Xcel Energy 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

Within MISO, an independent market monitor (IMM) reviews market bids and prices to identify any unusual activity. Xcel Energy

and other market participants continue to work with MISO, the IMM and the FERC to resolve Day 2 market implementation issues

such as dispatch methods and settlement calculation details.

MISO Long-Term Transmission Pricing — In October 2005, MISO filed a proposed change to its TEMT to regionalize future cost

recovery of certain high voltage (345 KV) transmission projects to be constructed for reliability improvements. The proposal, called

the Regional Expansion Criteria Benefits phase 1 (RECB I) proposal, would recover 20 percent of eligible transmission costs from all

transmission service customers in the MISO 15 state region, with 80 percent recovered on a sub-regional basis. The proposal would

exclude certain projects that had been planned prior to the October 2005 filing, and would require new generators to fund 50 percent

of the cost of network upgrades associated with their interconnection. In February 2006, the FERC generally approved the RECB I

proposal, but set the 20 percent limitation on regionalization for additional proceedings. Various parties filed requests for rehearing.

On Nov. 29, 2006, the FERC issued an order on rehearing upholding the February 2006 order and approving the 20 percent limitation.

On Dec. 13, 2006, the PSCW filed an appeal of the RECB I order.

In addition, in October 2006, MISO filed additional changes to its TEMT to regionalize future recovery of certain transmission

projects (230 KV and above) constructed for “economic” reasons (e.g., to provide access to lower cost generation supplies). The

filing, known as RECB II, would provide regional recovery of 20 percent of the project costs and sub-regional recovery of 80 percent,

based on a benefits analysis. MISO proposed that the RECB II tariff be effective April 1, 2007. Initial comments were filed at FERC

on Dec. 22, 2006. The date FERC will take initial action is not known.

Transmission service rates in the MISO region presently use a rate design, in which the transmission cost depends on the location of

the load being served. Costs of existing transmission facilities are not regionalized. MISO is required to file a replacement rate

methodology in August 2007, to be effective Feb. 1, 2008. It is possible MISO will propose to regionalize the recovery of the costs of

existing transmission facilities. Proposals to regionalize transmission costs could shift the costs of NSP-Minnesota and NSP-

Wisconsin transmission investments to other MISO transmission service customers, but would also shift the costs of transmission

investments in other parts of MISO to NSP-Minnesota and NSP-Wisconsin.

MISO/PJM SECA — On Nov. 18, 2004, the FERC issued an order approving portions of a plan providing for continued use of

location based rates for the MISO/PJM region, but rejecting proposed transition payments to compensate transmission owners for

reductions in transmission revenues. The FERC instead ordered the MISO and PJM to each file a Seams Elimination Charge

Adjustment (SECA) transition mechanism. The replacement compliance filings were effective Dec. 1, 2004, subject to refund.

The competing SECA compliance proposals were the subject of litigated hearings at the FERC. Certain parties proposed a regional

average SECA charge, which could shift costs to NSP-Minnesota and NSP-Wisconsin. On Aug. 10, 2006, the ALJ in the case issued

an initial decision recommending that all the SECA compliance filings be rejected and recommending adoption of a regional SECA,

which could shift approximately $13 million in charges to NSP-Minnesota and NSP-Wisconsin. Xcel Energy, through the MISO

transmission owners, filed exceptions to the ALJ initial decision, arguing the decision directly violates the 2004 FERC orders. In

addition, the MISO transmission owners have executed settlements with several parties in the litigation. The settlement resolves

specific claims and would limit any regionalization to unresolved claims. Final FERC action is expected in the SECA litigation in

2007.

Revenue Sufficiency Guarantee Charges — On April 25, 2006, the FERC issued an order determining that MISO had incorrectly

applied its TEMT regarding the application of the revenue sufficiency guarantee (RSG) charge to certain transactions. The FERC

ordered MISO to resettle all affected transactions retroactive to April 1, 2005. The RSG charges are collected from certain MISO

customers and paid to others. Based on the FERC order, NSP-Minnesota could be required to make net payments to MISO. On

Oct. 26, 2006, the FERC issued an order granting rehearing in part and reversed the prior ruling requiring MISO to issue retroactive

refunds and ordered MISO to implement prospective changes. In late November 2006, however, certain parties filed further requests

for rehearing challenging the reversal regarding refunds. The date of a final FERC decision is unknown, and one appeal has been filed.

Xcel Energy reserved $6.1 million in response to the April 25, 2006, FERC order.

Pending and Recently Concluded Regulatory Proceedings — MPUC

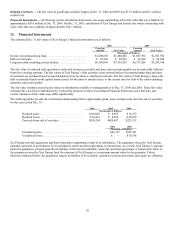

NSP-Minnesota Electric Rate Case — In November 2005, NSP-Minnesota requested an electric rate increase of $168 million or 8.05

percent. This increase was based on a requested 11 percent return on common equity, a projected common equity to total

capitalization ratio of 51.7 percent and a projected electric rate base of $3.2 billion. On Dec. 15, 2005, the MPUC authorized an

interim rate increase of $147 million, subject to refund, which became effective on Jan. 1, 2006.

On Sept. 1, 2006, the MPUC issued a written order granting an electric revenue increase of approximately $131 million for 2006

based on an authorized return on equity of 10.54 percent. The scheduled rate increase will be reduced in 2007 to $115 million to

reflect the return of Flint Hills Resources, a large industrial customer, to the NSP-Minnesota system. The MPUC approved the

wholesale margin settlement in which NSP-Minnesota returns most margins from unused generating capacity back to customers

through the FCA mechanism. NSP-Minnesota is allowed to earn an incentive on sales related to ancillary service obligations. The

MPUC Order became effective in November 2006, and final rates were implemented on February 1, 2007. A citizen intervenor has

appealed the MPUC’s decision.