Xcel Energy 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or persons other than ‘‘U.S. persons,’’ as that term is defined in Rule 902 under the Securities Act of 1933. The New

Notes were issued with a registration rights agreement.

In accordance with the EITF No. 96-19, Debtor’s Accounting for a Modification or Exchange of Debt Instruments, this

transaction was accounted for as an exchange. As such, the fees paid to the bondholders have been associated with the

replacement debt instruments and, along with the existing unamortized discount, will be amortized as an adjustment of

interest expense over the remaining term of the replacement debt instruments. Also, as required by EITF No. 96-19,

the fees paid to third parties were expensed as incurred and $1.7 million was included in interest charges and other

financing costs in the consolidated statements of income.

On June 19, 2007, Xcel Energy filed a registration statement with the SEC to exchange the New Notes for the

exchange notes, which have terms identical in all material respects to the New Notes, except that the exchange notes do

not contain transfer restrictions nor are they subject to registration rights. The exchange offer was completed on

Dec. 20, 2007.

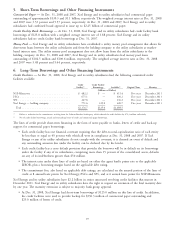

7. Generating Plant Ownership and Operation

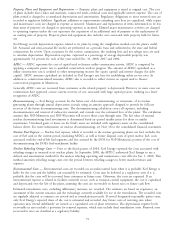

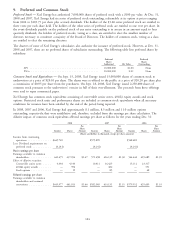

Joint Plant Ownership — Following are the investments by Xcel Energy’s subsidiaries in jointly owned plants and the

related ownership percentages as of Dec. 31, 2008:

Construction

Plant in Accumulated Work in

Service Depreciation Progress Ownership %

(Thousands of Dollars)

NSP-Minnesota

Sherco Unit 3 ..................................... $527,647 $325,472 $ 128 59.0

Sherco Common Facilities Units 1, 2 and 3 .................. 122,812 73,779 180 75.0

Transmission facilities, including substations .................. 4,790 2,231 — 59.0

Total NSP-Minnesota ............................... $655,249 $401,482 $ 308

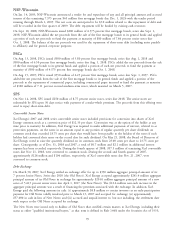

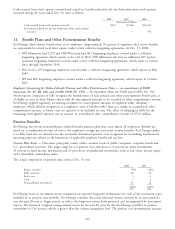

Construction

Plant in Accumulated Work in

Service Depreciation Progress Ownership %

PSCo

Hayden Unit 1 .................................... $ 88,386 $ 54,319 $ 411 75.5

Hayden Unit 2 .................................... 81,504 51,680 2,047 37.4

Hayden Common Facilities ............................. 31,563 11,479 414 53.1

Craig Units 1 and 2 ................................. 53,421 31,334 358 9.7

Craig Common Facilities Units 1, 2 and 3 ................... 33,205 14,058 456 6.5-9.7

Comanche Unit 3 .................................. — — 672,144 66.7

Transmission and other facilities, including substations ............ 141,119 52,803 529 11.6-68.1

Total PSCo ..................................... $429,198 $215,673 $676,359

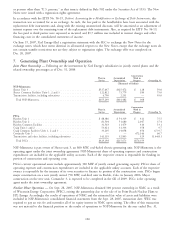

NSP-Minnesota is part owner of Sherco unit 3, an 860 MW, coal-fueled electric generating unit. NSP-Minnesota is the

operating agent under the joint ownership agreement. NSP-Minnesota’s share of operating expenses and construction

expenditures are included in the applicable utility accounts. Each of the respective owners is responsible for funding its

portion of construction and operating costs.

PSCo’s current operational assets include approximately 320 MW of jointly owned generating capacity. PSCo’s share of

operating expenses and construction expenditures are included in the applicable utility accounts. Each of the respective

owners is responsible for the issuance of its own securities to finance its portion of the construction costs. PSCo began

major construction on a new jointly owned 750 MW, coal-fired unit in Pueblo, Colo. in January 2006. Major

construction on the new unit, Comanche 3, is expected to be completed in the fall of 2009. PSCo is the operating

agent under the joint ownership agreement.

Nuclear Plant Operation — On Sept. 28, 2007, NSP-Minnesota obtained 100 percent ownership in NMC as a result

of Wisconsin Energy Corporation (WEC), exiting the partnership due to the sale of its Point Beach Nuclear Plant to

FPL Energy. Accordingly, the results of operations of NMC and the estimated fair value of assets and liabilities were

included in NSP-Minnesota’s consolidated financial statements from the Sept. 28, 2007, transaction date. WEC was

required to pay an exit fee and surrender all of its equity interest in NMC upon exiting. The effect of this transaction

was not material to the financial position or the results of operations to NSP-Minnesota for the year ended Dec. 31,

100