Xcel Energy 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commodity Price Risk — Xcel Energy’s utility subsidiaries are exposed to commodity price risk in their electric and

natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and

sales contracts for electric capacity, energy and energy-related products and for various fuels used in generation and

distribution activities. Commodity price risk is also managed through the use of financial derivative instruments. Xcel

Energy’s risk-management policy allows it to manage commodity price risk within each rate-regulated operation to the

extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term

wholesale and commodity trading activities, including the purchase and sale of electric capacity, energy and energy-

related instruments. Xcel Energy’s risk-management policy allows management to conduct these activities within

guidelines and limitations as approved by its risk management committee, which is made up of management personnel

not directly involved in the activities governed by this policy.

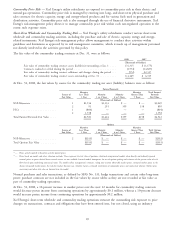

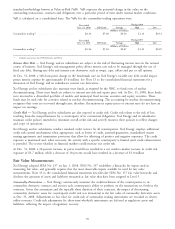

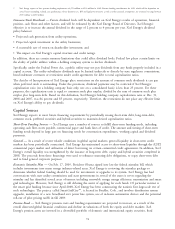

The fair value of the commodity trading contracts at Dec. 31, were as follows:

2008 2007

(Thousands of Dollars)

Fair value of commodity trading contract assets (liabilities) outstanding at Jan. 1 .... $6,315 $ (1,175)

Contracts realized or settled during the period ......................... (1,574) (14,827)

Fair value of commodity trading contract additions and changes during the period . . . (572) 22,317

Fair value of commodity trading contract assets outstanding at Dec. 31 .......... $4,169 $ 6,315

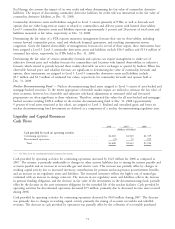

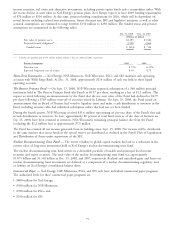

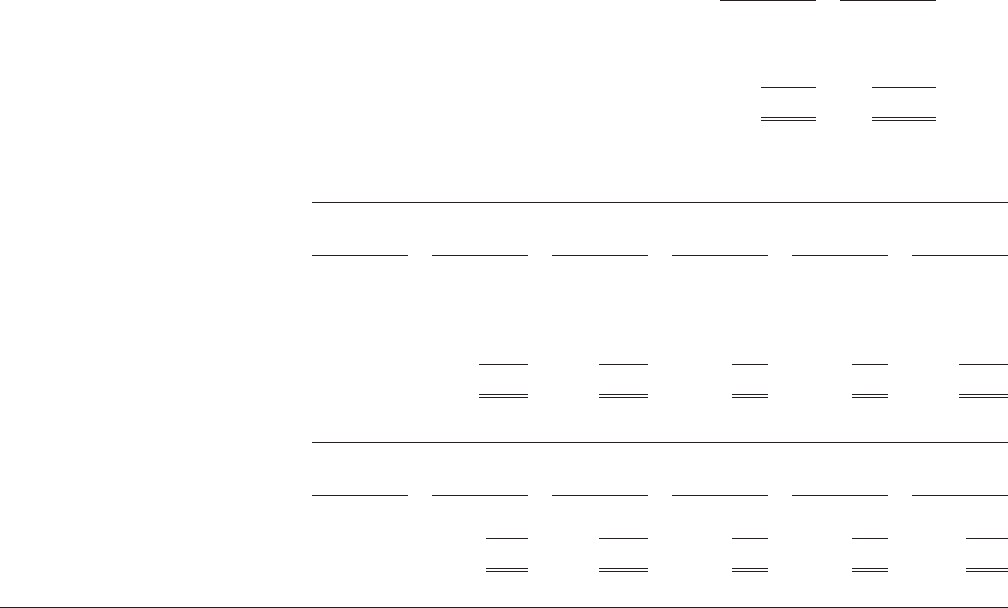

At Dec. 31, 2008, the fair values by source for the commodity trading net asset (liability) balances were as follows:

Futures/Forwards

Maturity Maturity Total Futures/

Source of Less Than Maturity Maturity Greater Than Forwards

Fair Value 1 Year 1 to 3 Years 4 to 5 Years 5 Years Fair Value

(Thousands of Dollars)

NSP-Minnesota ............... 1 $1,936 $1,133 $ — $ — $3,069

2 91 291 359 158 899

PSCo ..................... 1 (804) — — — (804)

2 1,358 — — — 1,358

Total Futures/Forwards Fair Value .... $2,581 $1,424 $359 $158 $4,522

Options

Maturity Maturity

Source of Less Than Maturity Maturity Greater Than Total Options

Fair Value 1 Year 1 to 3 Years 4 to 5 Years 5 Years Fair Value

(Thousands of Dollars)

NSP-Minnesota ............... 2 $(353) $ — $ — $ — $(353)

Total Options Fair Value ......... $(353) $ — $ — $ — $(353)

(1) — Prices actively quoted or based on actively quoted prices.

(2) — Prices based on models and other valuation methods. These represent the fair value of positions calculated using internal models when directly and indirectly quoted

external prices or prices derived from external sources are not available. Internal models incorporate the use of options pricing and estimates of the present value of cash

flows based upon underlying contractual terms. The models reflect management’s estimates, taking into account observable market prices, estimated market prices in the

absence of quoted market prices, the risk-free market discount rate, volatility factors, estimated correlations of commodity prices and contractual volumes. Market price

uncertainty and other risks also are factored into the model.

Normal purchases and sales transactions, as defined by SFAS No. 133, hedge transactions and certain other long-term

power purchase contracts are not included in the fair values by source tables as they are not recorded at fair value as

part of commodity trading operations.

At Dec. 31, 2008, a 10-percent increase in market prices over the next 12 months for commodity trading contracts

would decrease pretax income from continuing operations by approximately $0.1 million, whereas a 10-percent decrease

would increase pretax income from continuing operations by approximately $0.2 million.

Xcel Energy’s short-term wholesale and commodity trading operations measure the outstanding risk exposure to price

changes on transactions, contracts and obligations that have been entered into, but not closed, using an industry

69