Xcel Energy 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

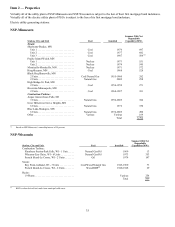

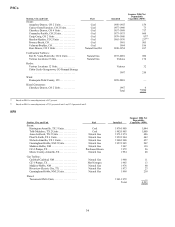

Patricia K. Vincent, 48, President and Chief Executive Officer, PSCo, October 2005 to present. Previously, President — Customer and

Field Operations Business Unit, Xcel Energy, July 2003 to October 2005, President — Retail Business Unit, Xcel Energy,

March 2001 to July 2003 and Vice President of Marketing and Sales, Xcel Energy Services Inc., August 2000 to March 2001.

David M. Wilks, 60, Vice President, Xcel Energy Services Inc., September 2000 to present; President — Energy Supply Group, Xcel

Energy Inc., August 2000 to present.

David M. Sparby, 52, Executive Vice President and Director, Acting President and Chief Executive Officer, NSP-Minnesota,

January 2007 to present; Previously, Vice President, Government and Regulatory Affairs, Xcel Energy Services Inc., September 2000

to January 2007.

No family relationships exist between any of the executive officers or directors.

Item 1A — Risk Factors

Risks Associated with Our Business

Our profitability depends in part on the ability of our utility subsidiaries to recover their costs from their customers and there may

be changes in circumstances or in the regulatory environment that impair the ability of our utility subsidiaries to recover costs

from their customers.

We are subject to comprehensive regulation by several federal and state utility regulatory agencies. The utility commissions in the

states where our utility subsidiaries operate regulate many aspects of our utility operations, including siting and construction of

facilities, customer service and the rates that we can charge customers. The FERC has jurisdiction, among other things, over wholesale

rates for electric transmission service and the sale of electric energy in interstate commerce.

The profitability of our utility operations is dependent on our ability to recover costs related to providing energy and utility services to

our customers. Our utility subsidiaries currently provide service at rates approved by one or more regulatory commissions. These rates

are generally regulated based on an analysis of the utility’s expenses incurred in a test year. Thus, the rates a utility is allowed to

charge may or may not match its expenses at any given time. While rate regulation is premised on providing a reasonable opportunity

to earn a reasonable rate of return on invested capital, there can be no assurance that the applicable regulatory commission will judge

all the costs of our utility subsidiaries to have been prudently incurred or that the regulatory process in which rates are determined will

always result in rates that will produce full recovery of such costs. Rising fuel costs could increase the risk that our utility subsidiaries

will not be able to fully recover their under-recovered fuel costs from their customers. Furthermore, there could be changes in the

regulatory environment that would impair the ability of our utility subsidiaries to recover costs historically collected from their

customers. If all of the costs of our utility subsidiaries are not recovered through customer rates, they could incur financial operating

losses, which, over the long term, could jeopardize their ability to pay us dividends and our ability to meet our financial obligations.

We are unable to predict the impact on our operating results from the future regulatory activities of any of these agencies. Changes in

regulations or the imposition of additional regulations could have an adverse impact on our results of operations and hence could

materially and adversely affect our ability to meet our financial obligations, including paying dividends on our common stock.

Any reductions in our credit ratings could increase our financing costs and the cost of maintaining certain contractual

relationships.

We cannot be assured that any of our current ratings or our subsidiaries’ ratings will remain in effect for any given period of time or

that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances in the future so warrant. In

addition, our credit ratings may change as a result of the differing methodologies or change in the methodologies used by the various

rating agencies. For example, Standard and Poor’s calculates an imputed debt associated with capacity payments from purchased

power contracts. An increase in the overall level of capacity payments would increase the amount of imputed debt, based on Standard

and Poor’s methodology. Therefore, Xcel Energy and its subsidiaries credit ratings could be adversely affected based on the level of

capacity payments associated with purchased power contracts or changes in how imputed debt is determined. Any downgrade could

lead to higher borrowing costs.

We are subject to commodity risks and other risks associated with energy markets.

We engage in wholesale sales and purchases of electric capacity, energy and energy-related products and are subject to market supply

and commodity price risk. Commodity price changes can affect the value of our commodity trading derivatives. We mark certain

derivatives to estimated fair market value on a daily basis (mark-to-market accounting), which may cause earnings variability. We

utilize quoted market prices to the maximum extent possible in determining the value of these derivative commodity instruments. For

positions for which market prices are not available, we utilize models based on forward price curves. These models incorporate

estimates and assumptions as to a variety of factors such as pricing relationships between various energy commodities and geographic

locations. Actual experience can vary significantly from these estimates and assumptions and significant changes from our

assumptions could cause significant earnings variability.