Xcel Energy 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

counterparty valuations, internal valuations and broker quotes. There have been no material changes in the techniques or models used

in the valuation of interest rate swaps during the periods presented.

At Dec. 31, 2006 and 2005, a 100-basis-point change in the benchmark rate on Xcel Energy’s variable rate debt would impact pretax

interest expense by approximately $7.0 million and $10.3 million, respectively. See Note 11 to the Consolidated Financial Statements

for a discussion of Xcel Energy and its subsidiaries’ interest rate swaps.

Xcel Energy and its subsidiaries also maintain trust funds, as required by the NRC, to fund costs of nuclear decommissioning. These

trust funds are subject to interest rate risk and equity price risk. As of Dec. 31, 2006 and 2005, these funds were invested primarily in

domestic and international equity securities and fixed-rate fixed-income securities. These funds may be used only for activities related

to nuclear decommissioning. The accounting for nuclear decommissioning recognizes that costs are recovered through rates; therefore

fluctuations in equity prices or interest rates do not have an impact on earnings.

Credit Risk — Xcel Energy and its subsidiaries are also exposed to credit risk. Credit risk relates to the risk of loss resulting from the

nonperformance by a counterparty of its contractual obligations. Xcel Energy and its subsidiaries maintain credit policies intended to

minimize overall credit risk and actively monitor these policies to reflect changes and scope of operations.

Xcel Energy and its subsidiaries conduct standard credit reviews for all counterparties. Xcel Energy employs additional credit risk

control mechanisms, such as letters of credit, parental guarantees, standardized master netting agreements and termination provisions

that allow for offsetting of positive and negative exposures. The credit exposure is monitored and, when necessary, the activity with a

specific counterparty is limited until credit enhancement is provided.

At Dec. 31, 2006, a 10-percent increase in prices would have resulted in a net mark-to-market increase in credit risk exposure of $8.1

million, while a decrease of 10 percent would have resulted in a decrease of $7.3 million.

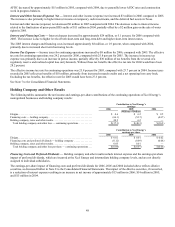

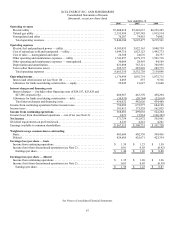

Liquidity and Capital Resources

Cash Flows

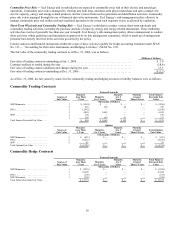

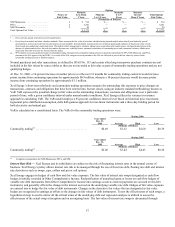

2006 2005 2004

(Millions of Dollars)

Cash provided by (used in) operating activities

Continuing operations.......................... $1,729 $1,131 $1,128

Discontinued operations........................ 195 53 (315)

Total...................................... $1,924 $1,184 $ 813

Cash provided by operating activities for continuing operations increased $598 million during 2006. The increase is primarily due to

the timing of working capital activity. Specifically, the collection of receivables and the collection of recoverable purchased natural

gas and electric energy costs increased in 2006. The increase in cash provided by operations was partially offset by the timing of cash

expenditures for accounts payable. Cash provided by operating activities for discontinued operations increased $150 million during

2006, largely due to the recognition of deferred tax assets related to NRG.

Cash provided by operating activities for continuing operations was basically unchanged for 2005 and 2004. Cash provided by

operating activities for discontinued operations increased $368 million during 2005 compared with 2004. During 2004, Xcel Energy

paid $752 million pursuant to the NRG settlement agreement, which was partially offset by tax benefits received.

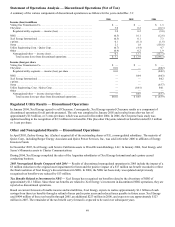

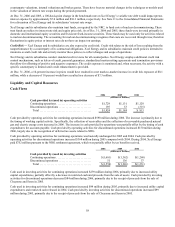

2006 2005 2004

(Millions of Dollars)

Cash provided by (used in) investing activities

Continuing operations.......................... $(1,601) $(1,362) $(1,268)

Discontinued operations ........................ 51 136 37

Total ...................................... $(1,550) $(1,226) $(1,231)

Cash used in investing activities for continuing operations increased $239 million during 2006, primarily due to increased utility

capital expenditures, partially offset by a decrease in restricted cash and proceeds from the sale of assets. Cash provided by investing

activities for discontinued operations decreased $84 million during 2006, primarily due to the receipt of proceeds from the sale of

Cheyenne and Seren in 2005.

Cash used in investing activities for continuing operations increased $94 million during 2005, primarily due to increased utility capital

expenditures and restricted cash released in 2004. Cash provided by investing activities for discontinued operations increased $99

million during 2005, primarily due to the receipt of proceeds from the sale of Cheyenne and Seren in 2005.