Xcel Energy 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

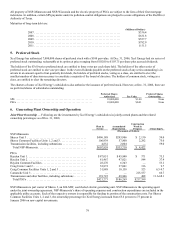

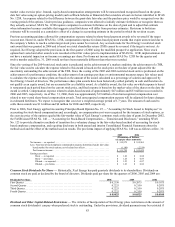

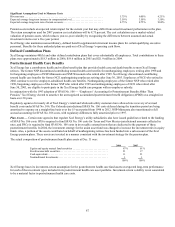

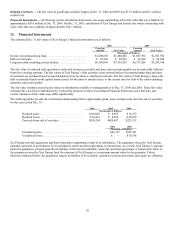

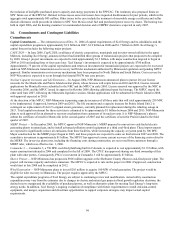

Benefit Costs — The components of net periodic postretirement benefit costs are:

2006 2005 2004

(Thousands of Dollars)

Service cost................................................... $ 6,633 $ 6,684 $ 6,100

Interest cost................................................... 52,939 55,060 52,604

Expected return on plan assets..................................... (26,757) (25,700) (23,066)

Curtailment gain ............................................... —

—

—

Settlement gain ................................................ —

—

—

Amortization of transition obligation................................ 14,444 14,578 14,578

Amortization of prior service credit................................. (2,178) (2,178) (2,179)

Amortization of net loss gain...................................... 24,797 26,246 21,651

Net periodic postretirement benefit cost under SFAS No. 106(a) ........... 69,878 74,690 69,688

Additional cost recognized due to effects of regulation.................. 3,891 3,891 3,891

Net cost recognized for financial reporting ........................... $ 73,769 $ 78,581 $ 73,579

Significant assumptions used to measure costs (income)

Discount rate .................................................. 5.75% 6.00% 6.25%

Expected average long-term rate of return on assets (pretax) ............. 7.50% 5.50-8.50% 5.50-8.50%

