Xcel Energy 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

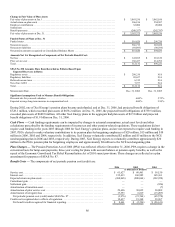

Xcel Energy’s capitalization ratio (on a holding company basis only and not on a consolidated basis) is less than 25 percent. For these

purposes, the capitalization ratio is equal to (i) common stock plus surplus divided by (ii) the sum of common stock plus surplus plus

long-term debt. Based on this definition, the capitalization ratio at Dec. 31, 2006, was 81 percent. Therefore, the restrictions do not

place any effective limit on Xcel Energy’s ability to pay dividends because the restrictions are only triggered when the capitalization

ratio is less than 25 percent or will be reduced to less than 25 percent through dividends (other than dividends payable in common

stock), distributions or acquisitions of Xcel Energy common stock.

In addition, NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel

Energy, the holder of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $905 million in

additional cash dividends on common stock at Dec. 31, 2006.

The issuance of securities by Xcel Energy generally is not subject to regulatory approval. However, utility financings and certain

intra-system financings are subject to the jurisdiction of the applicable state regulatory commissions and/or the FERC under the

Federal Power Act. PSCo currently has authorization to issue up to $1.2 billion of long-term debt and $800 million of short-term debt.

SPS will seek authority for long-term debt as needed. SPS currently has authorization to issue up to $250 million in short-term debt.

NSP-Wisconsin currently has authorization to issue up to $125 million of long-term debt and $75 million of short-term debt. NSP-

Minnesota has authorization to issue long-term securities provided the equity ratio remain between 45.99 percent and 56.21 percent

and to issue short-term debt provided it does not exceed 15 percent of total capitalization. Total capitalization for NSP-Minnesota

cannot exceed $5.5 billion. Xcel Energy believes these authorizations are adequate and will seek additional authorization when

necessary, however, there can be no assurance that additional authorization will be granted on the timeframe or in the amounts

requested.

The FERC has granted a blanket authorization for certain intra-system financings involving holding companies. In addition, Xcel

Energy’s utility subsidiaries have received FERC authorization through June 30, 2008 to engage in intra-system financings, including

through the money pool, in amounts ranging from $250 million for each of NSP-Minnesota and PSCo, to $100 million for SPS and

$75 million for NSP-Wisconsin.

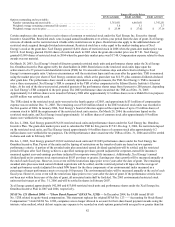

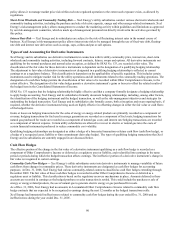

Stockholder Protection Rights Agreement — In June 2001, Xcel Energy adopted a Stockholder Protection Rights Agreement. Each

share of Xcel Energy’s common stock includes one shareholder protection right. Under the agreement’s principal provision, if any

person or group acquires 15 percent or more of Xcel Energy’s outstanding common stock, all other shareholders of Xcel Energy

would be entitled to buy, for the exercise price of $95 per right, common stock of Xcel Energy having a market value equal to twice

the exercise price, thereby substantially diluting the acquiring person’s or group’s investment. The rights may cause substantial

dilution to a person or group that acquires 15 percent or more of Xcel Energy’s common stock. The rights should not interfere with a

transaction that is in the best interests of Xcel Energy and its shareholders because the rights can be redeemed prior to a triggering

event for $0.01 per right.

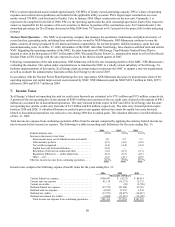

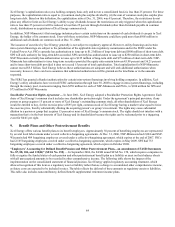

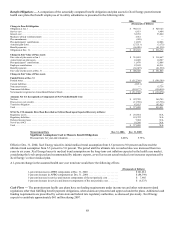

9. Benefit Plans and Other Postretirement Benefits

Xcel Energy offers various benefit plans to its benefit employees. Approximately 56 percent of benefiting employees are represented

by several local labor unions under several collective-bargaining agreements. At Dec. 31, 2006, NSP-Minnesota had 2,094 and NSP-

Wisconsin had 409 bargaining employees covered under a collective-bargaining agreement, which expires at the end of 2007. PSCo

had 2,165 bargaining employees covered under a collective-bargaining agreement, which expires in May 2009. SPS had 733

bargaining employees covered under a collective-bargaining agreement, which expires in October 2008.

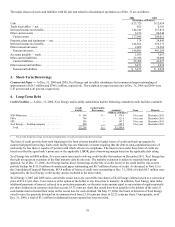

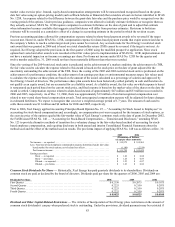

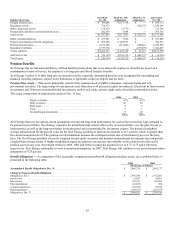

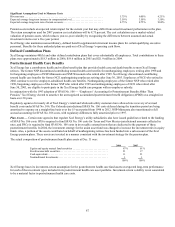

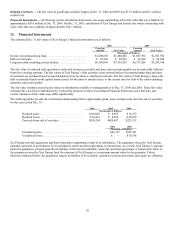

“Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment of FASB Statements

No. 87, 88, 106, and 132(R)” (SFAS No. 158) — In September 2006, the FASB issued SFAS No. 158, which requires companies to

fully recognize the funded status of each pension and other postretirement benefit plan as a liability or asset on their balance sheets

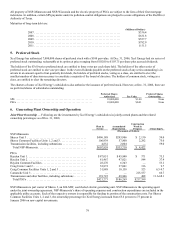

with all unrecognized amounts to be recorded in other comprehensive income. The following table shows the impact of the

implementation on the consolidated statement of financial position. Xcel Energy applied regulatory accounting treatment, which

allowed recognition of this item as a regulatory asset or liability rather than as a charge to accumulated other comprehensive income,

as future costs are expected to be included in rates. The table reflects the deferral of these amounts as regulatory assets or liabilities.

This table also includes noncontributory, defined benefit supplemental retirement income plans.