Xcel Energy 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

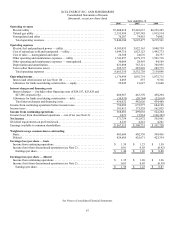

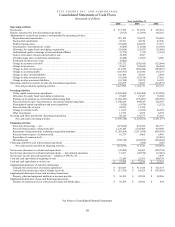

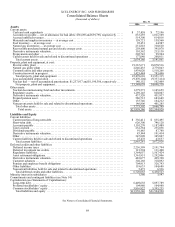

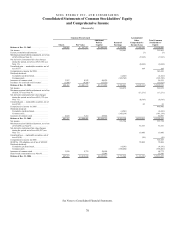

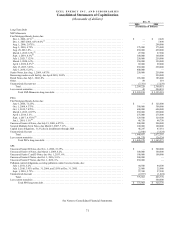

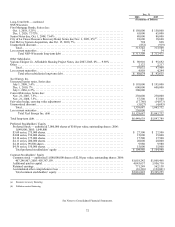

See Notes to Consolidated Financial Statements.

72

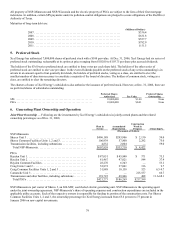

Dec. 31

2006 2005

(Thousands of Dollars)

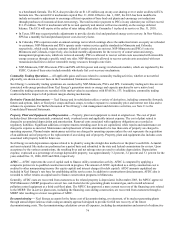

Long-Term Debt — continued

NSP-Wisconsin

First Mortgage Bonds, Series due:

Oct. 1, 2018, 5.25% ............................................................... $ 150,000 $ 150,000

Dec. 1, 2026, 7.375%.............................................................. 65,000 65,000

Senior Notes due, Oct. 1, 2008, 7.64% .................................................. 80,000 80,000

City of La Crosse Resource Recovery Bond, Series due Nov. 1, 2021, 6%(a) ................... 18,600 18,600

Fort McCoy System Acquisition, due Oct. 15, 2030, 7%................................... 794 828

Unamortized discount................................................................ (852) (919)

Total.......................................................................... 313,542 313,509

Less current maturities ............................................................... 34 34

Total NSP-Wisconsin long-term debt ............................................. $ 313,508 $ 313,475

Other Subsidiaries

Various Eloigne Co. Affordable Housing Project Notes, due 2007-2045, 0% — 9.89%.......... $ 90,910 $ 95,692

Other ............................................................................. 2,122 2,217

Total.......................................................................... 93,032 97,909

Less current maturities ............................................................... 4,958 4,294

Total other subsidiaries long-term debt............................................ $ 88,074 $ 93,615

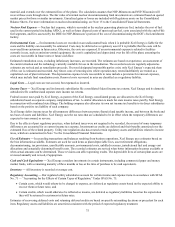

Xcel Energy Inc.

Unsecured senior notes, Series due:

July 1, 2008, 3.4%................................................................. $ 195,000 $ 195,000

Dec. 1, 2010, 7%.................................................................. 600,000 600,000

July 1, 2036, 6.5%................................................................. 300,000

—

Convertible notes, Series due:

Nov. 21, 2007, 7.5%............................................................... 230,000 230,000

Nov. 21, 2008, 7.5%............................................................... 57,500 57,500

Fair value hedge, carrying value adjustment ............................................. (17,786) (14,073)

Unamortized discount................................................................ (5,027) (4,695)

Total.......................................................................... 1,359,687 1,063,732

Less current maturities ............................................................... 230,000

—

Total Xcel Energy Inc. debt..................................................... $1,129,687 $1,063,732

Total long-term debt................................................................. $6,449,638 $5,897,789

Preferred Stockholders’ Equity

Preferred Stock — authorized 7,000,000 shares of $100 par value; outstanding shares: 2006:

1,049,800; 2005: 1,049,800

$3.60 series, 275,000 shares......................................................... $ 27,500 $ 27,500

$4.08 series, 150,000 shares......................................................... 15,000 15,000

$4.10 series, 175,000 shares......................................................... 17,500 17,500

$4.11 series, 200,000 shares......................................................... 20,000 20,000

$4.16 series, 99,800 shares.......................................................... 9,980 9,980

$4.56 series, 150,000 shares......................................................... 15,000 15,000

Total preferred stockholders’ equity ................................................ $ 104,980 $ 104,980

Common Stockholders’ Equity

Common stock — authorized 1,000,000,000 shares of $2.50 par value; outstanding shares: 2006:

407,296,907; 2005: 403,387,159................................................... $1,018,242 $1,008,468

Additional paid in capital........................................................... 4,043,657 3,956,710

Retained earnings................................................................. 771,249 562,138

Accumulated other comprehensive loss ............................................... (16,326) (132,061)

Total common stockholders’ equity................................................. $5,816,822 $5,395,255

(a) Resource recovery financing

(b) Pollution control financing