Xcel Energy 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

Interest Rate Cash Flow Hedges — Xcel Energy and its subsidiaries enter into various instruments that effectively fix the interest

payments on certain floating rate debt obligations or effectively fix the yield or price on a specified benchmark interest rate for a

specific period. These derivative instruments are designated as cash flow hedges for accounting purposes.

As of Dec. 31, 2006, Xcel Energy had net gains related to interest rate swaps of approximately $1.1 million in Accumulated Other

Comprehensive Income that it expects to recognize in earnings during the next 12 months.

Xcel Energy and its subsidiaries also enter into interest rate lock agreements, including treasury-rate locks and forward starting swaps,

that effectively fix the yield or price on a specified treasury security for a specific period. These derivative instruments are designated

as cash flow hedges for accounting purposes.

As of Dec. 31, 2006, Xcel Energy had net gains related to settled interest rate lock agreements of approximately $1.4 million in

Accumulated Other Comprehensive Income that it expects to recognize in earnings during the next 12 months.

Xcel Energy had no ineffectiveness related to interest rate cash flow hedges during the years ended Dec. 31, 2006 and 2005.

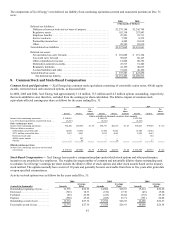

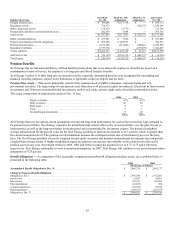

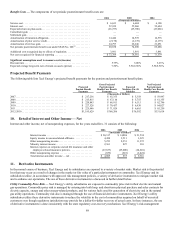

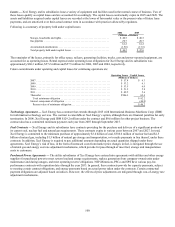

Financial Impact of Qualifying Cash Flow Hedges — The impact of qualifying cash flow hedges on Xcel Energy’s Accumulated

Other Comprehensive Income, included in the Consolidated Statements of Stockholders’ Equity and Comprehensive Income, is

detailed in the following table:

(Millions of Dollars)

Accumulated other comprehensive income related to hedges at Dec. 31, 2003 ......... $ 8.1

After-tax net unrealized gains related to derivatives accounted for as hedges .......... 1.6

After-tax net realized gains on derivative transactions reclassified into earnings ....... (9.6)

Accumulated other comprehensive income related to hedges at Dec. 31, 2004 ......... $ 0.1

After-tax net unrealized gains related to derivatives accounted for as hedges .......... 4.5

After-tax net realized gains on derivative transactions reclassified into earnings ....... (13.4)

Accumulated other comprehensive income related to hedges at Dec. 31, 2005 ......... $ (8.8)

After-tax net unrealized gains related to derivatives accounted for as hedges .......... 11.8

After-tax net realized gains on derivative transactions reclassified into earnings ....... (0.8)

Accumulated other comprehensive income related to hedges at Dec. 31, 2006 ......... $ 2.2

Fair Value Hedges

The effective portion of the change in the fair value of a derivative instrument qualifying as a fair value hedge is offset against the

change in the fair value of the underlying asset, liability or firm commitment being hedged. That is, fair value hedge accounting allows

the gains or losses of the derivative instrument to offset, in the same period, the gains and losses of the hedged item. The ineffective

portion of a derivative instrument’s change in fair value is recognized in current earnings.

Interest Rate Fair Value Hedges — Xcel Energy enters into interest rate swap instruments that effectively hedge the fair value of

fixed-rate debt. The fair market value of Xcel Energy’s interest rate swaps at Dec. 31, 2006, was a liability of approximately $8.3

million.

Normal Purchases or Normal Sales Contracts

Xcel Energy’s utility subsidiaries enter into contracts for the purchase and sale of commodities for use in their business operations.

SFAS No. 133 requires a company to evaluate these contracts to determine whether the contracts are derivatives. Certain contracts that

meet the definition of a derivative may be exempted from SFAS No. 133 as normal purchases or normal sales.

Xcel Energy evaluates all of its contracts when such contracts are entered to determine if they are derivatives and, if so, if they qualify

to meet the normal designation requirements under SFAS No. 133. None of the contracts entered into within the commodity trading

operations qualify for a normal designation.

In 2003, as a result of FASB Statement 133 Implementation Issue No. C20, Xcel Energy began recording several long-term power

purchase agreements at fair value due to accounting requirements related to underlying price adjustments. As these purchases are

recovered through normal regulatory recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts

were offset by regulatory assets and liabilities. During the first quarter of 2006, Xcel Energy qualified these contracts under the normal

purchase exception. Based on this qualification, the contracts are no longer adjusted to fair value and the previous carrying value of

these contracts will be amortized over the remaining contract lives along with the offsetting regulatory balances.

Normal purchases and normal sales contracts are accounted for as executory contracts.

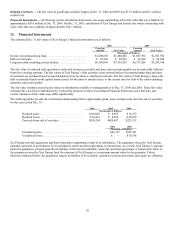

The following discussion briefly describes the use of derivative commodity and financial instruments at Xcel Energy and its

subsidiaries, and discloses the respective fair values at Dec. 31, 2006 and 2005.

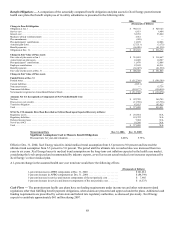

Commodity Trading Instruments — At Dec. 31, 2006 and 2005, the fair value of commodity trading contracts was $(1.2) million and

$3.9 million, respectively.