Xcel Energy 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions and

approvals, the desired reserve margin and the availability of purchased power, as well as alternative plans for meeting Xcel Energy’s

long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of restructuring requirements, compliance with future

environmental requirements and renewable portfolio standards to install emission-control equipment, and merger, acquisition and

divestiture opportunities to support corporate strategies may impact actual capital requirements.

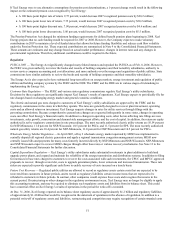

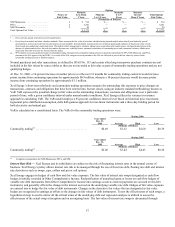

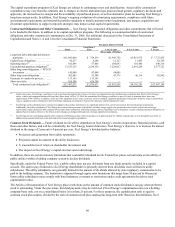

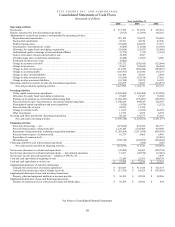

Contractual Obligations and Other Commitments — Xcel Energy has contractual obligations and other commitments that will need

to be funded in the future, in addition to its capital expenditure programs. The following is a summarized table of contractual

obligations and other commercial commitments at Dec. 31, 2006. See additional discussion in the Consolidated Statements of

Capitalization and Notes 3, 4, and 14 to the Consolidated Financial Statements.

Payments Due by Period

Total

Less than 1

Year 1 to 3 Years 4 to 5 Years

After

5 Years

(Thousands of Dollars)

Long-term debt, principal and interest

payments...................... $ 11,883,096 $ 759,539 $ 1,943,750 $ 1,451,972 $ 7,727,835

Capital lease obligations............ 92,237 6,286 12,123 11,463 62,365

Operating leases(a) ................. 811,899 57,405 106,693 101,485 546,316

Unconditional purchase obligations(b) .. 13,533,315 2,239,536 3,224,813 2,491,245 5,577,721

Other long-term obligations — WYCO

investment..................... 145,000 47,000 98,000 — —

Other long-term obligations.......... 202,045 25,388 47,579 46,116 82,962

Payments to vendors in process....... 113,183 113,183

—

— —

Short-term debt................... 626,300 626,300

—

— —

Total contractual cash obligations(c).. $ 27,407,075 $ 3,874,637 $ 5,432,958 $ 4,102,281 $ 13,997,199

(a) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease expiration date. Most of Xcel Energy’s

railcar, vehicle and equipment and aircraft leases have these terms. At Dec. 31, 2006, the amount that Xcel Energy would have to pay if it chose to terminate these leases was

approximately $186.1 million. In addition, at the end of the equipment leases’ terms, each lease must be extended, equipment purchased for the greater of the fair value or unamortized

value or equipment sold to a third party with Xcel Energy making up any deficiency between the sales price and the unamortized value.

(b) Xcel Energy and its subsidiaries have contracts providing for the purchase and delivery of a significant portion of its current coal, nuclear fuel and natural gas requirements.

Additionally, the utility subsidiaries of Xcel Energy have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and energy

requirements, replace generation from company-owned units under maintenance and during outages, and meet operating reserve obligations. Certain contractual purchase obligations are

adjusted based on indices. However, the effects of price changes are mitigated through cost-of-energy adjustment mechanisms.

(c) Xcel Energy also has outstanding authority under contracts and blanket purchase orders to purchase up to approximately $1.3 billion of goods and services through the year 2021, in

addition to the amounts disclosed in this table and in the forecasted capital expenditures.

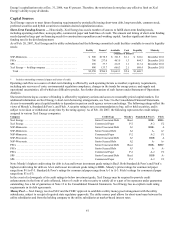

Common Stock Dividends — Future dividend levels will be dependent on Xcel Energy’s results of operations, financial position, cash

flows and other factors, and will be evaluated by the Xcel Energy board of directors. Xcel Energy’s objective is to increase the annual

dividend in the range of 2 percent to 4 percent per year. Xcel Energy’s dividend policy balances:

• Projected cash generation from utility operations;

• Projected capital investment in the utility businesses;

• A reasonable rate of return on shareholder investment; and

• The impact on Xcel Energy’s capital structure and credit ratings.

In addition, there are certain statutory limitations that could affect dividend levels. Federal law places certain limits on the ability of

public utilities within a holding company system to declare dividends.

Specifically, under the Federal Power Act, a public utility may not pay dividends from any funds properly included in a capital

account. The cash to pay dividends to Xcel Energy shareholders is primarily derived from dividends received from its utility

subsidiaries. The utility subsidiaries are generally limited in the amount of dividends allowed by state regulatory commissions to be

paid to the holding company. The limitation is imposed through equity ratio limitations that range from 30 percent to 60 percent.

Some utility subsidiaries must comply with bond indenture covenants or restrictions under credit agreements for debt to total

capitalization ratios.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred

stock is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding

company basis only, not on a consolidated basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to

common stock plus surplus, divided by the sum of common stock plus surplus plus long-term debt. Based on this definition, Xcel