Xcel Energy 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

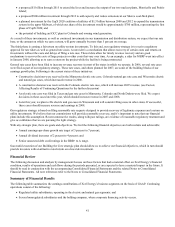

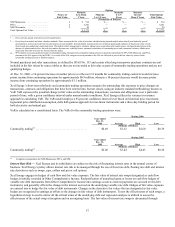

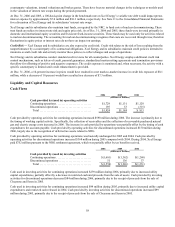

If Xcel Energy were to use alternative assumptions for pension cost determinations, a 1-percent change would result in the following

impact on the estimated pension costs recognized by Xcel Energy:

• A 100 basis point higher rate of return, 9.75 percent, would decrease 2007 recognized pension costs by $20.2 million;

• A 100 basis point lower rate of return, 7.75 percent, would increase 2007 recognized pension costs by $20.2 million;

• A 100 basis point higher discount rate, 7.00 percent, would decrease 2007 recognized pension costs by $4.6 million; and

• A 100 basis point lower discount rate, 5.00 percent, would increase 2007 recognized pension costs by $5.5 million.

The Pension Protection Act changed the minimum funding requirements for defined benefit pension plans beginning in 2008. Xcel

Energy projects that no cash funding would be required for 2007 or 2008. However, the Company expects to make voluntary

contributions in 2007 to maintain a level of funded status that allows for future funding flexibility and reduces cash flow volatility

under the Pension Protection Act. These expected contributions are summarized in Note 9 to the Consolidated Financial Statements.

These amounts are estimates and may change based on actual market performance, changes in interest rates and any changes in

governmental regulations. Therefore, additional contributions could be required in the future.

Regulation

PUHCA 2005 — The Energy Act significantly changed many federal statutes and repealed the PUHCA as of Feb. 8, 2006. However,

the FERC was given authority to review the books and records of holding companies and their nonutility subsidiaries, authority to

review service company accounting and cost allocations, and more authority over the merger and acquisition of public utilities. State

commissions have similar authority to review the books and records of holding companies and their nonutility subsidiaries.

The Energy Act is also expected to have substantial long-term effects on energy markets, energy investment and regulation of public

utilities and holding company systems by the FERC and the DOE. The FERC and the DOE are in various stages of rulemaking in

implementing the Energy Act.

Customer Rate Regulation — The FERC and various state regulatory commissions regulate Xcel Energy’s utility subsidiaries.

Decisions by these regulators can significantly impact Xcel Energy’s results of operations. Xcel Energy expects to periodically file for

rate changes based on changing energy market and general economic conditions.

The electric and natural gas rates charged to customers of Xcel Energy’s utility subsidiaries are approved by the FERC and the

regulatory commissions in the states in which they operate. The rates are generally designed to recover plant investment, operating

costs and an allowed return on investment. Xcel Energy requests changes in rates for utility services through filings with the

governing commissions. Because comprehensive general rate changes are requested infrequently in some states, changes in operating

costs can affect Xcel Energy’s financial results. In addition to changes in operating costs, other factors affecting rate filings are new

investments, sales growth, conservation and demand-side management efforts, and the cost of capital. In addition, the return on equity

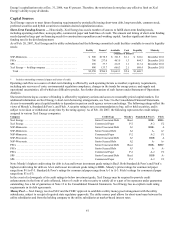

authorized is set by regulatory commissions in rate proceedings. The most recently authorized electric utility returns are 10.54 percent

for NSP-Minnesota; 11.0 percent for NSP-Wisconsin; 10.5 percent for PSCo; and 11.5 percent for SPS. The most recently authorized

natural gas utility returns are 10.4 percent for NSP-Minnesota, 11.0 percent for NSP-Wisconsin and 10.5 percent for PSCo.

Wholesale Energy Market Regulation — In April 2005, a Day 2 wholesale energy market operated by MISO was implemented to

centrally dispatch all regional electric generation and apply a regional transmission congestion management system. MISO now

centrally issues bills and payments for many costs formerly incurred directly by NSP-Minnesota and NSP-Wisconsin. NSP-Minnesota

and NSP-Wisconsin expect to recover MISO charges through either base rates or various recovery mechanisms. See Note 13 to the

Consolidated Financial Statements for further discussion.

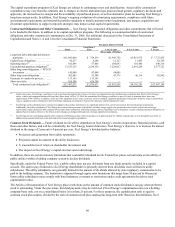

Capital Expenditure Regulation — Xcel Energy’s utility subsidiaries make substantial investments in plant additions to build and

upgrade power plants, and expand and maintain the reliability of the energy transmission and distribution systems. In addition to filing

for increases in base rates charged to customers to recover the costs associated with such investments, the CPUC and MPUC approved

proposals to recover, through a rate rider, costs to upgrade generation plants, lower emissions and increased transmission. These rate

riders are expected to provide significant cash flows to enable recovery of costs incurred on a timely basis.

Future Cost Recovery — Regulated public utilities are allowed to record as regulatory assets certain costs that are expected to be

recovered from customers in future periods, and to record as regulatory liabilities certain income items that are expected to be

refunded to customers in future periods. In contrast, other companies would expense these costs and recognize the income in the

current period. If restructuring or other changes in the regulatory environment occur, Xcel Energy may no longer be eligible to apply

this accounting treatment, and may be required to eliminate such regulatory assets and liabilities from its balance sheet. This could

have a material effect on Xcel Energy’s results of operations in the period the write-off is recorded.

At Dec. 31, 2006, Xcel Energy reported on its balance sheet regulatory assets of approximately $1.2 billion and regulatory liabilities

of approximately $1.4 billion that would be recognized in the statement of operations in the absence of regulation. In addition to a

potential write-off of regulatory assets and liabilities, restructuring and competition may require recognition of certain stranded costs