Xcel Energy 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.areas. PSCo’s services would be bypassed by the new KMIGT pipeline, resulting in a loss of annual revenues of

approximately $3.8 million. In February 2008, the FERC issued its order approving KMIGT’s application for the

Colorado Lateral project.

PSCo filed a complaint at the CPUC, requesting that the CPUC enter an order finding that Atmos must cease and

desist any further construction activity on the Colorado Lateral project that is under the jurisdiction of the CPUC until

such time as it applies for and is granted a certificate of public convenience and necessity (CPCN). In September 2008,

an ALJ issued an order that the proposed construction of the bypass laterals is not in the normal course of business and

ordered Atmos to file a CPCN application for CPUC consideration and approval.

In his recommended decision, the ALJ determined that Atmos’ 11-mile section of the ‘‘Colorado Lateral’’ would require

Atmos to obtain a CPCN prior to the facilities being placed into service and that the doctrine of regulatory monopoly

does not apply to the gas transportation service provided by PSCo, a local distribution company (LDC), to a

downstream LDC such as Atmos. Therefore, Atmos has no expectation of service from PSCo and PSCo has no

obligation to serve Atmos under the doctrine of regulated monopoly. The CPUC has confirmed the ALJ’s ruling in

deliberations on Feb. 5, 2009, but has not yet issued a final written order at this time.

Capability and Demand

PSCo projects peak day natural gas supply requirements for firm sales and backup transportation, which include

transportation customers contracting for firm supply backup, to be 1,874,731 MMBtu. In addition, firm transportation

customers hold 598,660 MMBtu of capacity for PSCo without supply backup. Total firm delivery obligation for PSCo

is 2,473,391 MMBtu per day. The maximum daily deliveries for PSCo in 2008 for firm and interruptible services were

1,889,099 MMBtu on Dec. 15, 2008.

PSCo purchases natural gas from independent suppliers. These purchases are generally priced based on market indices

that reflect current prices. The natural gas is delivered under transportation agreements with interstate pipelines. These

agreements provide for firm deliverable pipeline capacity of approximately 1,893,712 MMBtu/day, which includes

668,756 MMBtu of supplies held under third-party underground storage agreements. During 2008, an additional

416,419 MMBtu/Day of firm pipeline capacity was added to serve system growth. During this exercise to acquire

additional firm pipeline capacity, 165,521 MMBtu of storage capacity was converted to firm transportation with

balancing service attached. In addition, PSCo operates three company-owned underground storage facilities, which

provide about 35,000 MMBtu of natural gas supplies on a peak day. The balance of the quantities required to meet

firm peak day sales obligations are primarily purchased at PSCo’s city gate meter stations and a small amount is received

directly from wellhead sources.

PSCo is required by CPUC regulations to file a natural gas purchase plan by June of each year projecting and

describing the quantities of natural gas supplies, upstream services and the costs of those supplies and services for the

12-month period of the following year. PSCo is also required to file a natural gas purchase report by October of each

year reporting actual quantities and costs incurred for natural gas supplies and upstream services for the previous

12-month period.

Natural Gas Supply and Costs

PSCo actively seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio that

provides increased flexibility, decreased interruption and financial risk, and economical rates. In addition, PSCo

conducts natural gas price hedging activities that have been approved by the CPUC. This diversification involves

numerous supply sources with varied contract lengths.

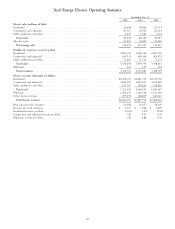

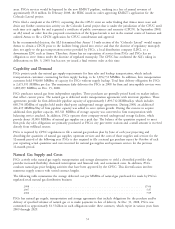

The following table summarizes the average delivered cost per MMBtu of natural gas purchased for resale by PSCo’s

regulated retail natural gas distribution business:

2008 .................................................................. $7.04

2007 .................................................................. 5.87

2006 .................................................................. 7.09

PSCo has natural gas supply, transportation and storage agreements that include obligations for the purchase and/or

delivery of specified volumes of natural gas or to make payments in lieu of delivery. At Dec. 31, 2008, PSCo was

committed to approximately $1.5 billion in such obligations under these contracts, which expire in various years from

2009 through 2029.

31