Xcel Energy 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

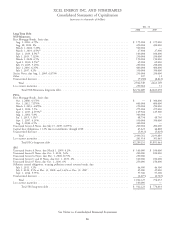

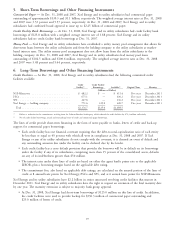

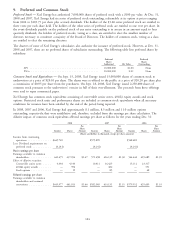

3. Selected Balance Sheet Data

Dec. 31, 2008 Dec. 31, 2007

(Thousands of Dollars)

Accounts receivable, net:

Accounts receivable ................................... $ 965,020 $ 1,000,981

Less allowance for bad debts ............................. (64,239) (49,401)

$ 900,781 $ 951,580

Inventories:

Materials and supplies ................................. $ 158,709 $ 152,770

Fuel ............................................ 227,462 142,764

Natural gas ........................................ 280,538 236,076

$ 666,709 $ 531,610

Property, plant and equipment, net:

Electric plant ........................................ $21,601,094 $ 20,313,313

Natural gas plant ...................................... 3,004,088 2,946,455

Common and other property .............................. 1,497,162 1,475,325

Construction work in progress ............................. 1,832,022 1,810,664

Total property, plant and equipment ....................... 27,934,366 26,545,757

Less accumulated depreciation .............................. (10,501,266) (10,049,927)

Nuclear fuel ......................................... 1,611,193 1,471,229

Less accumulated amortization ............................. (1,355,573) (1,291,370)

$ 17,688,720 $ 16,675,689

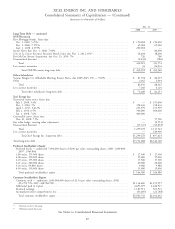

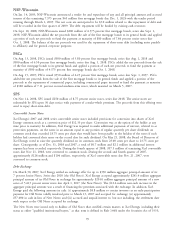

4. Discontinued Operations

Xcel Energy classified and accounted for certain assets as held for sale at Dec. 31, 2008 and 2007. Assets held for sale

are valued on an asset-by-asset basis at the lower of carrying amount or fair value less costs to sell. In applying those

provisions, management considered cash flow analyses, bids and offers related to those assets and businesses. Assets held

for sale are not depreciated.

Results of operations for divested businesses and the results of businesses held for sale are reported, for all periods

presented, as discontinued operations. In addition, the assets and liabilities of the businesses divested and held for sale

in 2008 and 2007 have been reclassified to assets and liabilities held for sale in the consolidated balance sheets. The

majority of current and noncurrent assets related to discontinued operations are deferred tax assets associated with

temporary differences and NOL and tax credit carryforwards that will be deductible in future years.

The major classes of assets and liabilities held for sale and related to discontinued operations as of Dec. 31 are as

follows:

2008 2007

(Thousands of Dollars)

Cash ............................................... $10,645 $ 6,792

Account receivables, net ................................... 209 913

Deferred income tax benefits ................................ 39,422 118,919

Other current assets ...................................... 6,365 2,197

Current assets held for sale and related to discontinued operations ....... 56,641 128,821

Deferred income tax benefits ................................ 150,912 97,284

Other noncurrent assets ................................... 30,544 23,026

Noncurrent assets held for sale and related to discontinued operations ..... 181,456 120,310

Accounts payable ....................................... 760 1,060

Other current liabilities ................................... 6,169 16,479

Current liabilities held for sale and related to discontinued operations ..... 6,929 17,539

Other noncurrent liabilities ................................. 20,656 20,384

Noncurrent liabilities held for sale and related to discontinued operations . . . $ 20,656 $ 20,384

96