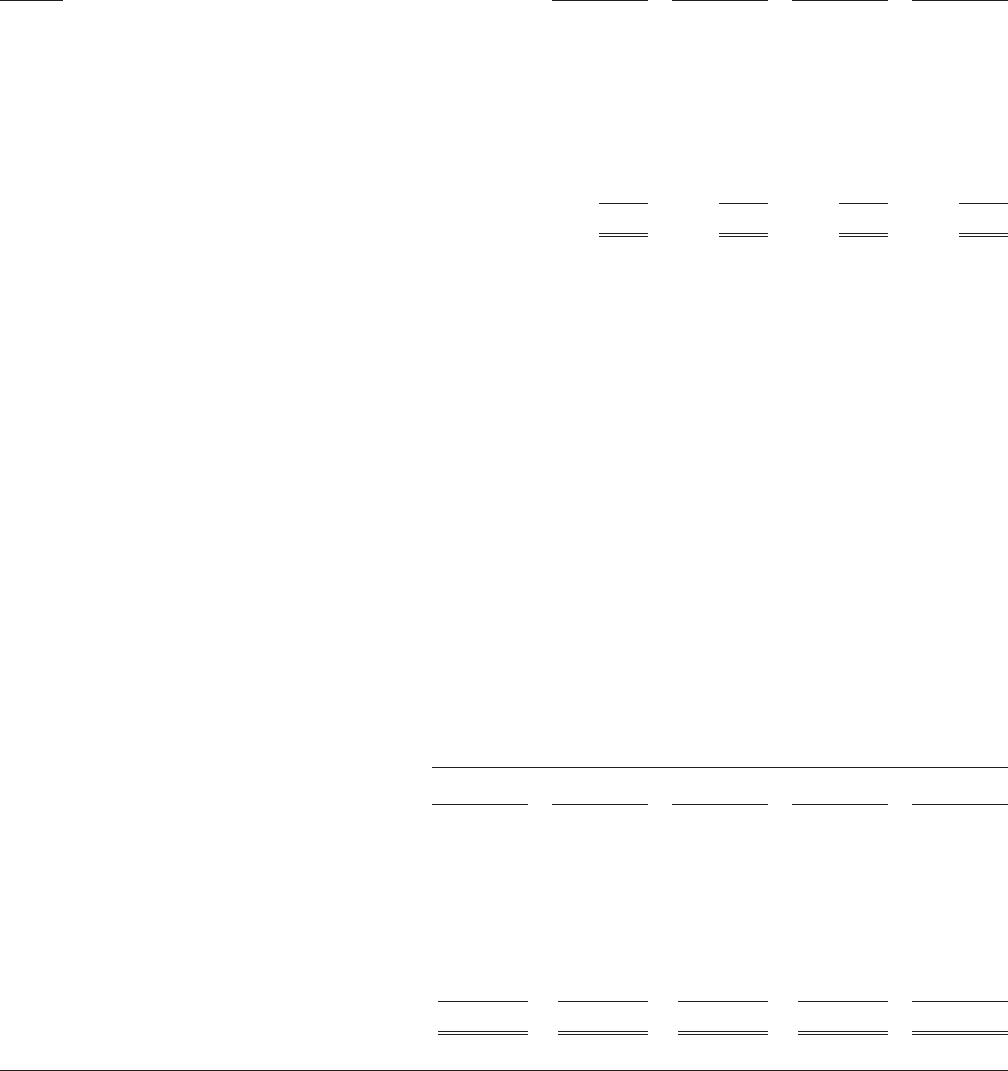

Payments Due by Period

Less than After 5

Total 1 Year 1 to 3 Years 4 to 5 Years Years

(Thousands of Dollars)

Long-term debt, principal and interest payments ..... $16,855,493 $ 1,075,532 $ 1,548,736 $ 2,128,614 $ 12,102,611

Capital lease obligations .................... 79,811 5,984 11,463 10,805 51,559

Operating leases(a)(b) ....................... 3,221,077 186,360 348,200 326,399 2,360,118

Unconditional purchase obligations ............. 11,456,886 2,410,916 3,003,824 1,756,451 4,285,695

Other long-term obligations — WYCO investment . . . 46,239 35,432 10,807 — —

Other long-term obligations(c) ................. 202,525 31,768 64,362 61,516 44,879

Payments to vendors in process ................ 149,319 149,319 — — —

Short-term debt ......................... 455,250 455,250 — — —

Total contractual cash obligations(d)(e)(f) .......... $32,466,600 $ 4,350,561 $ 4,987,392 $ 4,283,785 $ 18,844,862

(a) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease expiration date. Most of Xcel

Energy’s railcar, vehicle and equipment and aircraft leases have these terms. At Dec. 31, 2008, the amount that Xcel Energy would have to pay if it chose to terminate these

leases was approximately $162.1 million. In addition, at the end of the equipment leases’ terms, each lease must be extended, equipment purchased for the greater of the

fair value or unamortized value or equipment sold to a third party with Xcel Energy making up any deficiency between the sales price and the unamortized value.

(b) Included in operating lease payments are $160.3 million, $305.0 million, $292.5 million and $2.3 billion, for the less than 1 year, 1-3 years, 4-5 years and after 5 years

categories, respectively, pertaining to nine purchase power agreements that were accounted for as operating leases.

(c) Included in other long-term obligations are tax and interest related to unrecognized tax benefits recorded according to FIN 48.

(d) Xcel Energy and its subsidiaries have contracts providing for the purchase and delivery of a significant portion of its current coal, nuclear fuel and natural gas requirements.

Additionally, the utility subsidiaries of Xcel Energy have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and

energy requirements, replace generation from company-owned units under maintenance and during outages, and meet operating reserve obligations. Certain contractual

purchase obligations are adjusted based on indices. The effects of price changes are mitigated through cost-of-energy adjustment mechanisms.

(e) Xcel Energy also has outstanding authority under contracts and blanket purchase orders to purchase up to approximately $1.5 billion of goods and services through the year

2050, in addition to the amounts disclosed in this table and in the forecasted capital expenditures.

73