Xcel Energy 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

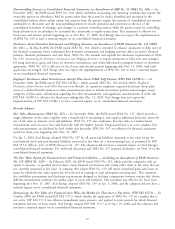

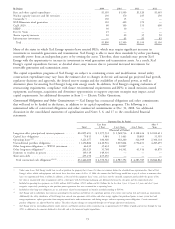

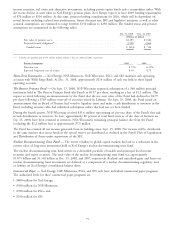

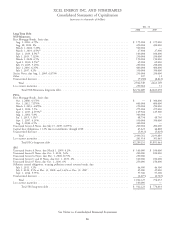

As of Feb. 13, 2009, the following represents the credit ratings assigned to various Xcel Energy companies:

Company Credit Type Moody’s Standard & Poor’s Fitch

Xcel Energy ........................................ Senior Unsecured Debt Baa1 BBB BBB+

Xcel Energy ........................................ Commercial Paper P-2 A-2 F2

NSP-Minnesota ..................................... Senior Unsecured Debt A3 BBB+ A

NSP-Minnesota ..................................... Senior Secured Debt A2 A A+

NSP-Minnesota ..................................... Commercial Paper P-2 A-2 F1

NSP-Wisconsin ..................................... Senior Unsecured Debt A3 A- A

NSP-Wisconsin ..................................... Senior Secured Debt A2 A A+

PSCo ............................................ Senior Unsecured Debt Baa1 BBB+ A-

PSCo ............................................ Senior Secured Debt A3 A A

PSCo ............................................ Commercial Paper P-2 A-2 F2

SPS............................................. Senior Unsecured Debt Baa1 BBB+ BBB+

SPS............................................. Commercial Paper P-2 A-2 F2

Note: Moody’s highest credit rating for debt is Aaa and lowest investment grade rating is Baa3. Both Standard & Poor’s and Fitch’s highest credit rating for

debt are AAA and lowest investment grade rating is BBB-. Moody’s prime ratings for commercial paper range from P-1 to P-3. Standard & Poor’s ratings for

commercial paper range from A-1 to A-3. Fitch’s ratings for commercial paper range from F1 to F3. A security rating is not a recommendation to buy, sell

or hold securities. Such rating may be subject to revision or withdrawal at any time by the credit rating agency and each rating should be evaluated

independently of any other rating.

On Nov. 5, 2008, S&P increased the senior unsecured credit ratings of NSP-Minnesota, NSP-Wisconsin and PSCo by

one notch.

In the event of a downgrade of its credit ratings to below investment grade, Xcel Energy may be required to provide

credit enhancements in the form of cash collateral, letters of credit or other security to satisfy all or a part of its

exposures under guarantees outstanding. See a list of guarantees at Note 14 to the consolidated financial statements.

Xcel Energy has no explicit credit rating requirements or hard triggers in its debt agreements.

Money Pool — Xcel Energy received FERC approval to establish a utility money pool arrangement with the utility

subsidiaries, subject to receipt of required state regulatory approvals. The utility money pool allows for short-term loans

between the utility subsidiaries and from the holding company to the utility subsidiaries at market-based interest rates.

The utility money pool arrangement does not allow loans from the utility subsidiaries to the holding company.

NSP-Minnesota, PSCo and SPS participate in the money pool pursuant to approval from their respective state

regulatory commissions.

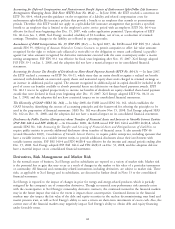

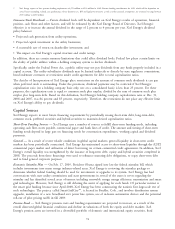

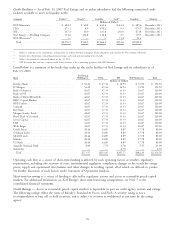

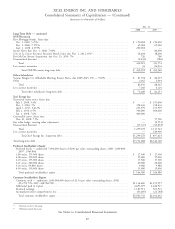

The borrowings or loans outstanding at Dec. 31, 2008, and the approved short-term borrowing limits from the money

pool are as follows (in millions):

Total

Borrowings Borrowing

(Loans) Limits

Xcel Energy ............................................... $(14) $ —

NSP-Minnesota ............................................ 64 250

PSCo ................................................... 41 250

SPS.................................................... (91) 100

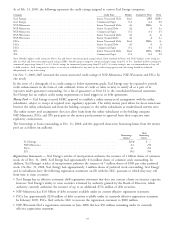

Registration Statements — Xcel Energy’s articles of incorporation authorize the issuance of 1 billion shares of common

stock. As of Dec. 31, 2008, Xcel Energy had approximately 454 million shares of common stock outstanding. In

addition, Xcel Energy’s articles of incorporation authorize the issuance of 7 million shares of $100 par value preferred

stock. On Dec. 31, 2008, Xcel Energy had approximately 1 million shares of preferred stock outstanding. Xcel Energy

and its subsidiaries have the following registration statements on file with the SEC, pursuant to which they may sell,

from time to time, securities:

• Xcel Energy has an effective automatic shelf registration statement that does not contain a limit on issuance capacity;

however, Xcel Energy’s ability to issue securities is limited by authority granted by the Board of Directors, which

authority currently authorizes the issuance of up to an additional $754 million of debt securities.

• NSP-Minnesota has $1.0 billion of debt securities available under its current effective registration statement.

• PSCo has approximately $250 million of debt securities available under its currently effective registration statement.

In February 2009, PSCo filed with the SEC to increase the registration statement to $800 million.

• NSP-Wisconsin filed a registration statement in June 2008 that has $50 million remaining under its currently

effective registration statement.

77