Xcel Energy 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

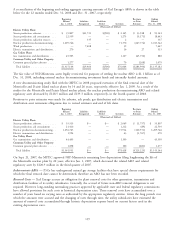

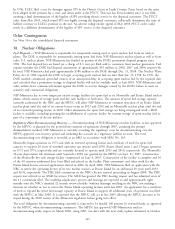

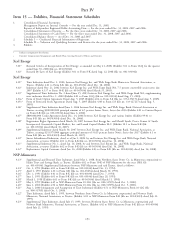

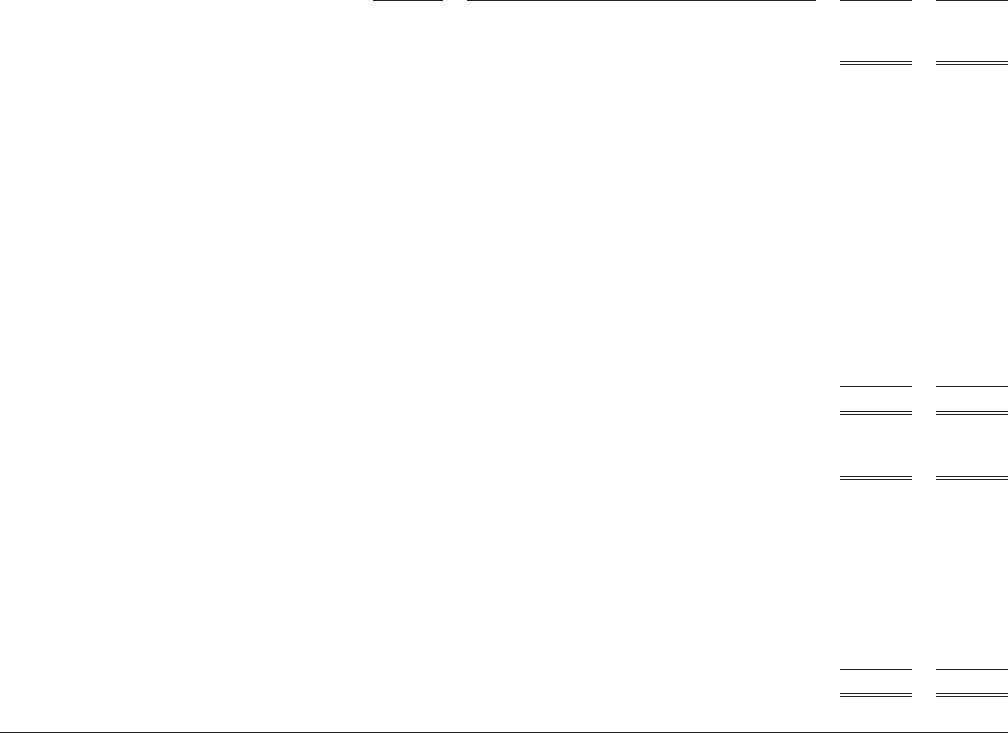

and liabilities in its consolidated statement of income. The components of unamortized regulatory assets and liabilities

of continuing operations shown on the consolidated balance sheets at Dec. 31 are:

See Note(s) Remaining Amortization Period 2008 2007

(Thousands of Dollars)

Regulatory Assets

Current regulatory asset — Unrecovered fuel costs . 1 Less than one year $ 32,843 $ 73,415

Pension and employee benefit obligations ...... 12 Various $1,212,542 $ 387,127

Net AROs(a) ....................... 1,17 Plant lives 299,294 39,891

AFDC recorded in plant(b) ............... 1 Plant lives 220,354 189,698

Contract valuation adjustments(c) ........... 14 Term of related contract 150,723 106,649

Conservation programs(b) ................ Various 117,188 119,839

Environmental costs ................... 16,17 Generally four to six years once actual expenditures 75,880 55,038

are incurred

Losses on reacquired debt ............... 1 Term of related debt 66,268 73,002

Renewable resource costs ................ One to two years 55,868 51,785

Nuclear outage costs .................. 16 Generally 18-24 months 40,690 —

Purchased power contracts costs ............ 14 Term of related contract 20,716 —

Unrecovered natural gas costs ............. 1 One to two years 14,657 22,505

State commission accounting adjustments(b) ..... Various 13,148 13,828

Rate case costs ...................... 1 Various 12,085 9,630

MISO Day 2 costs ................... 1 To be determined in future rate proceedings 11,783 12,035

Nuclear fuel storage ................... Four years 9,652 11,578

Nuclear decommissioning costs ............ To be determined in future rate proceedings 8,775 11,149

Other ........................... Various 27,656 11,689

Total noncurrent regulatory assets ............ $2,357,279 $1,115,443

Regulatory Liabilities

Current regulatory liability — Overrecovered fuel

costs(d) ......................... $ 134,212 $ 34,451

Plant removal costs ................... 1,17 $ 925,472 $ 906,996

Contract valuation adjustments(c) ........... 14 124,676 108,533

Investment tax credit deferrals ............. 68,313 72,686

Deferred income tax adjustments ........... 1 42,619 59,282

Nuclear outage costs collected in advance from

customers ....................... 13,678 —

Gain on sale of emission allowances ......... 1 8,153 21,334

Interest on income tax refunds ............ 1,736 3,472

Pension and employee benefit obligations ...... 12 —205,133

Other ........................... 9,949 12,551

Total noncurrent regulatory liabilities .......... $1,194,596 $1,389,987

(a) Includes amounts recorded for future recovery of AROs, less amounts recovered through nuclear decommissioning accruals and gains from decommissioning investments.

(b) Earns a return on investment in the ratemaking process. These amounts are amortized consistent with recovery in rates.

(c) Includes the fair value of certain long-term purchased power agreements used to meet energy capacity requirements.

(d) Included in other current liabilities of $331,419 and $268,720 at Dec. 31, 2008 and 2007, respectively, in the consolidated balance sheets.

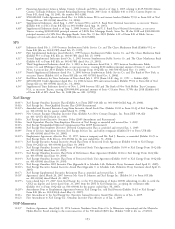

20. Segments and Related Information

The regulated electric utility operating results of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS, as well as the

regulated natural gas utility operating results of NSP-Minnesota, NSP-Wisconsin and PSCo are each separately and

regularly reviewed by Xcel Energy’s chief operating decision maker. Xcel Energy evaluates performance by each utility

subsidiary based on profit or loss generated from the product or service provided. These segments are managed

separately because the revenue streams are dependent upon regulated rate recovery, which is separately determined for

each segment.

Given the similarity of the regulated electric utility operations of its utility subsidiaries, and the similarity of the

regulated natural gas utility operations its utility subsidiaries, Xcel Energy has the following reportable segments:

regulated electric utility, regulated natural gas utility and all other.

• Xcel Energy’s regulated electric utility segment generates, transmits and distributes electricity in Minnesota,

Wisconsin, Michigan, North Dakota, South Dakota, Colorado, Texas and New Mexico. In addition, this

segment includes sales for resale and provides wholesale transmission service to various entities in the United

States. Regulated electric utility also includes commodity trading operations.

• Xcel Energy’s regulated natural gas utility segment transports, stores and distributes natural gas primarily in

portions of Minnesota, Wisconsin, North Dakota, Michigan and Colorado.

147