Xcel Energy 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

options since December 2001. The weighted average number of common and potentially dilutive shares outstanding

used to calculate Xcel Energy’s diluted earnings per share include the dilutive effect of stock options and other stock

awards based on the treasury stock method. The options normally have a term of 10 years and generally become

exercisable from three to five years after grant date or upon specified circumstances.

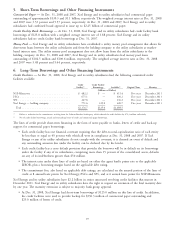

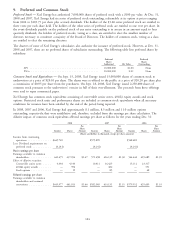

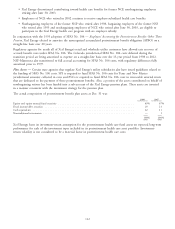

Activity in stock options was as follows for the years ended Dec. 31:

2008 2007 2006

Average Average Average

Awards Exercise Price Awards Exercise Price Awards Exercise Price

(Awards in thousands)

Outstanding beginning of year ...... 9,547 $27.19 12,374 $27.36 13,576 $26.92

Exercised ................... (12) 18.28 (266) 19.18 (563) 18.33

Forfeited ................... (67) 22.28 (50) 27.43 (89) 26.98

Expired .................... (1,008) 28.76 (2,511) 29.37 (550) 25.66

Outstanding at end of year ........ 8,460 27.05 9,547 27.19 12,374 27.36

Exercisable at end of year ......... 8,460 27.05 9,547 27.19 12,374 27.36

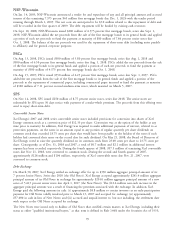

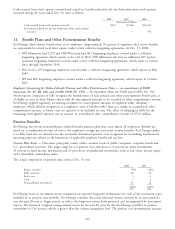

Range of Exercise Prices

$18.94 to $26.01 to $30.01 to

$26.00 $30.00 $51.25

Options outstanding and exercisable:

Number outstanding and exercisable ................... 2,832,105 5,104,485 523,083

Weighted average remaining contractual life (years) .......... 2.2 1.6 2.5

Weighted average exercise price ....................... $ 23.73 $ 26.90 $ 46.50

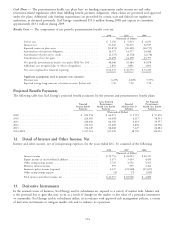

The total market value of stock options exercised and the total intrinsic value of options exercised were as follows for

the years ended Dec. 31:

2008 2007 2006

(Thousands of Dollars)

Market value of exercises ............................ $250 $6,398 $12,108

Intrinsic value of options exercised(a) ..................... 36 1,293 1,795

(a) Intrinsic value is calculated as market price at exercise date less the option exercise price

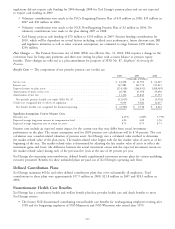

Restricted Stock — Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy

Executive Annual Incentive Award Plan. Restricted stock vests and settles in equal annual installments over a three-year

period. Xcel Energy reinvests dividends on the restricted stock it holds while restrictions are in place. Restrictions also

apply to the additional shares of restricted stock acquired through dividend reinvestment. If the restricted shares are

forfeited, the employee is not entitled to the dividends on those shares. Restricted stock has a fair value equal to the

market trading price of Xcel Energy’s stock at the grant date. Xcel Energy granted shares of restricted stock for the years

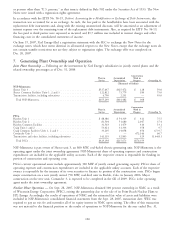

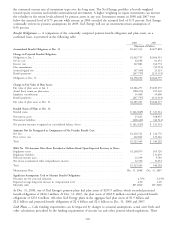

ended Dec. 31 as follows:

2008 2007 2006

Granted shares ................................... 27,931 37,000 10,481

Grant date fair value ............................... $20.62 $ 24.27 $ 19.10

A summary of the status of nonvested restricted stock as of Dec. 31, 2008, and changes for the year then ended, are as

follows:

Weighted

Average Grant

Shares Date Fair Value

Nonvested restricted stock at Jan. 1, 2008 ............................ 48,154 $23.13

Granted ................................................. 27,931 20.62

Vested .................................................. (19,915) 22.17

Dividend equivalents ......................................... 2,676 19.54

Nonvested restricted stock at Dec. 31, 2008 ........................... 58,846 22.06

Restricted Stock Units — Xcel Energy’s Board of Directors has granted restricted stock units under the Xcel Energy

Omnibus Incentive Plan approved by the shareholders in 2000 and under the Xcel Energy 2005 Omnibus Incentive

106