Xcel Energy 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

Monticello began operation in 1971 with an original license to operate until 2010. Prairie Island units 1 and 2 began operation in 1973

and 1974, respectively, and are licensed to operate until 2013 and 2014, respectively. In 2003, the Minnesota Legislature changed a

law that had limited expansion of on-site storage. On Sept. 28, 2006, the MPUC approved Xcel Energy’s request for a certificate of

need to authorize construction and operation of a dry spent fuel storage facility at Monticello. Minnesota statutes provide that the

order is not effective until June 1, 2007. The purpose of the stay is to give the state legislature the opportunity to review the MPUC

action if lawmakers wish. On Nov. 8, 2006, the NRC renewed the operating license of the Monticello nuclear plant for an additional

20 years to 2030. Plant assessments and other work for the Prairie Island applications started in 2006. The Prairie Island operating

license extension for an additional 20 years of operation will be filed in 2008 with the NRC.

The total obligation for decommissioning currently is expected to be funded 100 percent by external funds, as approved by the MPUC.

The MPUC last approved NSP-Minnesota’s nuclear decommissioning study request in March 2006, using 2005 cost data. The MPUC

approval decreasing 2006 decommissioning funding for Minnesota retail customers resulted from an extension of remaining life for

the Monticello unit by 10 years (from 2010 to 2020). Contributions to the external fund started in 1990 and are expected to continue

until plant decommissioning begins. The assets held in trusts as of Dec. 31, 2006, primarily consisted of investments in fixed income

securities, such as tax-exempt municipal bonds and U.S. government securities that mature in one to 20 years, and common stock of

public companies. NSP-Minnesota plans to reinvest matured securities until decommissioning begins.

Consistent with cost recovery in utility customer rates, NSP-Minnesota records annual decommissioning accruals based on periodic

site-specific cost studies and a presumed level of dedicated funding. Cost studies quantify decommissioning costs in current dollars.

Current authorized funding presumes that costs will escalate in the future at a rate of 3.61 percent per year. The total estimated

decommissioning costs that will ultimately be paid, net of income earned by external trust funds, is currently being accrued using an

annuity approach over the approved plant-recovery period. This annuity approach uses an assumed rate of return on funding, which is

currently 5.4 percent, net of tax, for external funding. The net unrealized gain on nuclear decommissioning investments is deferred as

a regulatory liability based on the assumed offsetting against decommissioning costs in current ratemaking treatment.

In 2006, the Nuclear Decommissioning Trust (NDT) fund also recorded the sale of certain investments in the non-qualified fund and

the reinvestment of the proceeds into the qualified fund. The sale and reinvestment, along with the transfer of securities was part of a

transaction intended to consolidate trust fund accounts into an income tax advantaged fund, resulting from the Energy Act. The

transfer of funds was completed in the fourth quarter of 2006.

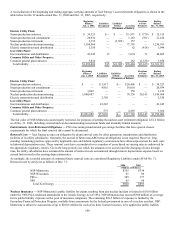

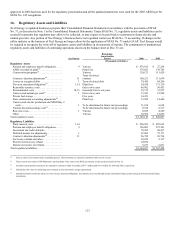

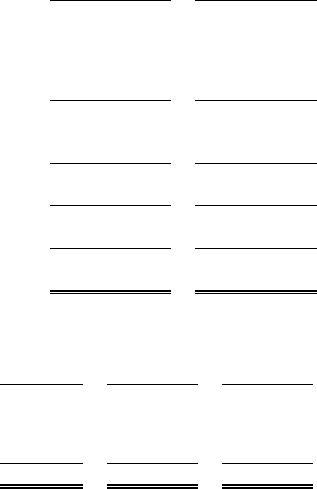

At Dec. 31, 2006, NSP-Minnesota had recorded and recovered in rates cumulative decommissioning accruals of $1.1 billion. The

following table summarizes the funded status of NSP-Minnesota’s decommissioning obligation based on approved regulatory

recovery parameters. Xcel Energy believes future decommissioning cost accruals will continue to be recovered in customer rates.

These amounts are not those recorded in the financial statements for the asset retirement obligation in accordance with SFAS No. 143.

2006 2005

(Thousands of Dollars)

Estimated decommissioning cost obligation from most recently approved study

(2005 and 2002 dollars, respectively) ............................... $ 1,683,750 $ 1,716,618

Effect of escalating costs to 2006 and 2005 dollars (at 3.61 and 4.19 percent per

year, respectively).............................................. 60,783 224,946

Estimated decommissioning cost obligation in current dollars .............. 1,744,533 1,941,564

Effect of escalating costs to payment date (at 3.61 and 4.19 percent per year,

respectively)................................................... 1,382,293 1,851,801

Estimated future decommissioning costs (undiscounted) .................. 3,126,826 3,793,365

Effect of discounting obligation (using risk-free interest rate)............... (1,675,114) (2,026,003)

Discounted decommissioning cost obligation ........................... 1,451,712 1,767,362

Assets held in external decommissioning trust .......................... 1,200,688 1,047,592

Discounted decommissioning obligation in excess of assets currently held in

external trust .................................................. $ 251,024 $ 719,770

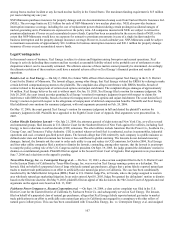

Decommissioning expenses recognized include the following components:

2006 2005 2004

(Thousands of Dollars)

Annual decommissioning cost accrual reported as depreciation expense:

Externally funded............................................. $ 48,069 $ 80,582 $ 80,582

Internally funded (including interest costs)......................... (5,046) (57,561 ) (53,307 )

Net decommissioning accruals recorded........................... $ 43,023 $ 23,021 $ 27,275

Negative accruals for internally funded portions in 2004 and 2005 reflect the impact of the 2002 decommissioning study approved in

2003, which approved an assumption of 100-percent external funding of future costs. The 2005 nuclear decommissioning filing