Xcel Energy 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

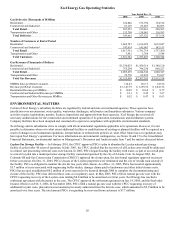

NATURAL GAS UTILITY OPERATIONS

Natural Gas Utility Trends

The most significant recent developments in the natural gas operations of the utility subsidiaries were the continued volatility in

wholesale natural gas market prices and the continued trend toward declining use per customer by residential customers as a result of

improved building construction technologies and higher appliance efficiencies. From 1996 to 2006, average annual sales to the typical

residential customer declined from 103 MMBtu per year to 82 MMBtu per year on a weather-normalized basis. Although recent

wholesale price increases do not directly affect earnings because of natural gas cost recovery mechanisms, the high prices are expected

to encourage further efficiency efforts by customers.

NSP-Minnesota

Ratemaking Principles

Summary of Regulatory Agencies and Areas of Jurisdiction — Retail rates, services and other aspects of NSP-Minnesota’s

operations are regulated by the MPUC and the NDPSC within their respective states. The MPUC has regulatory authority over aspects

of NSP-Minnesota’s financial activities, including security issuances, certain property transfers, mergers with other utilities and

transactions between NSP-Minnesota and its affiliates. In addition, the MPUC reviews and approves NSP-Minnesota’s natural gas

supply plans for meeting customers’ future energy needs.

Purchased Gas and Conservation Cost Recovery Mechanisms — NSP-Minnesota’s retail natural gas rates for Minnesota and North

Dakota include a PGA clause that provides for prospective monthly rate adjustments to reflect the forecasted cost of purchased natural

gas. The annual difference between the natural gas costs collected through PGA rates and the actual natural gas costs are collected or

refunded over the subsequent 12-month period. The MPUC and NDPSC have the authority to disallow recovery of certain costs if

they find the utility was not prudent in its procurement activities.

NSP-Minnesota is required by Minnesota law to spend a minimum of 0.5 percent of Minnesota natural gas revenue on conservation

improvement programs. These costs are recovered through an annual cost recovery mechanism for natural gas conservation and

energy management program expenditures. NSP-Minnesota is required to request a new cost recovery level annually.

Capability and Demand

Natural gas supply requirements are categorized as firm or interruptible (customers with an alternate energy supply). The maximum

daily send-out (firm and interruptible) for NSP-Minnesota was 601,336 MMBtu for 2006, which occurred on Feb. 17, 2006.

NSP-Minnesota purchases natural gas from independent suppliers. These purchases are generally priced based on market indices that

reflect current prices. The natural gas is delivered under natural gas transportation agreements with interstate pipelines. These

agreements provide for firm deliverable pipeline capacity of 526,013 MMBtu/day. In addition, NSP-Minnesota has contracted with

providers of underground natural gas storage services. These storage agreements provide storage for approximately 30 percent of

winter natural gas requirements and 37 percent of peak day, firm requirements of NSP-Minnesota.

NSP-Minnesota also owns and operates one LNG plant with a storage capacity of 2.13 Bcf equivalent and three propane-air plants

with a storage capacity of 1.4 Bcf equivalent to help meet its peak requirements. These peak-shaving facilities have production

capacity equivalent to 250,300 MMBtu of natural gas per day, or approximately 34 percent of peak day firm requirements. LNG and

propane-air plants provide a cost-effective alternative to annual fixed pipeline transportation charges to meet the peaks caused by firm

space heating demand on extremely cold winter days.

NSP-Minnesota is required to file for a change in natural gas supply contract levels to meet peak demand, to redistribute demand costs

among classes, or to exchange one form of demand for another. The 2006-2007 entitlement levels are pending MPUC action.

Natural Gas Supply and Costs

NSP-Minnesota actively seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio that provides

increased flexibility, decreased interruption and financial risk, and economical rates. In addition, NSP-Minnesota conducts natural gas

price hedging activity that has been approved by the MPUC. This diversification involves numerous domestic and Canadian supply

sources with varied contract lengths.