Xcel Energy 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

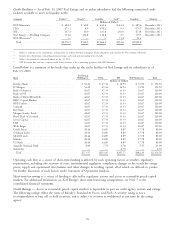

application to extend the operating licenses for both reactors at Prairie Island by 20 years was submitted to the

NRC on April 15, 2008. The NRC is expected to decide on the application in late 2010 or early in 2011.

A new decommissioning study filed with the MPUC in 2008 proposed extension of the final removal date of the

Monticello and Prairie Island nuclear plants by 14 and 26 years, respectively, effective Jan. 1, 2009. As a result of

the studies for Monticello and Prairie Island nuclear plants, the nuclear production decommissioning ARO and

related regulatory asset decreased by $128.5 million and $139.3 million, respectively, in the fourth quarter of

2008.

Revisions to prior estimates were made for asbestos, ash ponds, gas distribution and electric transmission and

distribution asset retirement obligations due to revised estimates and end of life dates.

• Cost Estimate With Spent Fuel Disposal — Federal regulations require the DOE to provide a permanent

repository for the storage of spent nuclear fuel. NSP-Minnesota has funded its portion of the DOE’s permanent

disposal program since 1981. The spent fuel storage assumptions have a significant influence on the

decommissioning cost estimate. The manner in which spent nuclear fuel is managed and the assumptions used

to develop cost estimates of decommissioning programs have a dramatic impact, which in turn can have a

corresponding impact on the resulting accrual.

The decommissioning calculation covers all expenses, including decontamination and removal of radioactive material,

and extends over the estimated lives of the plants. The total obligation for decommissioning currently is expected to be

funded 100 percent by a portion of the rates charged to customers, as approved by the MPUC. Decommissioning

expense recoveries are based upon the same assumptions and methodologies as the fair value obligations are recorded. In

addition to these assumptions discussed previously, assumptions related to future earnings of the nuclear

decommissioning fund are utilized by the MPUC in determining the recovery of decommissioning costs. Through

utilization of the annuity approach, an assumed rate of return on funding is calculated which provides the earnings rate.

With a long period of decommissioning and a funding period over the operating lives of each facility, the ability of the

fund to sustain the required payments after inflation while assuring the appropriate investment structure is critical in

obtaining the best benefit in the accrual. Currently, an assumption that the external funds will earn a return of

5.4 percent, after tax, is utilized when setting recovery by the MPUC.

Significant uncertainties exist in estimating the future cost of decommissioning including the method to be utilized, the

ultimate costs to decommission, and the planned treatment of spent fuel. Materially different results could be obtained

if different assumptions were utilized. Currently, our estimates of future decommissioning costs and the obligation to

retire the plants have a significant impact to our financial position. The amounts recorded for AROs and regulatory

assets for unrecovered costs are $1.1 billion and $299.3 million as of Dec. 31, 2008, and $1.3 billion and

$39.9 million as of Dec. 31, 2007. If different cost estimates, shorter life assumptions or different cost escalation rates

were utilized, this ARO and the unrecovered balance in regulatory assets could change materially. If future earnings on

the decommissioning fund are lower than that estimated currently, future decommissioning recoveries would need to

increase. The significance to our results of operations is reduced due to the fact that we record decommissioning

expense based upon recovery amounts approved by our regulators. This treatment reduces the volatility of expense over

time. The difference between regulatory funding (including both depreciation expense less returns from the investments

fund) and amounts recorded under SFAS No. 143 are deferred as a regulatory asset.

See Note 18 for further discussion regarding nuclear decommissioning.

Pending Accounting Changes

Recently Issued

Business Combinations (SFAS No. 141 (revised 2007)) — In December 2007, the FASB issued SFAS No. 141R, which

establishes principles and requirements for how an acquirer in a business combination recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest; recognizes

and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines

what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of

the business combination. SFAS No. 141R is to be applied prospectively to business combinations for which the

acquisition date is on or after the beginning of an entity’s fiscal year that begins on or after Dec. 15, 2008. Xcel Energy

will apply SFAS No. 141R to business combinations occurring subsequent to Jan. 1, 2009.

66