Xcel Energy 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

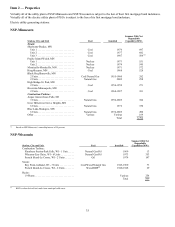

The following table summarizes the average delivered cost per MMBtu of natural gas purchased for resale by NSP-Minnesota’s

regulated retail natural gas distribution business:

2006 ....................................................................... $8.3

2

2005 ....................................................................... $8.9

0

2004 ....................................................................... $6.8

8

The cost of natural gas supply, transportation service and storage service is recovered through the PGA cost recovery mechanism.

NSP-Minnesota has firm natural gas transportation contracts with several pipelines, which expire in various years from 2007 through

2027.

NSP-Minnesota has certain natural gas supply, transportation and storage agreements that include obligations for the purchase and/or

delivery of specified volumes of natural gas or to make payments in lieu of delivery. At Dec. 31, 2006, NSP-Minnesota was

committed to approximately $722 million in such obligations under these contracts.

NSP-Minnesota purchases firm natural gas supply utilizing long-term and short-term agreements from approximately 25 domestic and

Canadian suppliers. This diversity of suppliers and contract lengths allows NSP-Minnesota to maintain competition from suppliers and

minimize supply costs.

See additional discussion of natural gas costs under Factors Affecting Results of Continuing Operations in Management’s Discussion

and Analysis under Item 7.

NSP-Wisconsin

Ratemaking Principles

Summary of Regulatory Agencies and Areas of Jurisdiction — NSP-Wisconsin is regulated by the PSCW and the MPSC.

The PSCW has a biennial base-rate filing requirement. By June of each odd-numbered year, NSP-Wisconsin must submit a rate filing

for the test year period beginning the following January. The filing procedure and review generally allow the PSCW sufficient time to

issue an order and implement new base rates effective with the start of the test year.

Natural Gas Cost Recovery Mechanisms — NSP-Wisconsin has a retail PGA natural gas cost recovery mechanism for Wisconsin

operations to recover changes in the actual cost of natural gas and transportation and storage services. The PSCW has the authority to

disallow certain costs if it finds the utility was not prudent in its procurement activities.

NSP-Wisconsin’s natural gas rate schedules for Michigan customers include a natural gas cost recovery factor, which is based on

12-month projections. After each 12-month period, a reconciliation is submitted whereby over-collections are refunded and any under-

collections are collected from the customers over the subsequent 12-month period.

Capability and Demand

Natural gas supply requirements are categorized as firm or interruptible (customers with an alternate energy supply). The maximum

daily send-out (firm and interruptible) for NSP-Wisconsin was 135,362 MMBtu for 2006, which occurred on Feb. 17, 2006.

NSP-Wisconsin purchases natural gas from independent suppliers. These purchases are generally priced based on market indices that

reflect current prices. The natural gas is delivered under natural gas transportation agreements with interstate pipelines. These

agreements provide for firm deliverable pipeline capacity of approximately 130,887 MMBtu/day. In addition, NSP-Wisconsin has

contracted with providers of underground natural gas storage services. These storage agreements provide storage for approximately 27

percent of winter natural gas requirements and 27 percent of peak day, firm requirements of NSP-Wisconsin.

NSP-Wisconsin also owns and operates one LNG plant with a storage capacity of 270,000 Mcf equivalent and one propane-air plant

with a storage capacity of 2,700 Mcf equivalent to help meet its peak requirements. These peak-shaving facilities have production

capacity equivalent to 18,408 MMBtu of natural gas per day, or approximately 14 percent of peak day firm requirements. LNG and

propane-air plants provide a cost-effective alternative to annual fixed pipeline transportation charges to meet the peaks caused by firm

space heating demand on extremely cold winter days.

NSP-Wisconsin is required to file a natural gas supply plan with the PSCW annually to change natural gas supply contract levels to

meet peak demand. NSP-Wisconsin’s winter 2006-2007 supply plan was approved by the PSCW in October 2006.