Xcel Energy 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

• a proposed $1 billion through 2015 to extend the lives and increase the output of our two nuclear plants, Monticello and Prairie

Island;

• a proposed $900 million investment through 2012 to add capacity and reduce emissions at our Sherco coal-fired plant;

• a planned investment by the CapX 2020 coalition of utilities of $1.3 billion between 2008 and 2012 to expand the transmission

system in the upper Midwest, of which our share of the investment would be approximately $700 million, representing the first

phase of CapX 2020; and

• the potential of building an IGCC plant in Colorado and owning wind generation.

As a result of these investments, as well as continued investments in our transmission and distribution system, we expect that our rate

base, or the amount on which we earn a return, will grow annually by more than 5 percent on average.

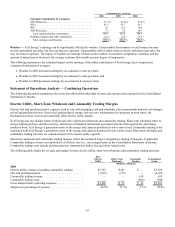

The third phase is earning a fair return on utility system investments. To this end, our regulatory strategy is to receive regulatory

approval for rate riders as well as general rate cases. A rate rider is a mechanism that allows recovery of certain costs and returns on

investments without the costs and delays of filing a rate case. These riders allow for timely revenue recovery and are good

mechanisms to recover the costs of large projects or other costs that vary over time. As an example, a rider for MERP went into effect

in January 2006, allowing us to earn a return on the project while the facility is being constructed.

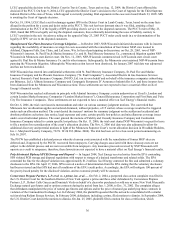

General rate cases have been filed to increase revenue recovery in most of the states in which we operate. In 2006, several rate cases

were filed as part of our regulatory strategy. These rate cases, and others planned for 2007, are some of the building blocks of our

earnings growth plan. Following is the current status of these initiatives:

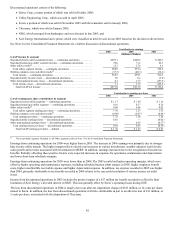

• Constructive decisions were received in the Minnesota electric rate case, Colorado natural gas rate case and Wisconsin electric

and natural gas cases, which increased revenue in 2006.

• A constructive decision was received in the Colorado electric rate case, which will increase 2007 revenue. (see Factors

Affecting Results of Continuing Operations for the further discussion)

• An electric rate case was filed in Texas and gas rate cases in Minnesota, Colorado and North Dakota were filed. We expect

decisions in these cases later this year, which should increase revenue in 2007 and 2008.

• Later this year, we plan to file electric and gas cases in Wisconsin and will consider filing cases in other states. If successful,

these cases should increase revenue and earnings in 2008.

Our regulatory strategy is based on filing reasonable rate requests designed to provide recovery of legitimate expenses and a return on

utility investments. We believe that our commissions will provide reasonable recovery, and it’s important to note that our financial

plans include this assumption. Recent constructive results, along with past rulings, are evidence of reasonable regulatory treatment and

give us confidence that we are pursuing the right strategy.

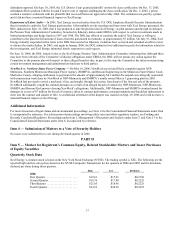

With any strategic plan, there are goals and objectives. We feel the following financial objectives are both realistic and achievable:

• Annual earnings-per-share growth rate target of 5 percent to 7 percent;

• Annual dividend increases of 2 percent to 4 percent; and

• Senior unsecured debt credit ratings in the BBB+ to A range.

Successful execution of our Building the Core strategic plan should allow us to achieve our financial objectives, which in turn should

provide investors with an attractive total return on a low-risk investment.

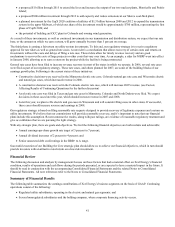

Financial Review

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel Energy’s financial

condition, results of operations and cash flows during the periods presented, or are expected to have a material impact in the future. It

should be read in conjunction with the accompanying Consolidated Financial Statements and the related Notes to Consolidated

Financial Statements. All note references refer to the Notes to Consolidated Financial Statements.

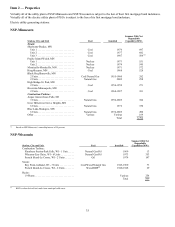

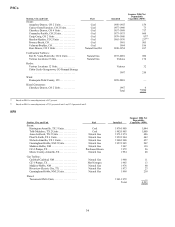

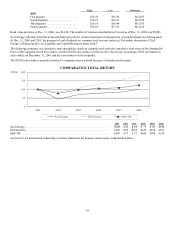

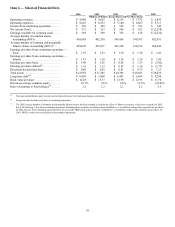

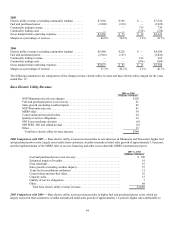

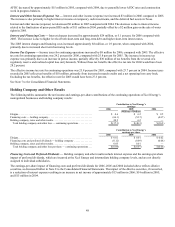

Summary of Financial Results

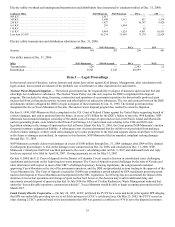

The following table summarizes the earnings contributions of Xcel Energy’s business segments on the basis of GAAP. Continuing

operations consist of the following:

• Regulated utility subsidiaries, operating in the electric and natural gas segments; and

• Several nonregulated subsidiaries and the holding company, where corporate financing activity occurs.