Xcel Energy 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

The utility money pool arrangement does not allow loans from the utility subsidiaries to the holding company. NSP-Minnesota, PSCo

and SPS participate in the money pool pursuant to approval from their respective state regulatory commissions. Borrowing limits are

$250 million, $250 million and $100 million, respectively. No borrowings or loans were outstanding at Dec. 31, 2006.

Registration Statements — Xcel Energy’s Articles of Incorporation authorize the issuance of 1 billion shares of common stock. As of

Dec. 31, 2006, Xcel Energy had approximately 407 million shares of common stock outstanding. In addition, Xcel Energy’s Articles

of Incorporation authorize the issuance of 7 million shares of $100 par value preferred stock. On Dec. 31, 2006, Xcel Energy had

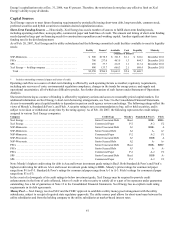

approximately 1 million shares of preferred stock outstanding. Xcel Energy and its subsidiaries have the following registration

statements on file with the SEC, pursuant to which they may sell, from time to time, securities:

• Xcel Energy has $700 million available under its currently effective registration statement.

• NSP-Minnesota has $390 million available under its currently effective registration statement.

• PSCo has approximately $225 million available under its currently effective registration statement.

Future Financing Plans

To facilitate potential long-term debt issuances at the utility subsidiaries, PSCo intends to file a long-term debt shelf registration

statement with the SEC in 2007, and NSP-Wisconsin may file a long-term debt shelf registration for up to $125 million.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements, other than those currently disclosed, that have or are reasonably likely

to have a current or future effect on financial condition, changes in financial condition, revenues or expenses, results of operations,

liquidity, capital expenditures or capital resources that is material to investors.

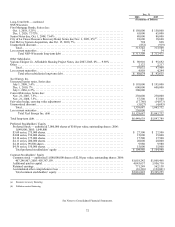

Earnings Guidance

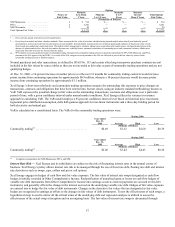

Xcel Energy’s 2007 earnings per share from continuing operations guidance and key assumptions are detailed in the following table.

2007 Diluted Earnings Per Share

Range

Utility operations ............................................................... $1.39 - $1.499

COLI tax benefit................................................................ 0.11

Holding company financing costs and other.......................................... (0.15)

Xcel Energy Continuing Operations ............................................ $1.35 - $1.455

Key Assumptions for 2007:

• Normal weather patterns are experienced during the year;

• Reasonable rate recovery is approved in the SPS Texas electric rate case;

• No material incremental accruals related to the SPS regulatory proceedings;

• Reasonable rate recovery in the Minnesota and Colorado natural gas rate cases;

• Weather-adjusted retail electric utility sales grow by approximately 1.7 percent to 2.2 percent;

• Weather-adjusted retail natural gas utility sales decline by approximately 1.0 percent to 2.0 percent;

• Short-term wholesale and commodity trading margins are within a range of $15 million to $25 million;

• Capacity costs at NSP-Minnesota and SPS are projected to increase approximately $35 million. Capacity costs at PSCo are

expected to be recovered under the PCCA;

• Utility operating and maintenance expenses increase between 2 percent and 3 percent;

• Depreciation expense increases approximately $45 million to $55 million;

• Interest expense increases approximately $30 million to $35 million;

• Allowance for funds used during construction-equity increases approximately $17 million to $23 million;

• Xcel Energy continues to recognize COLI tax benefits, which is currently being litigated with the IRS;