Xcel Energy 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

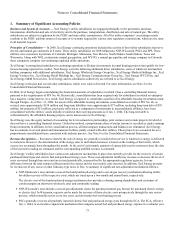

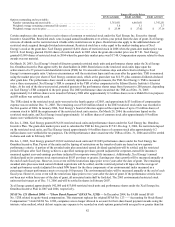

to a benchmark formula. The ECA also provides for an $11.25 million cap on any cost sharing over or under an allowed ECA

formula rate. The current ECA mechanism expired Dec. 31, 2006. Effective Jan. 1, 2007, the ECA has been modified to

include an incentive adjustment to encourage efficient operation of base load coal plants and encourage cost reductions

through purchases of economical short-term energy. The total incentive payment to PSCo in any calendar year will not exceed

$11.25 million. The ECA mechanism will be revised quarterly and interest will accrue monthly on the average deferred

balance. The ECA will expire at the earlier of rates taking effect after Comanche 3 is placed in service or Dec. 31, 2010.

• In Texas, SPS may request periodic adjustments to provide electric fuel and purchased energy cost recovery. In New Mexico,

SPS has a monthly fuel and purchased power cost-recovery factor.

• In Colorado, PSCo operates under an annual earnings test in which earnings above the authorized return on equity are refunded

to customers. NSP-Minnesota and PSCo operate under various service quality standards in Minnesota and Colorado,

respectively, which could require customer refunds if certain criteria are not met. NSP-Minnesota and PSCo’s rates in

Minnesota and Colorado, respectively, also include monthly adjustments for the recovery of conservation and energy-

management program costs, which are reviewed annually. PSCo is allowed to recover certain costs associated with renewable

energy resources through a specific retail rate rider. NSP-Minnesota is allowed to recover certain costs associated with new

transmission facilities to deliver renewable energy resources through a rate rider.

• NSP-Minnesota, NSP-Wisconsin, PSCo and SPS sell firm power and energy in wholesale markets, which are regulated by the

FERC. Certain of these rates include monthly wholesale fuel cost-recovery mechanisms.

Commodity Trading Operations — All applicable gains and losses related to commodity trading activities, whether or not settled

physically, are shown on a net basis in the Consolidated Statements of Income.

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota, PSCo and SPS. Commodity trading activities are not

associated with energy produced from Xcel Energy’s generation assets or energy and capacity purchased to serve native load.

Commodity trading contracts are recorded at fair market value in accordance with SFAS No. 133. In addition, commodity trading

results include the impact of all pertinent margin-sharing mechanisms.

Derivative Financial Instruments — Xcel Energy and its subsidiaries utilize a variety of derivatives, including commodity forwards,

futures and options, index or fixed price swaps and basis swaps, to reduce exposure to commodity price and interest rate risks and to

enhance its operations. For further discussion of Xcel Energy’s risk management and derivative activities, see Note 11 to the

Consolidated Financial Statements.

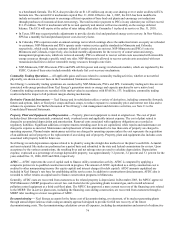

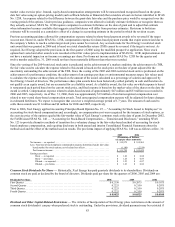

Property, Plant and Equipment and Depreciation — Property, plant and equipment is stated at original cost. The cost of plant

includes direct labor and materials, contracted work, overhead costs and applicable interest expense. The cost of plant retired is

charged to accumulated depreciation and amortization. Removal costs associated with regulatory obligations are recorded as

regulatory liabilities. Significant additions or improvements extending asset lives are capitalized, while repairs and maintenance are

charged to expense as incurred. Maintenance and replacement of items determined to be less than units of property are charged to

operating expenses. Planned major maintenance activities are charged to operating expense unless the cost represents the acquisition

of an additional unit of property or the replacement of an existing unit of property. Property, plant and equipment also includes costs

associated with property held for future use.

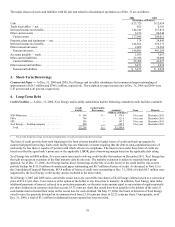

Xcel Energy records depreciation expense related to its plant by using the straight-line method over the plant’s useful life. Actuarial

and semi-actuarial life studies are performed on a period basis and submitted to the state and federal commissions for review. Upon

acceptance by the various commissions, the resulting lives and net salvage rates are used to calculate depreciation. Depreciation

expense, expressed as a percentage of average depreciable property, was approximately 3.2 percent, 3.2 percent and 3.1 percent for the

years ended Dec. 31, 2006, 2005 and 2004, respectively.

AFDC — AFDC represents the cost of capital used to finance utility construction activity. AFDC is computed by applying a

composite pretax rate to qualified construction work in progress. The amount of AFDC capitalized as a utility construction cost is

credited to other nonoperating income (for equity capital) and interest charges (for debt capital). AFDC amounts capitalized are

included in Xcel Energy’s rate base for establishing utility service rates. In addition to construction-related amounts, AFDC also is

recorded to reflect returns on capital used to finance conservation programs in Minnesota.

Generally, AFDC costs are recovered from customers as the related property is depreciated. In December 2003, the MPUC approved

NSP-Minnesota’s MERP proposal to convert two coal-fueled electric generating plants to natural gas, and to install advanced

pollution control equipment at a third coal-fired plant. The MPUC has approved a more current recovery of the financing costs related

to the MERP. The in-service plant costs, including the financing costs during construction, are recovered from customers through a

MERP rider resulting in a lower recognition of AFDC.

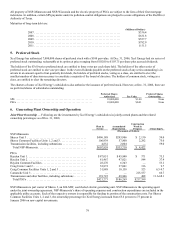

Decommissioning — Xcel Energy accounts for the future cost of decommissioning, or retirement, of its nuclear generating plants

through annual depreciation accruals using an annuity approach designed to provide for full rate recovery of the future

decommissioning costs. The decommissioning calculation covers all expenses, including decontamination and removal of radioactive