Xcel Energy 2008 Annual Report Download - page 109

Download and view the complete annual report

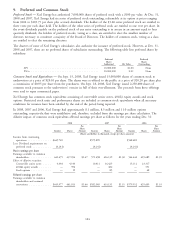

Please find page 109 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NSP-Wisconsin

On Jan. 14, 2009, NSP-Wisconsin announced a tender for and repurchase of any and all principal amount and accrued

interest of the remaining 7.375 percent $65 million first mortgage bonds due Dec. 1, 2026 with the tender period

running through March 1, 2009. The net costs are anticipated to be $3.0 million related to this repayment of debt and

will be recorded in the first quarter of 2009. The debt repayment will be funded by existing cash resources.

On Sept. 10, 2008, NSP-Wisconsin issued $200 million of 6.375 percent first mortgage bonds, series due Sept. 1,

2038. NSP-Wisconsin added the net proceeds from the sale of the first mortgage bonds to its general funds and applied

a portion of such net proceeds to fund the payment at maturity of $80 million of 7.64 percent senior notes due

Oct. 1, 2008. The balance of the net proceeds was used for the repayment of short-term debt (including notes payable

to affiliates) and for general corporate purposes.

PSCo

On Aug. 13, 2008, PSCo issued $300 million of 5.80 percent first mortgage bonds, series due Aug. 1, 2018 and

$300 million of 6.50 percent first mortgage bonds, series due Aug. 1, 2038. PSCo added the net proceeds from the sale

of the first mortgage bonds to its general funds and applied a portion of such net proceeds to fund the payment at

maturity of $300 million of 4.375 percent first mortgage bonds due Oct. 1, 2008.

On Aug. 15, 2007, PSCo issued $350 million of 6.25 percent first mortgage bonds, series due Sept. 1, 2037. PSCo

added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a portion of the

proceeds to the repayment of commercial paper, including commercial paper incurred to fund the payment at maturity

of $100 million of 7.11 percent secured medium-term notes, which matured on March 5, 2007.

SPS

On Nov. 14, 2008, SPS issued $250 million of 8.75 percent senior notes, series due 2018. The senior notes are

redeemable by SPS upon 30 days notice with payment of a make-whole premium. The proceeds from this offering were

used to repay short-term debt.

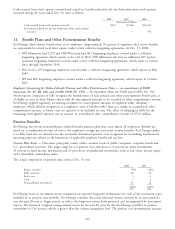

Convertible Senior Notes

Xcel Energy’s 2007 and 2008 series convertible senior notes included provisions for conversion into shares of Xcel

Energy common stock at a conversion price of $12.33 per share. Conversion was at the option of the holder at any

time prior to maturity. In addition, Xcel Energy was required to make additional payments of interest, referred to as

protection payments, on the notes in an amount equal to any portion of regular quarterly per share dividends on

common stock that exceeded 18.75 cents per share that would have been payable to the holders of the notes if such

holders had converted their notes on the record date for such dividend. On May 21, 2008, the Board of Directors of

Xcel Energy voted to raise the quarterly dividend on its common stock from 23.00 cents per share to 23.75 cents per

share. Consequently, as of Dec. 31, 2008 and 2007, a total of $0.7 million and $2.1 million in additional interest

expense has been recorded, respectively. During the fourth quarter of 2008, $57.5 million of remaining Xcel convertible

notes due Nov. 21, 2008, were converted to common stock. During the second and fourth quarter of 2007,

approximately $126 million and $104 million, respectively, of Xcel convertible notes due Nov. 21, 2007, were

converted to common stock.

Debt Exchange

On March 30, 2007, Xcel Energy settled an exchange offer for up to $350 million aggregate principal amount of its

7 percent Senior Notes, Series due 2010 (the Old Notes). Xcel Energy accepted approximately $241.4 million aggregate

principal amount of its Old Notes in exchange for approximately $254.0 million aggregate principal amount of a new

series of 5.613 percent senior notes due April 1, 2017 (the New Notes). The $12.6 million non-cash increase in the

aggregate principal amount was a result of financing the premium associated with the exchange. In addition, Xcel

Energy paid the following amounts in cash: (i) approximately $4.8 million to certain investors as an early participation

payment for Old Notes validly tendered prior to March 13, 2007 and accepted for exchange; (ii) approximately

$57,000 in cash in lieu of New Notes; and (iii) accrued and unpaid interest to, but not including, the settlement date

with respect to the Old Notes accepted for exchange.

The New Notes were issued only to holders of Old Notes that certified certain matters to Xcel Energy, including their

status as either ‘‘qualified institutional buyers,’’ as that term is defined in Rule 144A under the Securities Act of 1933,

99