Xcel Energy 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

Energy achieves a specified earnings per share (EPS) growth (adjusted for corporate-owned life insurance) measured against Dec. 31,

2006 EPS (adjusted for corporate-owned life insurance). The forms of performance-based restricted stock unit agreements are filed as

Exhibits 10.30 and 10.32 to this Form 10-K.

Additionally, Xcel Energy’s annual dividend paid on its common stock must remain at $0.89 per share or greater. EPS growth will be

measured annually at the end of each fiscal year. However, in no event will the restrictions lapse prior to Dec. 31, 2008. If the

performance criteria have not been met within four years of the date of grant, all associated Units shall be forfeited.

The remaining 25 percent of awarded Units plus associated earned dividend equivalents shall be settled, and the restricted period will

lapse, after the average of actual performance results for the three components of an environmental index (measured as a percent of

target performance) meets or exceeds 100 percent. The environmental index will be measured annually at the end of each fiscal year.

However, in no event will the restrictions lapse prior to Dec. 31, 2008. If the performance criteria have not been met within four years

of the date of grant, all associated Units shall be forfeited.

The separate awards of performance shares also will represent an equal number of shares of Xcel Energy common stock. Performance

shares may not be sold or otherwise transferred. Payout of the performance share award will be dependent entirely on a single

measure, total shareholder return (TSR). Xcel Energy’s TSR will be measured over a three-year period. Xcel Energy’s TSR is

compared to the TSR of other companies in the Edison Electric Institute’s Electrics Index as a peer group. At the end of the three-year

period, potential payouts of the performance shares range from 0 percent to 200 percent, depending on Xcel Energy’s TSR compared

to the peer group.

The terms of the foregoing grants are consistent with the 2005 Omnibus Incentive Plan and terms of award agreements filed as

Appendix B to Xcel Energy’s 2005 Proxy Statement and Exhibits 10.30, 10.31 and 10.32 to this Form 10-K.

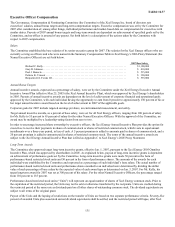

The following table shows the number of performance-based restricted stock units and performance shares granted, effective Jan. 1,

2007, to Named Executive Officers:

Named Executive Officer

Performance-based

Restricted Stock Units Performance Shares

Richard C. Kelly ........................................ 86,478 95,211

Gary R. Johnson......................................... 11,819 13,012

Paul J. Bonavia.......................................... 18,927 20,838

Patricia K. Vincent....................................... 11,242 12,377

Benjamin G.S. Fowke III.................................. 18,927 20,838

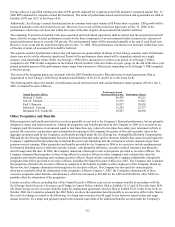

Other Perquisites and Benefits

Other perquisites and benefits provided to executives generally are not tied to the Company’s financial performance, but are primarily

designed to attract and retain executives. Among the perquisites and benefits provided by the Company in 2006 to its executives are

Company-paid life insurance in an amount equal to four times base pay, reduced to two times base salary post retirement (which, in

general, the executives can purchase upon termination by repaying to the Company the greater of the cash surrender value or the

aggregate premiums paid by the Company), and benefits provided under the Xcel Energy Inc. Nonqualified Deferred Compensation

Plan and the Xcel Energy Supplemental Executive Retirement Plan that make up for retirement benefits that cannot be paid under the

Company’s qualified retirement plans due to Internal Revenue Code limitations and the exclusion of certain elements of pay from

pension-covered earnings. Other perquisites and benefits provided by the Company in 2006 to its executives include reimbursement

for financial planning services and home security systems, cash perquisite allowance, executive medical insurance and physicals,

aircraft usage and club dues. In 2006, the Company undertook a thorough review of perquisites provided to executive officers. The

Company compared the perquisites to those being offered to executive officers in other companies and evaluated the value the

perquisites provided in attracting and retaining executive officers. Based on this evaluation the Company substantially changed the

perquisites that will be provided to executive officers, including the Named Executive Officers in 2007. The Company also evaluated

the perquisites offered to the executive officers as compared to the benefits available to other employees of the Company. Based on

this review, the Company eliminated most perquisites for executive officers. The Company has increased the cash perquisite

allowance to partially offset the elimination of the perquisites. Effective January 1, 2007, the Committee eliminated all of these

executive perquisites other than the cash allowance, which was increased to $30,000 for the CEO and $25,000 for other NEO’s to

partially offset the elimination of the perquisites.

Certain executive officers, including four of the Named Executive Officers, may receive severance benefits in accordance with the

Xcel Energy Senior Executive Severance and Change in Control Policy, which is filed as Exhibits 10.15 and 10.28 to this form 10-K.

Mr. Bonavia may receive severance benefits under his employment agreement, which is filed as Exhibit 10.25 to this Form 10-K. In

October 2006, the Committee amended the 2003 Policy to reduce the separation benefits payable to an executive officer other than in

the event of a change in control to the following: (i) a lump sum severance benefit equal to one times my annual salary and target

annual incentive; (ii) a lump sum payment equal to the actuarial equivalent of the additional benefits accrued under the Company’s