Xcel Energy 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.99

the inclusion of ineligible purchased power capacity and energy payments in the FPPCAC. The testimony also proposed limits on

SPS’ future use of the FPPCAC. Related to these issues some intervenors have requested disallowances for past periods, which in the

aggregate total approximately $45 million. Other issues in the case include the treatment of renewable energy certificates and sulfur

dioxide allowance credit proceeds in relation to SPS’ New Mexico retail fuel and purchased power recovery clause. The hearing was

held in April 2006, and the hearing examiner’s recommended decision and a NMPRC decision is expected in early 2007.

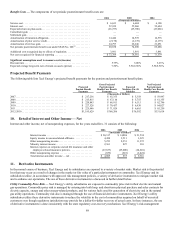

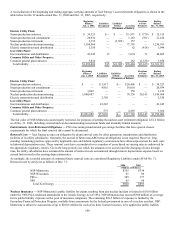

14. Commitments and Contingent Liabilities

Commitments

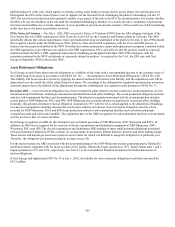

Capital Commitments — The estimated cost as of Dec. 31, 2006 of capital requirements of Xcel Energy and its subsidiaries and the

capital expenditure programs is approximately $1.9 billion in 2007, $1.9 billion in 2008 and $1.7 billion in 2009. Xcel Energy’s

capital forecast includes the following major projects:

CAPX 2020 — In June 2006, CapX 2020, an alliance of electric cooperatives, municipals and investor-owned utilities in the upper

Midwest, including Xcel Energy, announced that it had identified three groups of transmission projects that proposed to be complete

by 2020. Group 1 project investments are expected to total approximately $1.3 billion, with major construction targeted to begin in

2009 or 2010 and ending three or four years later. Xcel Energy’s investment is expected to be approximately $700 million.

Approximately 75 percent of the capital expenditures and return on investment for transmission projects are expected to be recovered

under an NSP-Minnesota transmission cost recovery tariff rider mechanism authorized by Minnesota legislation and pending MPUC

approval. Similar transmission cost recovery mechanisms have been proposed in North Dakota and South Dakota. Cost recovery by

NSP-Wisconsin is expected to occur through the biennial PSCW rate case process.

Nuclear Capacity Increases and Life Extension — In August 2004, NSP-Minnesota announced plans to pursue 20-year license

renewals for the Monticello and Prairie Island nuclear plants, whose licenses will expire between 2010 and 2014. License renewal

applications for Monticello were submitted to the NRC and the MPUC in early 2005. License renewal was approved by the NRC in

November 2006, and the MPUC issued its approval in October 2006 allowing additional spent fuel storage. The MPUC stayed the

order until June 2007, following the Minnesota legislative session. Similar applications will be submitted for Prairie Island in 2008,

with approval expected in 2010.

At the direction of the MPUC, NSP-Minnesota is pursuing capacity increases of all three units that will total approximately 250 MW,

to be implemented, if approved, between 2009 and 2015. The life extension and a capacity increase for Prairie Island Unit 2 is

contingent on replacement of Unit 2’s original steam generators, currently planned for replacement during the refueling outage in

2013. Total capital investment for these activities is estimated to be approximately $1 billion between 2006 and 2015. NSP-Minnesota

plans to seek approval for an alternative recovery mechanism from customers of its nuclear costs. It is NSP-Minnesota’s plan to

submit the certificate of need for Monticello in the second quarter of 2007 and the certificate of need for Prairie Island in the third

quarter of 2007.

MERP Project — In December 2003, the MPUC approved NSP-Minnesota’s MERP proposal to convert two coal-fueled electric

generating plants to natural gas, and to install advanced pollution control equipment at a third coal-fired plant. These improvements

are expected to significantly reduce air emissions from these facilities, while increasing the capacity at system peak by 300 MW.

Major construction for the MERP project began in 2005, and these projects are expected to come on line between 2007 and 2009. The

cumulative investment is approximately $1 billion. The MPUC has approved a more current recovery of the financing costs related to

the MERP. The in-service plant costs, including the financing costs during construction, are recovered from customers through a

MERP rider, which was effective Jan. 1, 2006.

Comanche 3 — Comanche 3, a 750 MW coal-fired plantbeing built in Colorado, is expected to cost approximately $1.35 billion, with

major construction initiated in 2006 and completed in the fall of 2009. The CPUC has approved sharing one-third ownership of this

plant with other parties. Consequently, PSCo’s investment in Comanche 3 will be approximately $1 billion.

Sherco Project — NSP-Minnesota has proposed a $905 million upgrade at the Sherburne County (Sherco) coal-fired power plant. The

project will increase capacity and reduce emissions. The MPUC is expected to rule on the project in 2008. If approved, construction

would start in late 2008 and be completed in 2012.

Wind Generation — NSP-Minnesota plans to invest $205 million to acquire 100-MW of wind generation. The project would be

eligible for rider recovery in Minnesota. The project requires approval by the MPUC.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth regulatory decisions, the

desired reserve margin and the availability of purchased power, as well as alternative plans for meeting Xcel Energy’s long-term

energy needs. In addition, Xcel Energy’s ongoing evaluation of compliance with future requirements to install emission-control

equipment, and merger, acquisition and divestiture opportunities to support corporate strategies may impact actual capital

requirements.