Xcel Energy 2008 Annual Report Download - page 73

Download and view the complete annual report

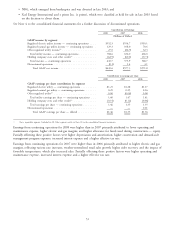

Please find page 73 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In October 2008, NSP-Minnesota filed a proposed MERP rider for 2009 designed to recover costs related to MERP

environmental improvement projects. Under this rider, NSP-Minnesota proposes to recover $114 million in 2009, an

increase of approximately $23 million over 2008.

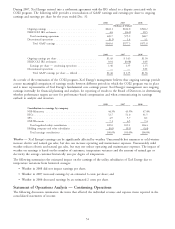

Impact of Nonregulated Investments

In the past, Xcel Energy’s investments in nonregulated operations had a significant impact on its results of operations.

As a result of the divestiture of NRG and other nonregulated operations, Xcel Energy does not expect that its

investments in nonregulated operations to have a significant impact on its results in the future.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of the consolidated financial statements and related disclosures in compliance with GAAP requires the

application of accounting rules and guidance, as well as the use of estimates. The application of these policies

necessarily involves judgments regarding future events, including the likelihood of success of particular projects, legal

and regulatory challenges and anticipated recovery of costs. These judgments could materially impact the consolidated

financial statements and disclosures, based on varying assumptions. In addition, the financial and operating environment

also may have a significant effect on the operation of the business and on the results reported even if the nature of the

accounting policies applied have not changed. The following is a list of accounting policies that are most critical to the

portrayal of Xcel Energy’s financial condition and results, and that require management’s most difficult, subjective or

complex judgments. Each of these has a higher potential likelihood of resulting in materially different reported amounts

under different conditions or using different assumptions. Each critical accounting policy has been discussed with the

Audit Committee of the Xcel Energy Board of Directors.

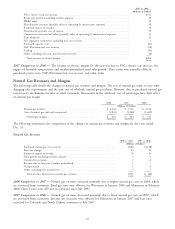

Regulatory Accounting

Xcel Energy is a holding company with rate-regulated subsidiaries that are subject to the FASB Accounting for the Effects

of Certain Types of Regulation (SFAS No. 71). SFAS No. 71 provides that rate-regulated entities account for and report

assets and liabilities consistent with the recovery of those incurred costs in rates, if the rates established are designed to

recover the costs of providing the regulated service and if the competitive environment makes it probable that such rates

could be charged and collected. Xcel Energy’s rates are derived through the ratemaking process, which results in the

recording of regulatory assets and liabilities based on the probability of current and future cash flows. Regulatory assets

represent incurred or accrued costs that have been deferred because they are probable of future recovery from customers.

Regulatory liabilities represent incurred or accrued credits that have been deferred because they will be returned to

customers in future rates. In other businesses or industries, regulatory assets would be charged to expense and regulatory

liabilities would be recorded as income. As of Dec. 31, 2008 and 2007, Xcel Energy has recorded regulatory assets of

approximately $2.4 billion and $1.1 billion and regulatory liabilities of approximately $1.2 billion and $1.4 billion,

respectively. Each subsidiary is subject to regulation that varies from jurisdiction to jurisdiction. If future recovery of

costs, in any such jurisdiction, ceases to be probable, Xcel Energy would be required to charge these assets to current

earnings. However, there are no current or expected proposals or changes in the regulatory environment that impact the

probability of future recovery of these assets. In addition, deregulation would be a change that occurs over time, due to

legal processes and procedures, which could moderate the impact to Xcel Energy’s consolidated financial statements.

See Note 19 for additional details on regulatory assets and liabilities.

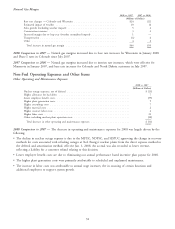

Income Tax Accruals

Judgment, uncertainty, and estimates are a significant aspect of the income tax accrual process that accounts for the

effects of current and deferred income taxes. Uncertainty associated with the application of tax statutes and regulations

and the outcomes of tax audits and appeals require that judgment and estimates be made in the accrual process and in

the calculation of effective tax rates (ETR).

ETRs are also highly impacted by assumptions. ETR calculations are revised every quarter based on best available

year-end tax assumptions (income levels, deductions, credits, etc.) by legal entity; adjusted in the following year after

63