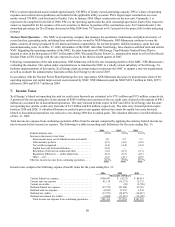

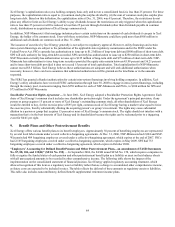

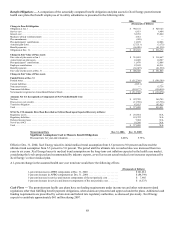

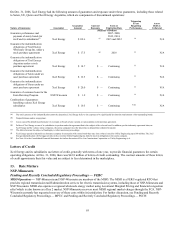

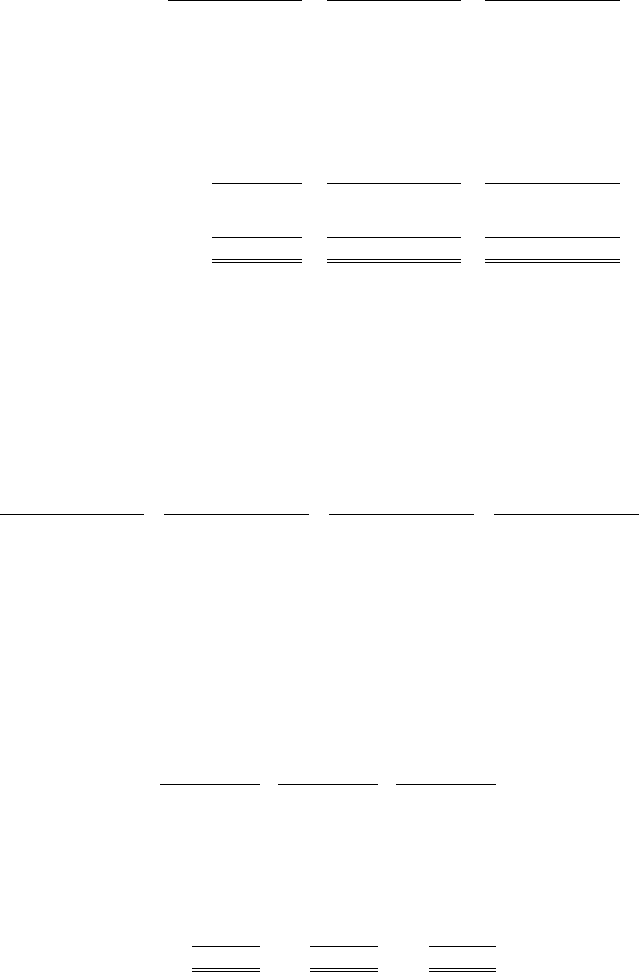

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

Projected

Pension Benefit

Payments

Gross Projected

Postretirement

Health Care Benefit

Payments

Expected

Medicare Part D

Subsidies

Net Projected

Postretirement

Health Care Benefit

Payments

(Thousands of Dollars)

2007....................................... $ 217,236 $ 65,355 $ 5,358 $ 59,997

2008....................................... $ 215,815 $ 67,110 $ 5,755 $ 61,355

2009....................................... $ 220,843 $ 68,911 $ 6,115 $ 62,796

2010....................................... $ 227,528 $ 70,457 $ 6,430 $ 64,027

2011....................................... $ 225,446 $ 71,924 $ 6,665 $ 65,259

2012-2016 .................................. $ 1,195,629 $ 368,206 $ 36,592 $ 331,614

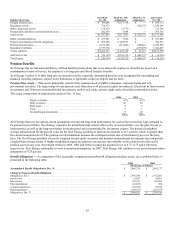

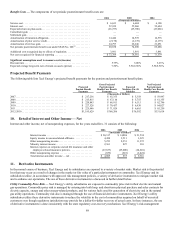

10. Detail of Interest and Other Income — Net

Interest and other income, net of nonoperating expenses, for the years ended Dec. 31 consists of the following:

2006 2005 2004

(Thousands of Dollars)

Interest income................................... $ 20,317 $ 14,886 $ 21,534

Equity income in unconsolidated affiliates.............. 4,450 2,511 3,225

Other nonoperating income.......................... 5,253 8,251 11,272

Minority interest income............................ 2,361 827 310

Interest expense on corporate-owned life insurance and other

employee-related insurance policies................. (27,637) (25,000 ) (24,601)

Other nonoperating expense ......................... (659) (618 ) (2,424 )

Total interest and other income — net ................. $ 4,085 $ 857 $ 9,316

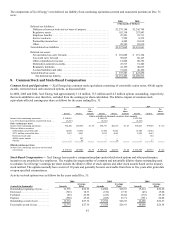

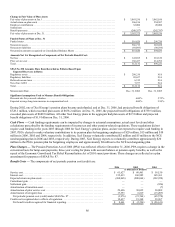

11. Derivative Instruments

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk is the potential

loss that may occur as a result of changes in the market or fair value of a particular instrument or commodity. Xcel Energy and its

subsidiaries utilize, in accordance with approved risk management policies, a variety of derivative instruments to mitigate market risk

and to enhance our operations. The use of these derivative instruments is discussed in further detail below.

Utility Commodity Price Risk — Xcel Energy’s utility subsidiaries are exposed to commodity price risk in their electric and natural

gas operations. Commodity price risk is managed by entering into both long- and short-term physical purchase and sales contracts for

electric capacity, energy and other energy-related products, and for various fuels used for generation of electricity and in the natural

gas utility operations. Commodity risk also is managed through the use of financial derivative instruments. Xcel Energy’s utility

subsidiaries utilize these derivative instruments to reduce the volatility in the cost of commodities acquired on behalf of our retail

customers even though regulatory jurisdiction may provide for a dollar-for-dollar recovery of actual costs. In these instances, the use

of derivative instruments is done consistently with the state regulatory cost-recovery mechanism. Xcel Energy’s risk-management