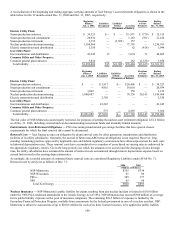

Xcel Energy 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

collectively establish and fund statewide energy efficiency and renewable resource programs. The funding mechanism will include a

contribution from the utilities totaling 1.2 percent of annual operating revenues, which will be fully recoverable in customer rates.

Docket 1-AC-221 will revise Wisconsin Administrative Code PSC Chapter 118 that allows for the creation and tracking of renewable

resource credits (RRCs). RRCs can be created and used by a utility to meet its renewable obligation under the recently revised RPS, or

sold to another utility for its use in meeting its RPS requirement. NSP-Wisconsin anticipates it will be able to meet the RPS with its

pro-rata share of existing and planned renewable generation on the NSP System. Both of these rules are expected to be adopted in

early 2007.

Energy Legislation — In 2005, the Minnesota Legislature passed and the Governor signed an Omnibus Energy Bill, effective July 1,

2005. Among other things, the new law provides authority for the MPUC to approve rate rider recovery for transmission investments

that have been approved through a certificate of need, the biennial transmission plan, or are associated with compliance with the

state’s renewable energy objective. The statute provides that the rate rider may include recovery of the revenue requirement associated

with qualifying projects, including a current return on construction work in progress. NSP-Minnesota’s filing to the MPUC for

approval of a new TCR tariff to implement this statute was approved in 2006 and the filing to establish initial TCR rates is pending

MPUC approval.

The 2005 Texas Legislature passed a law, effective June 18, 2005, establishing statutory authority for electric utilities outside of the

electric reliability council of Texas in the SPP or the Western Electricity Coordinating Council to have timely recovery of

transmission infrastructure investments. After notice and hearing, the PUCT may allow recovery on an annual basis of the reasonable

and necessary expenditures for transmission infrastructure improvement costs and changes in wholesale transmission charges under a

tariff approved by the FERC. In Dec. 2006, PUCT Staff issued a draft rule for comment. The PUCT will initiate a formal rulemaking

for this process in 2007.

15. Nuclear Obligations

Fuel Disposal — NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is

responsible for permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear plants. NSP-

Minnesota has funded its portion of the DOE’s permanent disposal program since 1981. The fuel disposal fees are based on a charge

of 0.1 cent per kilowatt-hour sold to customers from nuclear generation. Fuel expense includes the DOE fuel disposal assessments of

approximately $13 million in 2006, $12 million in 2005 and $13 million in 2004. In total, NSP-Minnesota had paid approximately

$360 million to the DOE through Dec. 31, 2006. However, it is not determinable whether the amount and method of the DOE’s

assessments to all utilities will be sufficient to fully fund the DOE’s permanent storage or disposal facility.

The Nuclear Waste Policy Act of 1982 required the DOE to begin accepting spent nuclear fuel no later than Jan. 31, 1998. In 1996, the

DOE notified commercial spent-fuel owners of an anticipated delay in accepting spent nuclear fuel by the required date and conceded

that a permanent storage or disposal facility will not be available until at least 2010. NSP-Minnesota and other utilities have

commenced lawsuits against the DOE to recover damages caused by the DOE’s failure to meet its statutory and contractual

obligations.

NSP-Minnesota has its own temporary on-site storage facilities for spent fuel at its Monticello and Prairie Island nuclear plants, which

consist of storage pools at both sites and a dry cask facility at Prairie Island. With the dry cask storage facility licensed by the NRC,

approved in 1994 and again in 2003, management believes it has adequate storage capacity to continue operation of its Prairie Island

nuclear plant until at least the end of its current license terms in 2013 and 2014. The Monticello nuclear plant has storage capacity in

the storage pool to continue operations until 2010. In 2005, NSP-Minnesota filed a certificate of need to allow interim storage of spent

fuel at the Monticello nuclear plant to support license renewal and operation for an additional 20 years, and in October 2006, the

MPUC issued its approval allowing additional interim spent fuel storage. Minnesota Statutes provide that the MPUC decision

becomes effective June 1, 2007, which allows the legislature the opportunity to review the MPUC action if desired. All of the

alternatives for spent fuel storage are being investigated until a DOE facility is available, including pursuing the establishment of a

private facility for interim storage of spent nuclear fuel as part of a consortium of electric utilities.

Nuclear fuel expense includes payments to the DOE for the decommissioning and decontamination of the DOE’s uranium-enrichment

facilities. In 1993, NSP-Minnesota recorded the DOE’s initial assessment of $46 million, which is payable in annual installments for

15 years to 2007. NSP-Minnesota is amortizing each installment to expense on a monthly basis. The most recent installment paid in

2006 was $4.9 million; future installments are subject to inflation adjustments under the DOE rules. NSP-Minnesota is obtaining rate

recovery of these DOE assessments through the cost-of-energy adjustment clause as the assessments are amortized. Accordingly, the

unamortized assessment of $3.7 million at Dec. 31, 2006, is deferred as a regulatory asset.

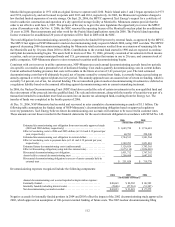

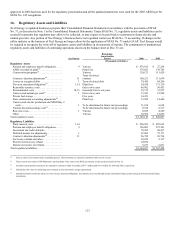

Regulatory Plant Decommissioning Recovery — Decommissioning of NSP-Minnesota’s nuclear facilities, as last approved by the

MPUC, is planned for the period from cessation of operations through 2050, assuming the prompt dismantlement method. NSP-

Minnesota is currently accruing the regulatory costs for decommissioning over the MPUC-approved cost-recovery period and

including the accruals in a regulatory liability account. The total decommissioning cost obligation is recorded as an asset retirement

obligation in accordance with SFAS No. 143.