Xcel Energy 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

not recoverable under market pricing. See Notes 1 and 16 to the Consolidated Financial Statements for further discussion of regulatory

deferrals.

Tax Matters

Interest Expense Deductibility — In April 2004, Xcel Energy filed a lawsuit against the U.S. government in the U.S. District Court

for the District of Minnesota to establish its right to deduct the interest expense that had accrued during tax years 1993 and 1994 on

policy loans related to the COLI policies.

After Xcel Energy filed this suit, the IRS sent two statutory notices of deficiency of tax, penalty and interest for 1995 through 1999.

Xcel Energy has filed U.S. Tax Court petitions challenging those notices. Xcel Energy anticipates the dispute relating to its interest

expense deductions will be resolved in the refund suit that is pending in the Minnesota Federal District Court and the Tax Court

petitions will be held in abeyance pending the outcome of the refund litigation. In the third quarter of 2006, Xcel Energy also received

a statutory notice of deficiency from the IRS for tax years 2000 through 2002 and timely filed a Tax Court petition challenging the

denial of the COLI interest expense deductions for those years.

On Oct. 12, 2005, the district court denied Xcel Energy’s motion for summary judgment on the grounds that there were disputed

issues of material fact that required a trial for resolution. At the same time, the district court denied the government’s motion for

summary judgment that was based on its contention that PSCo had lacked an insurable interest in the lives of the employees insured

under the COLI policies. However, the district court granted Xcel Energy’s motion for partial summary judgment on the grounds that

PSCo did have the requisite insurable interest.

On May 5, 2006, Xcel Energy filed a second motion for summary judgment. On Aug. 18, 2006, the U.S. government filed a second

motion for summary judgment. On Feb. 14, 2007, the Magistrate Judge issued his Report and Recommendation (R&R) to the Judge

concerning both motions. In his R&R the Magistrate Judge recommends both motions be denied due to fact issues in dispute. Both

parties will have an opportunity to file objections by March 5, 2007 to the Magistrate Judge’s recommendations. The Judge will then

have broad authority to, among other things, accept or reject the recommendations in whole or in part. If both sides’ motions are

ultimately denied, a trial is set to begin on July 24, 2007.

Xcel Energy believes that the tax deduction for interest expense on the COLI policy loans is in full compliance with the tax law.

Accordingly, PSRI has not recorded any provision for income tax or related interest or penalties, and has continued to take deductions

for interest expense on policy loans on its income tax returns for subsequent years. The litigation could require several years to reach

final resolution. Defense of Xcel Energy’s position may require significant cash outlays, which may or may not be recoverable in a

court proceeding. The ultimate resolution of this matter is uncertain and could have a material adverse effect on Xcel Energy’s

financial position, results of operations and cash flows.

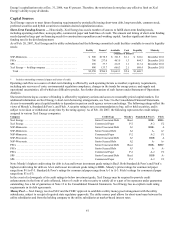

Should the IRS ultimately prevail on this issue, tax and interest payable through Dec. 31, 2006, would reduce earnings by an estimated

$421 million. Xcel Energy has received formal notification that the IRS will seek penalties. If penalties (plus associated interest) also

are included, the total exposure through Dec. 31, 2006, is approximately $499 million. In addition, Xcel Energy’s annual earnings for

2007 would be reduced by approximately $49 million, after tax, or 11 cents per share, if COLI interest expense deductions were no

longer available.

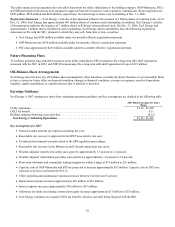

COLI Dow Chemical Court Decision — On Jan. 23, 2006, the 6th Circuit of the U.S. Court of Appeals issued an opinion in a federal

income tax case involving the interest deductions for a COLI program at Dow Chemical Company. The 6th Circuit denied the tax

deductions and reversed the decision of the trial court in the case.

Xcel Energy has analyzed the impact of the Dow decision on its pending COLI litigation and concluded there are significant factual

differences between its case and the Dow case. The court’s opinion in the Dow case outlined three indicators of potential economic

benefits to be examined in a COLI case and noted that the outcome of COLI cases is very fact determinative. These indicators are:

• Positive pre-deduction cash flows;

• Mortality gains; and

• The buildup of cash values.

In a split decision, the 6th Circuit found that the Dow COLI plans possessed none of these indicators of economic substance.

However, in Xcel Energy’s COLI case, the plans were projected to have sizeable pre-deduction cash flows, based upon the relevant

assumptions when purchased. Moreover, the plans presented the opportunity for mortality gains that were not eliminated either

retroactively or prospectively. Xcel Energy’s COLI plans had no provision for giving back any mortality gains that it might realize. In

addition, Xcel Energy’s plans had large cash value increases that were not encumbered by loans during the first seven years of the

policies. Consequently, Xcel Energy believes that the facts and circumstances of its case are stronger than Dow’s case and continues

to believe its case has strong merits.